Office Depot 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

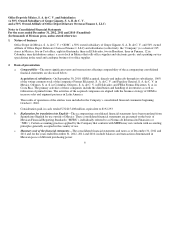

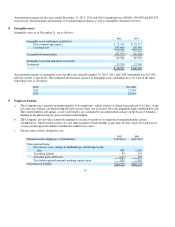

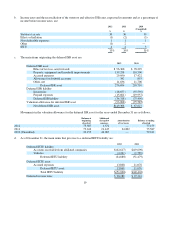

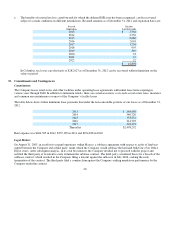

The transition liability balance generated in 2007 will be amortized over a five-year period.

14

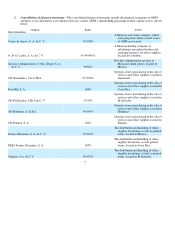

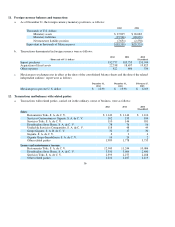

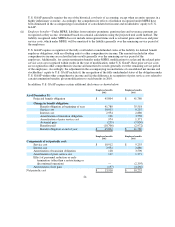

d. Nominal rates used in actuarial calculations are as follows:

2012 2011

% %

Discount of the

p

ro

j

ected benefit obli

g

ation at

p

resent value

8.19

7.98

Salar

y

increase

5.73

5.86

Minimum wa

g

e increase rate

4.27

4.27

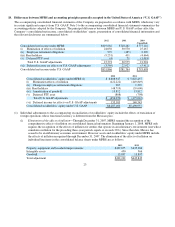

e. Net cost for the

p

eriod includes the followin

g

items:

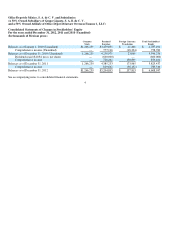

2012 2011 2010

(Unaudited)

Service cost

$10,913

$9,255

$9,22

0

Interest cost

2,954

2,88

0

2,068

Amortization of unreco

g

nized

p

rior service costs

208

5,197

3,978

Amortization of actuarial

g

ains

1,412

(6,977)

(1,759)

Effect of personnel reduction or early termination (other than a

restructurin

g

or discontinued o

p

eration)

(605) (605)

(509)

