Office Depot 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

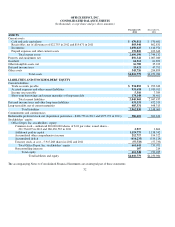

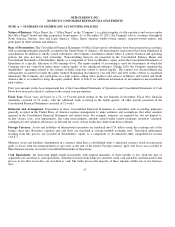

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

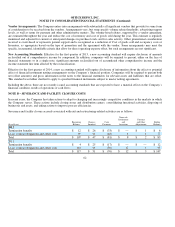

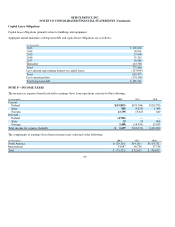

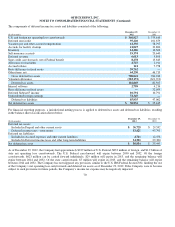

Accruals for facility closure costs are based on the future commitments under contracts, adjusted for assumed sublease benefits and

discounted at the Company’s risk-adjusted rate at the time of closing. Additionally, the Company recognizes charges to terminate

existing commitments and charges or credits to adjust remaining closed facility accruals to reflect current expectations. Refer to Note

B for additional information on accrued balance relating to future commitments under operating leases for closed facilities. The short-

term and long-term components of this liability are included in Accrued expenses and other current liabilities and Deferred income

taxes and other long-term liabilities, respectively, on the Consolidated Balance Sheets.

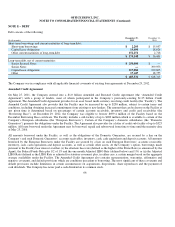

Accrued Expenses: Included in Accrued expenses and other current liabilities in the Consolidated Balance Sheets are accrued

payroll-related amounts of approximately $203.8 million and $262 million at December 29, 2012 and December 31, 2011,

respectively.

Fair Value of Financial Instruments: The estimated fair values of financial instruments recognized in the Consolidated Balance

Sheets or disclosed within these Notes to Consolidated Financial Statements have been determined using available market

information, information from unrelated third-party financial institutions and appropriate valuation methodologies, primarily

discounted projected cash flows. Considerable judgment is required when interpreting market information and other data to develop

estimates of fair value. Refer to Note I for additional information on fair value.

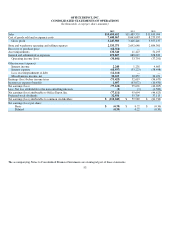

Revenue Recognition: Revenue is recognized at the point of sale for retail transactions and at the time of successful delivery fo

r

contract, catalog and Internet sales. Sales taxes collected are not included in reported sales. The Company uses judgment in estimating

sales returns, considering numerous factors including historical sales return rates. The Company also records reductions to revenue

for customer programs and incentive offerings including special pricing agreements, certain promotions and other volume-based

incentives. Revenue from sales of extended warranty service plans is either recognized at the point of sale or over the warranty

period, depending on the determination of legal obligor status. All performance obligations and risk of loss associated with such

contracts are transferred to an unrelated third-party administrator at the time the contracts are sold. Costs associated with these

contracts are recognized in the same period as the related revenue.

A liability for future performance is recognized when gift cards are sold and the related revenue is recognized when gift cards are

redeemed as payment for the products. The Company recognizes as revenue the unused portion of the gift card liability when

historical data indicates that additional redemption is remote.

Franchise fees, royalty income and the sales of products to franchisees and licensees, which currently are not significant, are included

in Sales, while product costs are included in Cost of goods sold and occupancy costs in the Consolidated Statements of Operations.

Cost of Goods Sold and Occupancy: The Company includes in Cost of goods sold and occupancy costs, inventory costs, net o

f

estimable vendor allowances and rebates, cash discounts on purchased inventory, freight costs incurred to bring merchandise to stores

and warehouses, provisions for inventory value and physical adjustments and occupancy costs, including depreciation or facility rent

of inventory-holding and selling locations and related utilities.

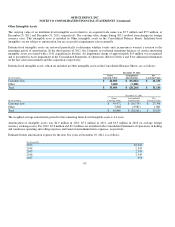

Shipping and Handling Fees and Costs: Income generated from shipping and handling fees is recorded in Sales for all periods

presented. Freight costs incurred to ship merchandise to customers are recorded as a component of Store and warehouse operating and

selling expenses. Distribution costs, including shipping costs, combined with warehouse handling costs totaled $711.5 million in

2012, $727.0 million in 2011 and $747.1 million in 2010. Approximately $6 million of accruals for distribution related facility

closures is included in the 2011 amount.

60