Office Depot 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

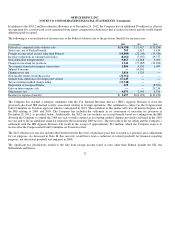

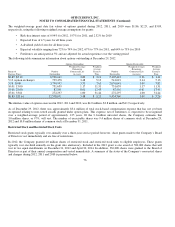

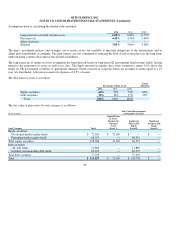

As of December 29, 2012, there was approximately $10.1 million of total unrecognized compensation cost related to nonvested

restricted stock. This expense, net of forfeitures, is expected to be recognized over a weighted-average period of approximately 2

years. Of the 5.5 million unvested shares at year end, the Company estimates that 5.0 million shares will vest. The total grant date fai

r

value of shares vested during 2012 was approximately $2.4 million.

Performance-Based Incentive Program

During 2012, the Company implemented a performance-based long-term incentive program consisting of performance stock units and

performance cash. Payouts under this program are based on achievement of certain financial targets set by the Board of Directors, and

are subject to additional service vesting requirements, generally of three years from the grant date. In total, 2.1 million performance

stock units were granted under the program. Based on 2012 performance, 1.0 million shares were earned and will be subject to the

vesting requirements; all remaining shares were forfeited.

The Company also granted $15.0 million in performance cash under the program described above. Based on 2012 performance, $5.6

million was considered earned and the remaining $9.4 million was forfeited. The vesting of the performance cash is identical to the

vesting for the performance stock units discussed above.

Long-Term Incentive Cash Plan

During 2012, certain of the Company’s employees were eligible to receive time-vested long-term incentive cash. Approximately $6

million was granted in March of 2012 with a three-year ratable vesting schedule. Awards vest on each of the first three anniversaries

following the grant date. As of December 29, 2012 there was approximately $5.5 million that remained outstanding.

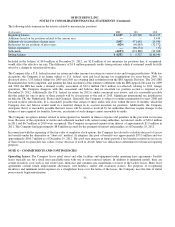

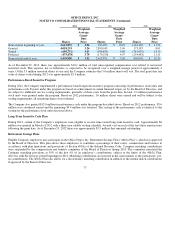

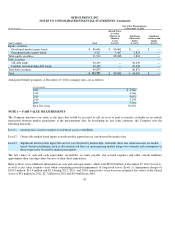

Retirement Savings Plans

Eligible Company employees may participate in the Office Depot, Inc. Retirement Savings Plan (“401(k) Plan”), which was approved

by the Board of Directors. This plan allows those employees to contribute a percentage of their salary, commissions and bonuses in

accordance with plan limitations and provisions of Section 401(k) of the Internal Revenue Code. Company matching contributions

were suspended by the compensation and benefits committee of the Board of Directors during 2010. The committee reinstated the

Company matching provisions at 50% of the first 4% of an employee’s contributions, subject to the limits of the 401(k) Plan,

effective with the first pay period beginning in 2011. Matching contributions are invested in the same manner as the participants’ pre-

tax contributions. The 401(k) Plan also allows for a discretionary matching contribution in addition to the normal match contributions

if approved by the Board of Directors.

77

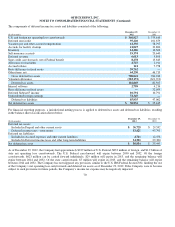

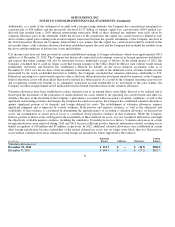

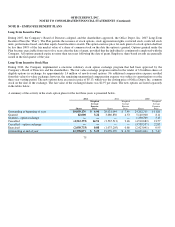

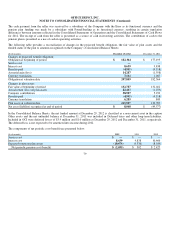

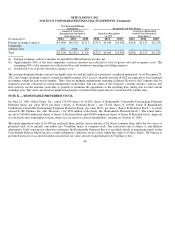

2012 2011 2010

Shares

Weighted

Average

Grant-

Date

Price

Shares

Weighted

Average

Grant-

Date

Price

Shares

Weighted

Average

Grant-

Date

Price

Nonvested at beginning of year

2,612,876

$3.96

496,059

$10.39

1,318,162

$13.21

Granted

4,018,253

3.26

2,890,943

3.96

173,387

8.01

Vested

(695,751)

3.45

(594,876)

9.00

(741,007)

14.19

Forfeited

(475,478)

3.79

(179,25

0

) 4.97

(254,483)

11.31

Nonvested at end of

y

ear

5,459,90

0

$3.52

2,612,876

$3.96

496,059

$10.39