Office Depot 2012 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In 2012, the Company adopted the following pronouncements, which did not have a material effect in the

accompanying consolidated financial statements:

30

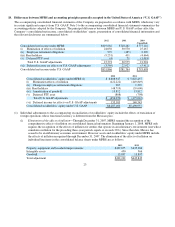

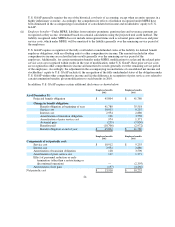

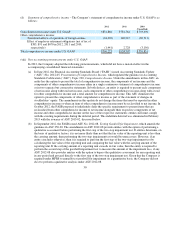

(d) Statement of comprehensive income

–

The Company’s statement of comprehensive income under U.S. GAAP is as

follows:

2012 2011 2010

(Unaudited)

Consolidated net income under U.S. GAAP

$831,866

$781,764

$793,698

Other com

p

rehensive income:

Translation effects of o

p

erations of forei

g

n entities

(34,202)

140,215

(30,711)

Effect of employee retirement obligations (net of tax of

$385, $91 and $670 in 2012, 2011 and 2010,

res

p

ectivel

y

)

(1,441) 2,728

(3,156)

Total com

p

rehensive income under U.S. GAAP

$796,223

$924,707

$759,831

(viii)

N

ew accounting pronouncements under U.S. GAAP:

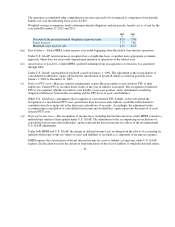

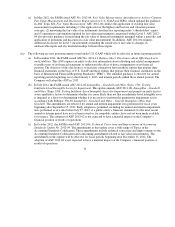

(a) In June 2012, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update

(“ASU”) No. 2012-05, Presentation of Comprehensive Income, which updated the guidance in Accounting

Standards Codification (“ASC”) Topic 220, Comprehensive Income. Under the amendments in this ASU, an

entity has the option to present the total of comprehensive income, the components of net income and the

components of other comprehensive income either in a single continuous statement of comprehensive income

or in two separate but consecutive statements. In both choices, an entity is required to present each component

of net income along with total net income, each component of other comprehensive income along with a total

for other comprehensive income and a total amount for comprehensive income. This ASU eliminates the

option to present the components of other comprehensive income as part of the statement of changes in

stockholders’ equity. The amendments in this update do not change the items that must be reported in other

comprehensive income or when an item of other comprehensive income must be reclassified to net income. In

October 2012, the FASB proposed to indefinitely defer the specific requirement to present items that are

reclassified from other comprehensive income to net income alongside their respective components of net

income and other comprehensive income on the face of the respective statements; entities still must comply

with the existing requirements during the deferral period. This indefinite deferral was eliminated in February

2013 with the issuance of ASU 2013-02, discussed below.

(b) In September 2012, the FASB issued ASU No. 2012-08, Testing Goodwill for Impairment, which amends the

guidance in ASC 350-20. The amendments in ASU 2012-08 provide entities with the option of performing a

qualitative assessment before performing the first step of the two-step impairment test. If entities determine, on

the basis of qualitative factors, it is not more likely than not that the fair value of the reporting unit is less than

the carrying amount, then performing the two-step impairment test would be unnecessary. However, if an

entity concludes otherwise, then it is required to perform the first step of the two-step impairment test by

calculating the fair value of the reporting unit and comparing the fair value with the carrying amount of the

reporting unit. If the carrying amount of a reporting unit exceeds its fair value, then the entity is required to

perform the second step of the goodwill impairment test to measure the amount of the impairment loss, if any.

ASU 2012-08 also provides entities with the option to bypass the qualitative assessment for any reporting unit

in any period and proceed directly to the first step of the two-step impairment test. Given that the Company is

required under MFRS to annually test goodwill for impairment on a quantitative basis, the Company did not

elect to

p

erform a

q

ualitative anal

y

sis under ASU 2012-08.