Office Depot 2012 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

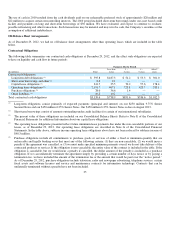

SIGNIFICANT TRENDS, DEVELOPMENTS AND UNCERTAINTIES

Competitive Factors — Over the years, we have seen continued development and growth of competitors in all segments of ou

r

business. In particular, mass merchandisers and warehouse clubs, as well as grocery and drugstore chains, have increased thei

r

assortment of home office merchandise, attracting additional back-to-school customers and year-round casual shoppers. Warehouse

clubs have expanded beyond their in-store assortment by adding catalogs and web sites from which a much broader assortment o

f

products may be ordered. We also face competition from other office supply stores that compete directly with us in numerous

markets. This competition is likely to result in increased competitive pressures on pricing, product selection and services provided.

Many of these retail competitors, including discounters, warehouse clubs, and drug stores and grocery chains, carry basic office

supply products. Some of them also feature technology products. Many of them may price certain of these offerings lower than we do,

but they have not shown an indication of greatly expanding their somewhat limited product offerings at this time. This trend towards

a

proliferation of retailers offering a limited assortment of office products is a potentially serious trend in our industry that could shift

purchasing away from office supply specialty retailers and adversely impact our results.

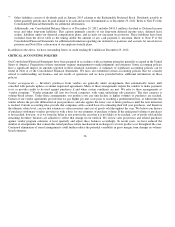

We have also seen growth in competitors that offer office products over the Internet, featuring special purchase incentives and one-

time deals (such as close-outs). Through our own successful Internet and business-to-business web sites, we believe that we have

positioned ourselves competitively in the e-commerce arena.

Another trend in our industry has been consolidation, as competitors in office supply stores and the copy/print channel have been

acquired and consolidated into larger, well-capitalized corporations. This trend towards consolidation, coupled with acquisitions by

financially strong organizations, is potentially a significant trend in our industry that could impact our results.

We regularly consider these and other competitive factors when we establish both offensive and defensive aspects of our overall

business strategy and operating plans.

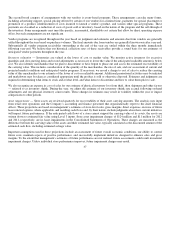

E

conomic Factors — Our customers in the North American Retail Division and the International Division and many of our customers

in the North American Business Solutions Division are predominantly small and home office businesses. Accordingly, spending by

these customers is affected by macroeconomic conditions, such as changes in the housing market and commodity costs, credit

availability and other factors. The downturn in the global economy experienced in recent years negatively impacted our sales and

profits.

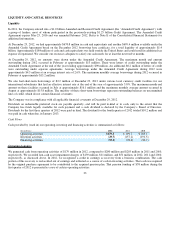

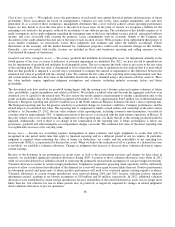

L

iquidity Factors — Historically, we have generated positive cash flow from operating activities and have had access to broad

financial markets that provide the liquidity we need to operate our business. Together, these sources have been used to fund operating

and working capital needs, as well as invest in business expansion through new store openings, capital improvements and

acquisitions. Due to the downturn in the global economy, our operating results have declined. We have in place an asset based credit

facility to provide liquidity, subject to availability as specified in the agreement. Further deterioration in our financial results could

negatively impact our credit ratings, our liquidity and our access to the capital markets. Certain of our existing indebtedness matures

in 2013 and there can be no assurance that we will be able to refinance all or a portion of that indebtedness. If we are able to refinance

all or a portion of that indebtedness, the terms of such refinancing will likely be less favorable than the terms of our existing

indebtedness, which would increase future interest expense.

40