Office Depot 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

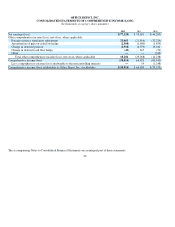

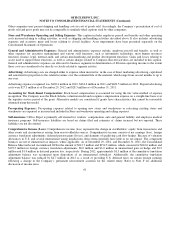

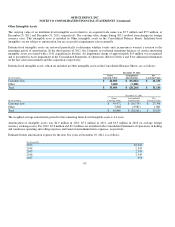

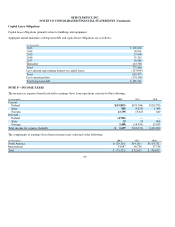

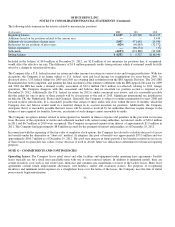

The charges incurred are presented in the following captions of the Consolidated Statements of Operations.

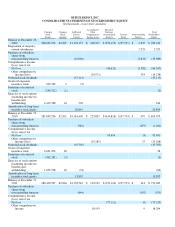

The charges incurred are recognized in Divisions as presented below.

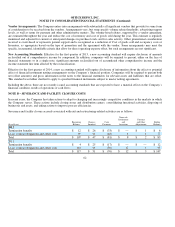

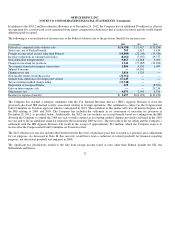

Severance costs usually require cash payment within one year of expense recognition. Facility closure costs usually require cash

payments over the related lease contract period or until the lease is terminated. The Company maintains accruals for facilities closed

that are considered part of operating activities. Accrual for facilities closed for 2012 and 2011 totaled $10 million and $14 million,

respectively. Closure costs and accretion totaled $4 million and $1 million in 2012 and 2011, respectively. Cash payments of $8

million and $7 were made in 2012 and 2011, respectively.

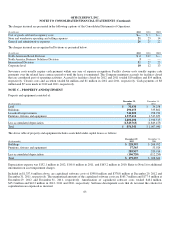

NOTE C – PROPERTY AND EQUIPMENT

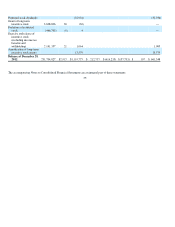

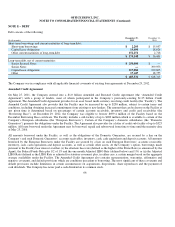

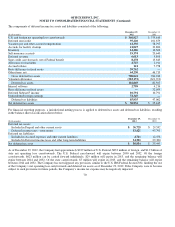

Property and equipment consisted of:

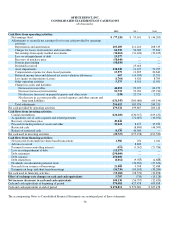

The above table of property and equipment includes assets held under capital leases as follows:

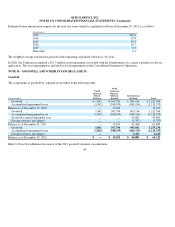

Depreciation expense was $152.1 million in 2012, $161.0 million in 2011, and $163.2 million in 2010. Refer to Note I for additional

information on asset impairment charges.

Included in $1,337.6 million above, are capitalized software costs of $398.0 million and $378.8 million at December 29, 2012 and

December 31, 2011, respectively. The unamortized amounts of the capitalized software costs are $165.7 million and $177.9 million at

December 29, 2012 and December 31, 2011, respectively. Amortization of capitalized software costs totaled $46.2 million,

$45.2 million and $42.2 million in 2012, 2011 and 2010, respectively. Software development costs that do not meet the criteria fo

r

capitalization are expensed as incurred.

63

(In millions) 2012 2011 2010

Cost of

g

oods sold and occu

p

anc

y

costs

$

—

$ 1

$

—

Store and warehouse o

p

eratin

g

and sellin

g

ex

p

enses

21

25

14

General and administrative ex

p

enses

26

25

22

(In millions) 2012 2011 2010

North American Retail Division

$ 2

$12

$

—

North America Business Solutions Division

3

—

—

International Division

32

27

23

Cor

p

orate level

10

12

13

(In thousands)

December 29,

2012

December 31,

2011

Land

$31,430

$34,258

Buildin

g

s

290,153

335,862

Leasehold im

p

rovements

746,909

998,736

Furniture, fixtures and e

q

ui

p

ment

1,337,612

1,547,659

2,406,104

2,916,515

Less accumulated de

p

reciation

(1,549,763)

(1,849,475)

Total

$856,341

$1,067,040

(In thousands)

December 29,

2012

December 31,

2011

Buildin

g

s

$228,392

$266,992

Furniture, fixtures and e

q

ui

p

ment

57,565

53,924

285,957

320,916

Less accumulated de

p

reciation

(106,720)

(112,250)

Total

$179,237

$208,666