Office Depot 2012 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

The cash payment from the seller was received by a subsidiary of the Company with the Euro as its functional currency and the

pension plan funding was made by a subsidiary with Pound Sterling as its functional currency, resulting in certain translation

differences between amounts reflected in the Consolidated Statements of Operations and the Consolidated Statements of Cash Flows

for 2012. The receipt of cash from the seller is presented as a source of cash in investing activities. The contribution of cash to the

pension plan is presented as a use of cash in operating activities.

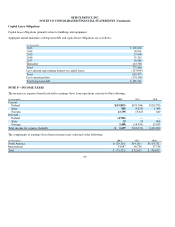

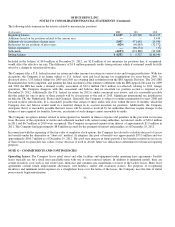

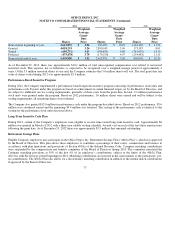

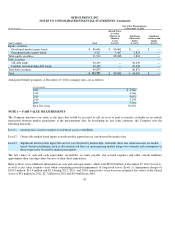

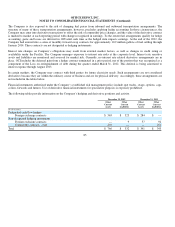

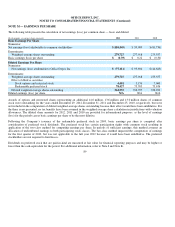

The following table provides a reconciliation of changes in the projected benefit obligation, the fair value of plan assets and the

funded status of the plan to amounts recognized on the Company’s Consolidated Balance Sheets:

In the Consolidated Balance Sheets, the net funded amount at December 29, 2012 is classified as a non-current asset in the caption

Other assets and the net unfunded balance at December 31, 2011 was included in Deferred taxes and other long-term liabilities.

Included in OCI were deferred losses of $3.9 million and $1.0 million at December 29, 2012 and December 31, 2011, respectively.

The deferred loss is not expected to be amortized into income during 2012.