Net cost for the

p

eriod

$14,882

$9,75

0

$ 12,998

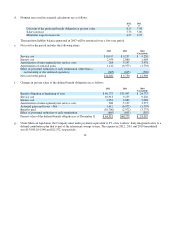

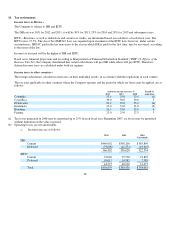

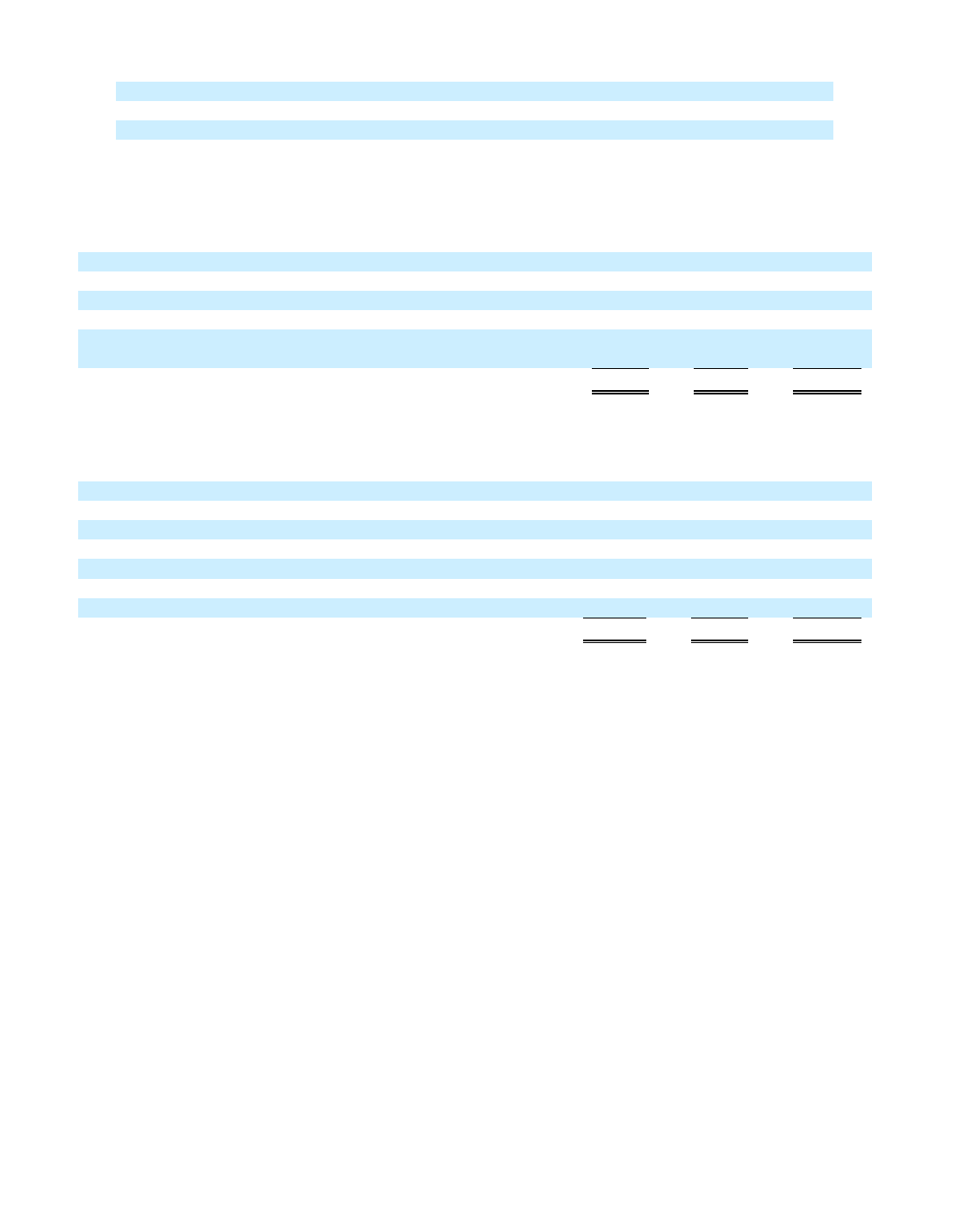

f. Chan

g

es in

p

resent value of the defined benefit obli

g

ation are as follows:

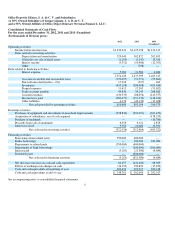

2012 2011 2010

(Unaudited)

Benefit obli

g

ation at be

g

innin

g

of

y

ear

$40,775

$33,997

$24,773

Service cost

10,913

9,255

9,22

0

Interest cost

2,954 2,880

2,068

Amortization of unreco

g

nized

p

rior service costs

208

5,197

3,977

Actuarial

g

ains and losses

–

Net

1,412

(6,977)

(1,759)

Benefits

p

aid

(10,706)

(2,972)

(3,775)

Effect of

p

ersonnel reduction or earl

y

termination

(605)

(605)

(507)

Present value of the defined benefit obli

g

ation as of December 31

$ 44,951

$40,775

$ 33,997

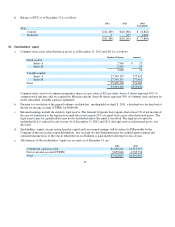

g. Under Mexican legislation, the Company must make payments equivalent to 2% of its workers’ daily integrated salary to a

defined contribution plan that is part of the retirement savings system. The expense in 2012, 2011 and 2010 (unaudited)

was $15,908, $14,348 and $12,552, res

p

ectivel

y

.