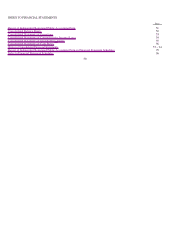

Office Depot 2012 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

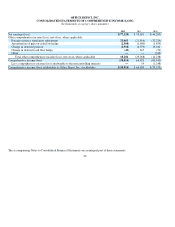

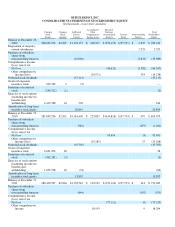

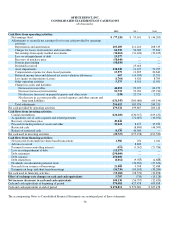

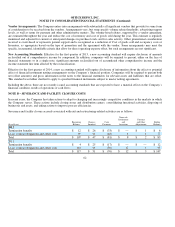

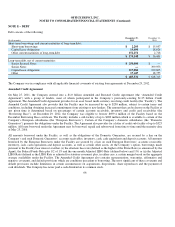

OFFICE DEPOT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

56

2012 2011 2010

Cash flows from operating activities:

Net earnin

g

s (loss)

$(77,120)

$ 95,691

$(46,205)

Adjustments to reconcile net earnings (loss) to net cash provided by operating

activities:

De

p

reciation and amortization

203,189

211,410

208,319

Char

g

es for losses on inventories and receivables

64,930

56,200

57,824

Net earnin

g

s from e

q

uit

y

method investments

(30,462)

(31,426)

(30,635)

Loss on extin

g

uishment of debt

13,377

_

_

__

Recover

y

of

p

urchase

p

rice

(58,049)

_

_

__

Pension

p

lan fundin

g

(58,030)

_

_

__

Dividends received

_

_

25,016

—

Asset im

p

airments

138,540

11,427

51,295

Com

p

ensation ex

p

ense for share-based

p

a

y

ments

13,579

13,895

20,840

Deferred income taxes and deferred tax assets valuation allowances

667

(14,999)

15,551

Loss (

g

ain) on dis

p

osition of assets

(1,764)

4,420

8,709

Other o

p

eratin

g

activities

5,375

8,510

11,501

Chan

g

es in assets and liabilities:

Decrease in receivables

44,052

99,927

60,273

Decrease (increase) in inventories

52,733

53,902

(87,724)

Net decrease (increase) in

p

re

p

aid ex

p

enses and other assets

(138)

25,754

2,522

Net decrease in accounts payable, accrued expenses and other current and

lon

g

-term liabilities

(131,547)

(360,060)

(69,144)

Total ad

j

ustments

256,452

103,976

249,331

Net cash

p

rovided b

y

o

p

eratin

g

activities

179,332

199,667

203,126

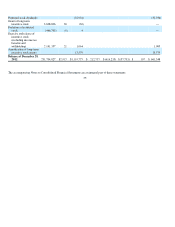

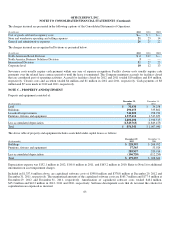

Cash flows from investing activities:

Ca

p

ital ex

p

enditures

(120,260)

(130,317)

(169,452)

Ac

q

uisitions, net of cash ac

q

uired, and related

p

a

y

ments

_

_

(72,667)

(10,952)

Recover

y

of

p

urchase

p

rice

49,841

_

_

__

Proceeds from dis

p

osition of assets and other

32,122

8,117

35,393

Restricted cash

_

_

(8,800)

(46,509)

Release of restricted cash

8,570

46,509

—

Net cash used in investin

g

activities

(29,727)

(157,158)

(191,520)

Cash flows from financing activities:

Net

p

roceeds from em

p

lo

y

ee share-based transactions

1,586

254

1,011

Advance received

_

_

8,800

—

Pa

y

ment for non-controllin

g

interests

(551)

(1,262)

(21,786)

Loss on extin

g

uishment of debt

(13,377)

_

_

__

Debt retirement

(250,000)

_

_

__

Debt issuance

250,000

_

_

__

Debt related fees

(8,012)

(9,945)

(4,688)

Dividends on redeemable

p

referred stoc

k

_

_

(36,852)

(27,639)

Proceeds from issuance of borrowin

g

s

21,908

9,598

52,488

Pa

y

ments on lon

g

- and short-term borrowin

g

s

(56,736)

(69,169)

(30,284)

Net cash used in financin

g

activities

(55,182)

(98,576)

(30,898)

Effect of exchange rate changes on cash and cash equivalents

5,707

(730)

(13,128)

Net increase (decrease) in cash and cash equivalents

100,130

(56,797)

(32,420)

Cash and cash e

q

uivalents at be

g

innin

g

of

p

eriod

570,681

627,478

659,898

Cash and cash e

q

uivalents at end of

p

eriod

$ 670,811

$ 570,681

$ 627,478