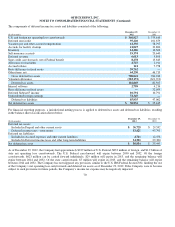

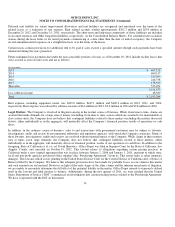

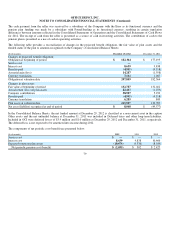

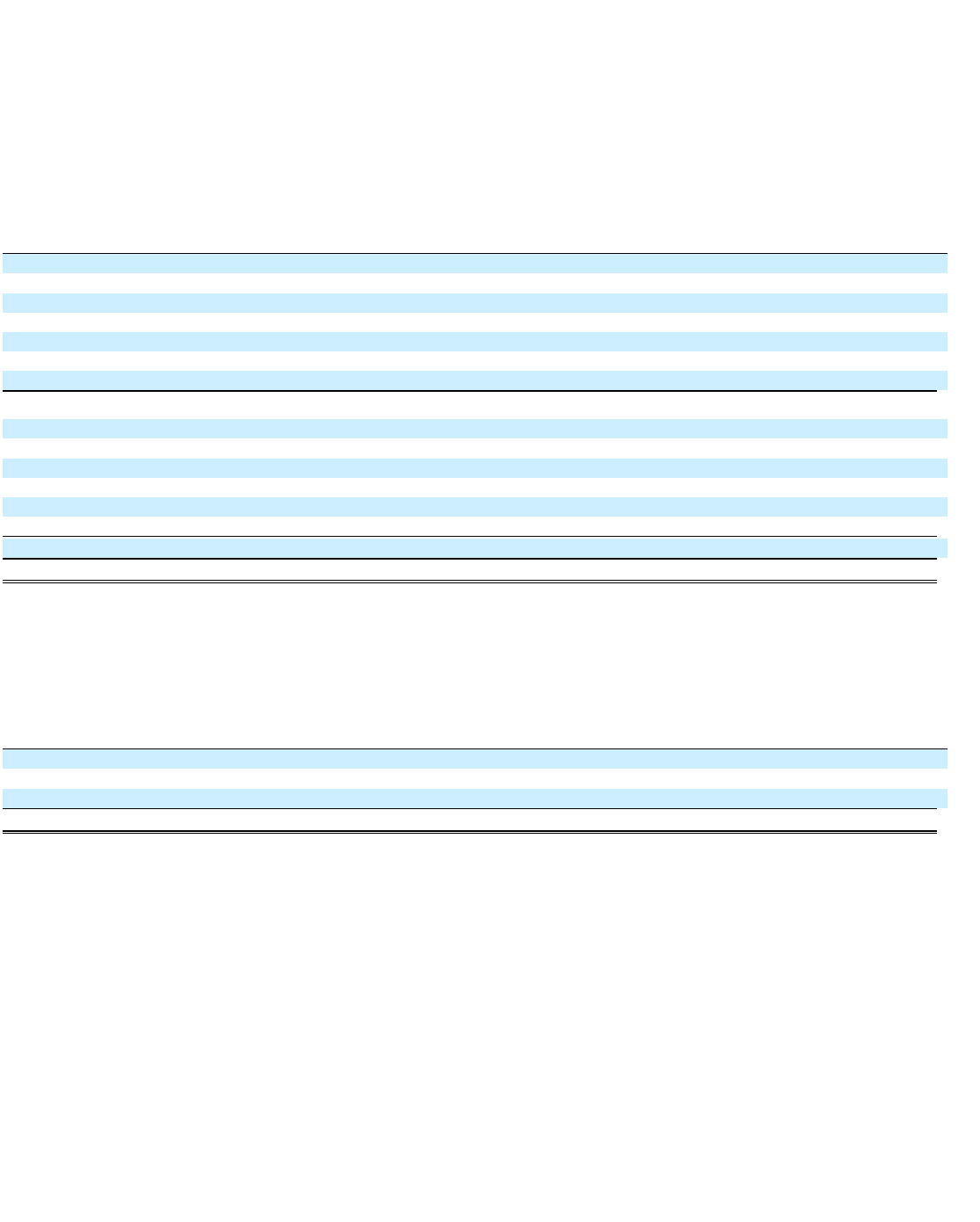

The components of net periodic cost (benefit) are presented below:

79

(In thousands) December 29, 2012 December 31, 2011

Chan

g

es in

p

ro

j

ected benefit obli

g

ation:

Obli

g

ation at be

g

innin

g

of

p

eriod

$ 182,364

$ 177,195

Service cost

—

—

Interest cost

8,639

9,838

Benefits

p

aid

(4,545)

(4,118)

Actuarial

g

ain (loss)

14,28

7

(1,558)

Currenc

y

translation

7,114

1,007

Obli

g

ation at valuation date

207,859

182,364

Chan

g

es in

p

lan assets:

Fair value at be

g

innin

g

of

p

eriod

132,78

7

132,022

Actual return (loss) on

p

lan assets

22,413

(1,259)

Com

p

an

y

contributions

58,98

7

5,293

Benefits

p

aid

(4,545)

(4,118)

Currenc

y

translation

6,285

849

Plan assets at valuation date

215,92

7

132,787

Net asset (liabilit

y

) reco

g

nized at end of

p

eriod

$ 8,068

$(49,577)

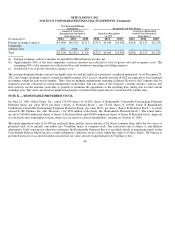

(In thousands) 2012 2011 2010

Service cost

$

—

$

—

$

—

Interest cost

8,639

9,838

10,466

Ex

p

ected return on

p

lan assets

(10,674)

(9,336)

(8,039)

Net

p

eriodic

p

ension cost (benefit)

$ (2,035)

$ 502

$ 2,427