Office Depot 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our business is highly competitive and failure to adequately differentiate ourselves or respond to shifting consumer demands

could adversely impact our financial performance.

The office products market is highly competitive and we compete locally, domestically and internationally with office supply stores,

including Staples and OfficeMax, wholesale clubs such as Costco and BJs, mass merchandisers such as Wal-Mart and Target,

computer and electronics superstores such as Best Buy, Internet-based companies such as Amazon.com, food and drug stores,

discount stores, and direct marketing companies. Many competitors have also increased their presence by broadening thei

r

assortments or broadening from retail into the delivery and e-commerce channels, while others have substantially greater financial

resources to devote to sourcing, marketing and selling their products. Product pricing is also becoming ever more competitive,

particularly among competitors on the Internet. In order to achieve and maintain expected profitability levels, we must continue to

grow by adding new customers and taking market share from competitors. In addition, consumers are utilizing more technology and

purchasing less paper, file storage and similar products. If we are unable to provide technology solutions and services that meet

consumer needs or if we are unable to effectively compete, our sales and financial performance will be negatively impacted.

I

f we are unable to successfully maintain a relevant multichannel experience for our customers, our results of operations could be

adversely affected.

With the increasing use of computers, tablets, mobile phones and other devices to shop in our stores and online, we offer full and

mobile versions of our website (www.officedepot.com) and applications for mobile phones and tablets. In addition, we are increasing

the use of social media as a means of interacting with our customers and enhancing their shopping experiences. Multichannel retailing

is rapidly evolving and we must keep pace with the changing expectations of our customers and new developments by ou

r

competitors. If we are unable to attract and retain team members or contract third parties with the specialized skills needed to support

our multichannel platforms, or are unable to implement improvements to our customer-facing technology in a timely manner, ou

r

ability to compete and our results of operations could be adversely affected. In addition, if our web site and our other customer-facing

technology systems do not function as designed, we may experience a loss of customer confidence and satisfaction, data security

breaches, lost sales or be exposed to fraudulent purchases, which could adversely affect our reputation and results of operations.

We do a significant amount of business with government entities and loss of this business could negatively impact our results.

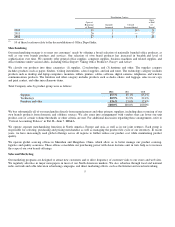

One of our largest U.S. customer groups consists of various state and local governments, government agencies and non-profit

organizations. Contracting with state and local governments is highly competitive, subject to federal and state procurement laws,

requires more restrictive contract terms and can be expensive and time-consuming. Bidding such contracts often requires that we

incur significant upfront time and expense without any assurance that we will win a contract. Our ability to compete successfully fo

r

and retain business with the federal and various state and local governments is highly dependent on cost-effective performance and is

also sensitive to changes in national and international priorities and U.S., state and local government budgets, which in the current

economy continue to decrease. We service a substantial amount of government agency business through agreements with consortiums

of governmental and non-profit entities. If we are unsuccessful in retaining these customers, or if there is a significant reduction in

sales under our large government contracts or if we lose these contracts, it could adversely impact our financial results.

I

f a significant number of our vendors demand accelerated payments or require cash on delivery, such demands could have an

adverse impact on our operating cash flow and result in severe stress on our liquidity.

We purchase products for resale under credit arrangements with our vendors and have been able to negotiate payment terms that are

approximately equal in length to the time it takes to sell the vendor’s products. When the global economy is experiencing weakness as

it has over the last five years, vendors may seek credit insurance to protect against non-payment of amounts due to them. If we

continue to experience declining operating performance, and if we experience severe liquidity challenges, vendors may demand that

we accelerate our payment for their products. Borrowings under our existing credit facility could reach maximum levels under such

circumstances, causing us to seek alternative liquidity measures, but we may not be able to meet our obligations as they become due

until we secure such alternative measures.

10