Office Depot 2012 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174

|

|

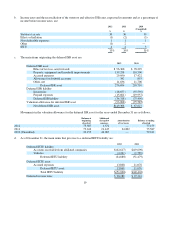

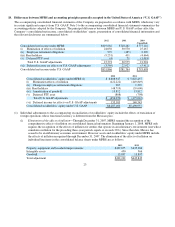

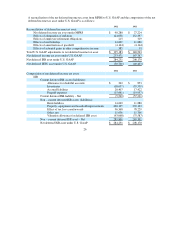

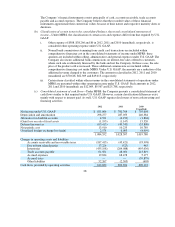

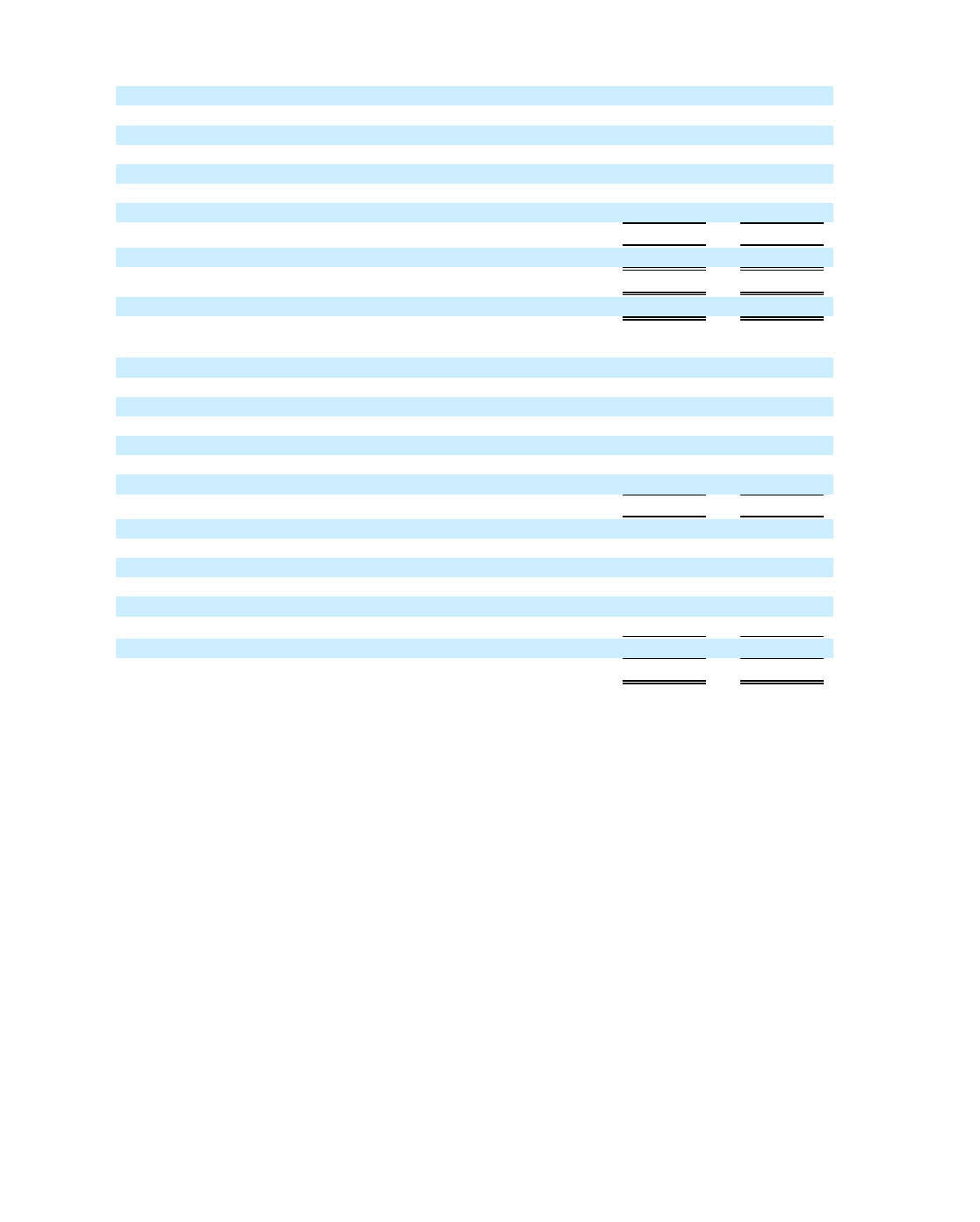

A reconciliation of the net deferred income tax asset from MFRS to U.S. GAAP and the composition of the net

deferred income tax asset under U.S. GAAP is as follows:

26

2012 2011

Reconciliation of deferred income tax asset:

Net deferred income tax asset under MFRS

$ 98,288

$27,224

Effects of elimination of inflation

124,058

132,397

Effects of em

p

lo

y

ee retirement obli

g

ations

215

319

Effects of rent holida

y

s

14,669

11,880

Effects of amortization of

g

oodwill

(4,144)

(4,144)

Effects of actuarial

g

ains in other com

p

rehensive income

385

91

Total U.S. GAAP ad

j

ustments to net deferred income tax asset

$ 135,183

$140,543

Net deferred income tax asset under U.S. GAAP

233,471

167,767

Net deferred ISR asset under U.S. GAAP

284,231

208,170

Net deferred IETU asset under U.S. GAAP

(50,760)

(40,403)

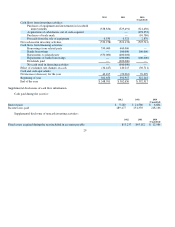

2012 2011

Com

p

osition of net deferred income tax asset:

ISR

Current deferred ISR assets (liabilities):

Allowance for doubtful accounts

$ 342

$853

Inventories

(18,657)

(55,539)

Accrued liabilities

28,407

17,422

Pre

p

aid ex

p

enses

(15,661)

(19,957)

Current deferred ISR liabilit

y

–

Net

(5,569)

(57,221)

Non

–

current deferred ISR assets (liabilities):

Rents holida

y

s

14,669

11,880

Pro

p

ert

y

, e

q

ui

p

ment and leasehold im

p

rovements

260,195

239,163

Effect of tax loss carr

y

forwards

96,368

78,229

Other, net

11,636

11,706

Valuation allowance for deferred ISR asset

(93,068)

(75,587)

Non

–

current deferred ISR asset

–

Net

289,800

265,391

Net deferred ISR asset under U.S. GAAP

$ 284,231

$208,170