Office Depot 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

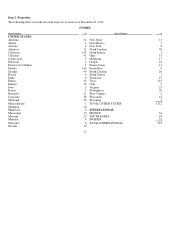

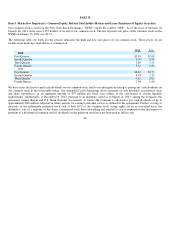

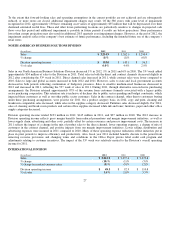

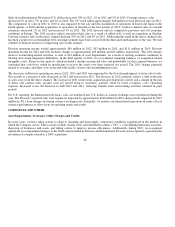

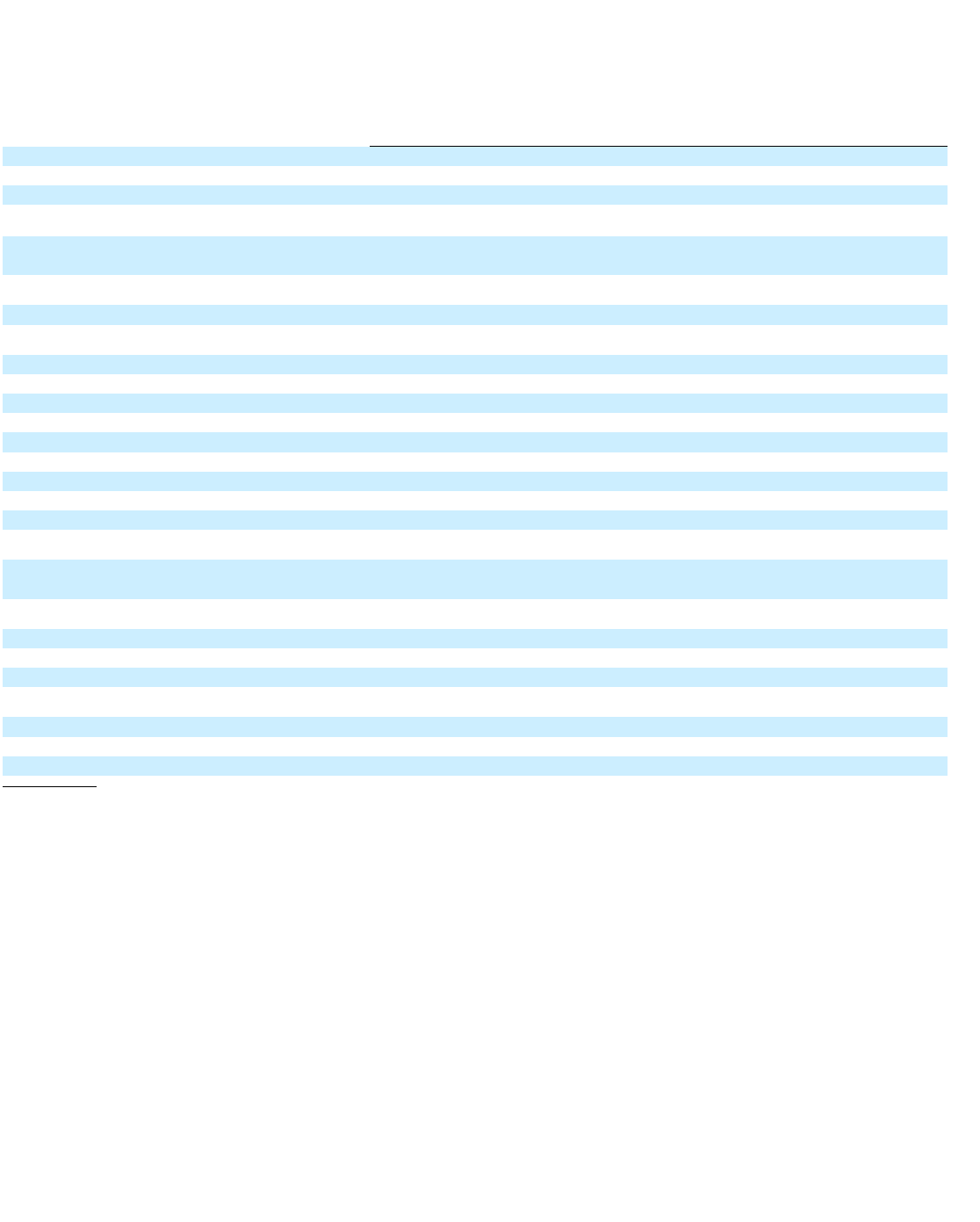

Item 6. Selected Financial Data.

