Office Depot 2012 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174

|

|

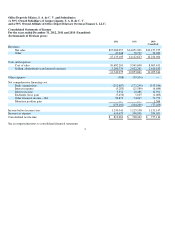

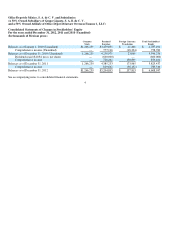

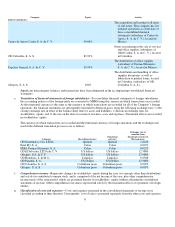

Office Depot de México, S. A. de C. V. and Subsidiaries

(A 50% Owned Subsidiary of Grupo Gigante, S. A. B. de C. V.

and a 50% Owned Affiliate of Office Depot Delaware Overseas Finance 1, LLC)

Consolidated Statements of Changes in Stockholders’ Equity

For the years ended December 31, 2012, 2011 and 2010 (Unaudited)

(In thousands of Mexican pesos)

See accompanying notes to consolidated financial statements.

4

Common

Stock

Retained

Earnings

Foreign Currency

Translation

Total Stockholders’

Equity

Balances as of Januar

y

1, 2010 (Unaudited)

$1,266,239

$3,479,855

$41,40

0

$4,787,494

Com

p

rehensive income (Unaudited)

—

777,116

(18,334)

758,782

Balances as of December 31, 2010 (Unaudited)

1,266,239

4,256,971

23,066

5,546,276

Dividends

p

aid ($10.81

p

esos

p

er share)

—

(600,000)

—

(600,00

0

)

Com

p

rehensive income

—

728,262

150,899

879,161

Balances as of December 31, 2011

1,266,239

4,385,233

173,965

5,825,437

Com

p

rehensive income

—

819,662

(36,152)

783,51

0

Balances as of December 31, 2012

$1,266,239

$5,204,895

$ 137,813

$ 6,608,947