Office Depot 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Interest expense was impacted by the reversal of accrued interest of $32 million in 2011 and $11 million in 2010 following

settlements of uncertain tax positions. Our accounting policy is to present interest accruals and reversals on uncertain tax positions as

a component of interest expense. Additionally, approximately $2 million of interest income was recognized in 2010 from one of the

tax settlements.

On March 15, 2012, we completed a cash tender offer to purchase up to $250 million aggregate principal amount of 6.25% Senio

r

Notes due 2013. The total consideration for each $1,000.00 note surrendered was $1,050.00. Additionally, tender fees and

a

proportionate amount of deferred debt issue costs and a deferred cash flow hedge gain were included in the measurement of the $12.1

million extinguishment costs reported in the Consolidated Statement of Operations for 2012.

Our net miscellaneous income consists of our earnings of joint venture investments, gains and losses related to foreign exchange

transactions, and investment results from our deferred compensation plan. We recognized earnings from our joint venture in Mexico,

Office Depot de Mexico, of approximately $32 million, $34 million and $31 million in 2012, 2011, and 2010, respectively. These

results also were impacted by foreign currency and other gains and losses in all periods.

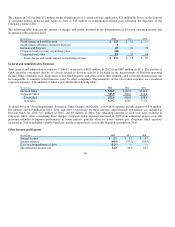

Income Taxes

The negative 2% effective tax rate for 2012 results from recognizing tax expense in jurisdictions with pre-tax income while being

precluded from recognizing deferred tax benefits on pre-tax losses in the U.S. and certain international jurisdictions that are subject to

valuation allowances. Additionally, the pension settlement was a non-taxable transaction and the full year tax rate includes a net $14

million tax benefit from an approved tax loss carryback. The effective rate also reflects the impact on deferred tax asset from a tax

rate change in an international jurisdiction.

The effective tax rates for 2011 and 2010 reflect benefits from settlements of uncertain tax positions (“UTPs”) and from the reversal

of valuation allowances on deferred tax assets. The 2011 rate includes the reversal of $81 million of UTP accruals following closure

of tax audits and the expiration of the statute of limitations on previously open tax years. The 2010 effective rate includes the reversal

of approximately $30 million of UTP accruals. In addition, 2011 and 2010 include approximately $9 million and $10 million,

respectively, of discrete benefits from the release of valuation allowances in certain European countries because of improved

performance in those jurisdictions. Partially offsetting these tax benefits is income tax expense recognized for taxpaying entities.

Because of significant valuation allowances that remain in other jurisdictions, deferred tax benefits are not recognized on certain loss

generating entities. Within our international operations, statutory tax expense is generally lower compared to the aggregate U.S.

federal and state income tax rates. This is further impacted by favorable tax ruling within our international operations.

The aggregate reversal of UTPs in 2010 was reduced by approximately $7 million which was offset against other tax-related accounts

and had no impact on earnings. The UTP reversals also resulted in a reversal of previously accrued interest expense of $32 million in

2011 and $11 million in 2010, as well as recognition of $2 million of interest income in 2010. Our accounting policy is to include

accrued interest on UTPs, and any related reversals, as a component of interest expense in the consolidated statement of operations.

31

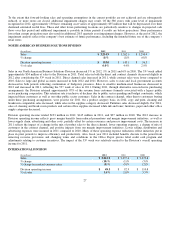

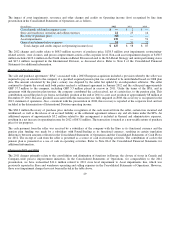

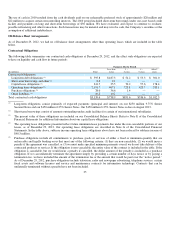

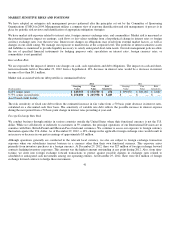

(In millions) 2012 2011 2010

Income tax ex

p

ense (benefit)

$ 1.

7

$ (63.1)

$ (10.5)

Effective income tax rate*

(2)%

(193)%

18%

* Income taxes as a

p

ercenta

g

e of earnin

g

s (loss) before income taxes.