The following table sets forth selected consolidated financial data at and for each of the five fiscal years in the period ended

December 29, 2012. It should be read in conjunction with the Consolidated Financial Statements and Notes thereto and MD&A,

included in Items 7 and 8 of this Annual Report, respectively.

22

(In thousands, exce

p

t

p

er share amounts and statistical data)

2012

2011

2010

2009

2008

Statements of Operations Data:

Sales

$10,695,65

2

$11,489,533

$11,633,094

$12,144,467

$14,495,544

Net earnin

g

s (loss)

$(77,12

0

)

$95,691

$(46,205)

$(598,724)

$(1,481,003)

Net earnings (loss) attributable to Office Depot, Inc.

$ (77,111)

$ 95,694

$ (44,623)

$ (596,465)

$ (1,478,938)

Net earnings (loss) available to common

shareholders

$(110,045)

$59,989

$(81,736)

$(626,971)

$(1,478,938)

Net earnin

g

s (loss)

p

er share:

Basic

$(0.39) $0.22 $ (0.3

0

)

$(2.30)

$(5.42)

Diluted

$(0.39) $0.22 $(0.3

0

)

$ (2.30)

$ (5.42)

Statistical Data:

Facilities o

p

en at end of

p

eriod:

United States:

Office su

pp

l

y

stores

1,11

2

1,131

1,147

1,152

1,267

Distribution centers

13

13

13

15

20

Crossdock facilities

2

2

3

6

12

International :

Office su

pp

l

y

stores

123 131 97

137

162

Distribution centers

23

27

26

39

43

Call centers

21

22

25

29

27

Total square footage

—

North American Retail

Division

25,518,02

7

26,556,126

27,559,184

28,109,844

30,672,862

Percenta

g

e of sales b

y

se

g

ment:

North American Retail Division

41.7%

42.4%

42.7%

42.1%

42.2%

North American Business Solutions Division

30.0% 28.4% 28.3%

28.7%

28.6%

International Division

28.3% 29.2% 29.0%

29.2%

29.2%

Balance Sheet Data:

Total assets

$4,010,779

$4,250,984

$4,569,437

$4,890,346

$5,268,226

Lon

g

-term debt, excludin

g

current maturities

485,331

648,313

659,82

0

662,74

0

688,788

Redeemable

p

referred stock, net

386,401

363,636

355,979

355,308

—

Includes 53 weeks in accordance with our 52

—

53 week re

p

ortin

g

convention.

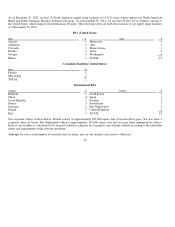

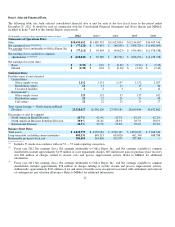

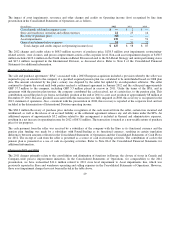

Fiscal year 2012 Net earnings (loss), Net earnings attributable to Office Depot, Inc., and Net earnings available to commo

n

shareholders include approximately $139 million of asset impairment charges, $63 million net gain on purchase price recovery

and $56 million of charges related to closure costs and process improvement activity. Refer to MD&A for additional

information.

Fiscal year 2011 Net earnings (loss), Net earnings attributable to Office Depot, Inc., and Net earnings available to commo

n

shareholders includes approximately $58 million of charges relating to facility closure and process improvement activity.

Additionally, approximately $123 million of tax and interest benefits were recognized associated with settlements and removal

of contin

g

encies and valuation allowances. Refer to MD&A for additional information.

(1)

(2)(3)(4)(5)(6)

(2)(3)(4)(5)(6)

(2)(3)(4)(5)(6)

(7)

(1)

(2)

(3)