Office Depot 2012 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

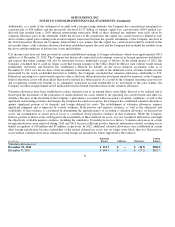

Additionally, as a result of the settlement of an audit with a foreign taxing authority, the Company has conceded net operating loss

carryforwards of $56 million and the previously disclosed $1.73 billion of foreign capital loss carryforwards ($454 million tax-

effected) that resulted from a 2010 internal restructuring transaction. Both of these deferred tax attributes were fully offset by

valuation allowance prior to the settlement. Under the tax laws of the jurisdiction, the capital loss carryforward was limited to only

offset a future capital gain resulting from an intercompany transaction between the specific subsidiaries of the Company involved in

the 2010 transaction. Because the Company believed that it was remote that the capital loss carryforward would be realized in the

foreseeable future, a full valuation allowance had been established against the asset and the Company had excluded the attribute fro

m

the above tabular renditions of deferred tax assets and liabilities.

U.S. income taxes have not been provided on certain undistributed earnings of foreign subsidiaries, which were approximately $451

million as of December 29, 2012. The Company has historically reinvested such earnings overseas in foreign operations indefinitely

and expects that future earnings will also be reinvested overseas indefinitely except as follows. In the fourth quarter of 2012, the

Company concluded that it could no longer assert that foreign earnings of the Office Depot de Mexico joint venture would remain

permanently reinvested, and therefore has established a deferred tax liability on the excess financial accounting value as o

f

December 29, 2012 over the tax basis of the investment. Concurrently, as a result of the additional source of future taxable income

represented by the newly established deferred tax liability, the Company concluded that valuation allowances attributable to U.S.

Federal net operating loss carryforwards equal in value to the basis differential in the investment should be removed, as the Company

believes that these assets will more likely than not be realized in a future period. As a result of the Company incurring a pre-tax loss

and recognizing current-year benefits to its cumulative translation account attributable to its investment in the joint venture, the

Company recorded an approximate net $5 million deferred tax benefit from the release of the valuation allowance.

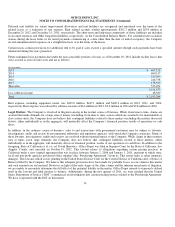

Valuation allowances have been established to reduce deferred asset to an amount that is more likely than not to be realized and is

based upon the uncertainty of the realization of certain deferred tax assets related to net operating loss carryforwards and other tax

attributes. Because of the downturn in the Company’s performance associated with recessionary economic conditions, as well as the

significant restructuring activities and charges the Company has taken in response, the Company has established valuation allowances

against significant portions of its domestic and foreign deferred tax assets. The establishment of valuation allowances requires

significant judgment and is impacted by various estimates. Both positive and negative evidence, as well as the objectivity and

verifiability of that evidence, is considered in determining the appropriateness of recording a valuation allowance on deferred tax

assets. An accumulation of recent pre-tax losses is considered strong negative evidence in that evaluation. While the Company

believes positive evidence exists with regard to the realizability of these deferred tax assets, it is not considered sufficient to outweigh

the objectively verifiable negative evidence, including the cumulative 36 month pre-tax loss history. Valuation allowances in certain

foreign jurisdictions were removed during 2010 and 2011 because sufficient positive financial information existed, resulting in tax

benefit recognition of $10 million and $9 million, respectively. In 2012, additional valuation allowances were established in certain

other foreign jurisdictions because realizability of the related deferred tax assets was no longer more likely than not. Deferred tax

assets without valuation allowances remain in certain foreign tax jurisdictions where supported by the evidence.

71

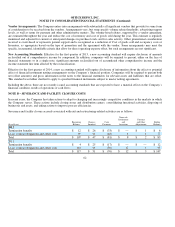

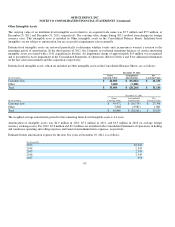

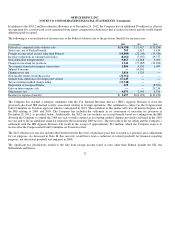

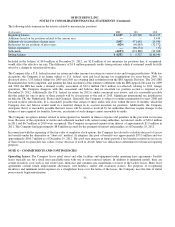

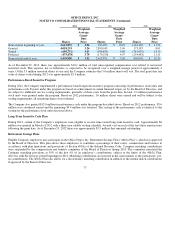

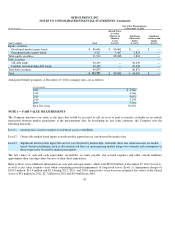

(In millions)

Beginning

Balance Additions Deductions

Ending

Balance

Valuation allowances at:

December 29, 2012

$621.7

$

—

$ (38.5)

$583.2

December 31, 2011

$648.9

$

—

$(27.2)

$621.7