Office Depot 2012 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

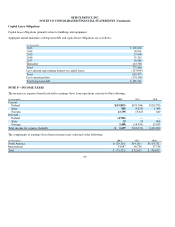

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

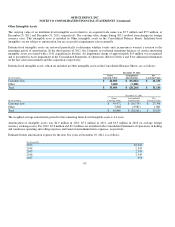

Property and Equipment: Property and equipment additions are recorded at cost. Depreciation and amortization is recognized ove

r

their estimated useful lives using the straight-line method. The useful lives of depreciable assets are estimated to be 15-30 years fo

r

buildings and 3-10 years for furniture, fixtures and equipment. Computer software is amortized over three years for common office

applications, five years for larger business applications and seven years for certain enterprise-wide systems. Leasehold improvements

are amortized over the shorter of the estimated economic lives of the improvements or the terms of the underlying leases, including

renewal options considered reasonably assured. The Company capitalizes certain costs related to internal use software that is expected

to benefit future periods. These costs are amortized using the straight-line method over the expected life of the software, which are

estimated to be 3-7 years.

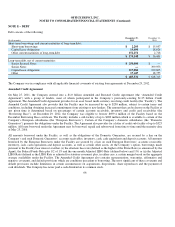

Goodwill and Other Intangible Assets: Goodwill represents the excess of the cost of an acquisition over the value assigned to net

tangible and identifiable intangible assets of the business acquired. The Company assesses possible goodwill impairment annually in

the fourth quarter, or sooner if indications of possible impairment are identified. The Company elected to perform a quantitative test

of goodwill for 2012 and no impairment was identified. This test compares the book value of net assets to the fair value of the

reporting units. If the fair value is determined to be less than the book value, a second step is performed to compute the amount o

f

impairment as the difference between the estimated fair value of goodwill and the carrying value. The fair value of the reporting units

with goodwill were estimated using a discounted cash flow analysis and certain market information. This method of estimating fai

r

value requires assumptions, judgments and estimates of future performance.

Unless conditions warrant earlier action, intangible assets with indefinite lives also are assessed annually for impairment during the

fourth quarter. The Company elected to perform a quantitative test of its indefinite life intangible asset for 2012 and no impairment

was identified. The test was based on a discounted cash flow approach.

Cost of other intangible assets are amortized over their estimated useful lives. Amortizable intangible assets are periodically reviewed

to determine whether events and circumstances warrant a revision to the remaining period of amortization. During 2012, a charge o

f

approximately $14 million was recognized related to impairment of amortizing intangible assets. Refer to Note I for additional

discussion.

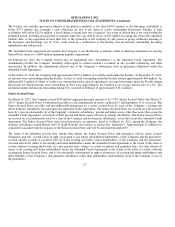

Impairment of Long-Lived Assets: Long-lived assets with identifiable cash flows are reviewed for possible impairment annually o

r

whenever events or changes in circumstances indicate that the carrying amount of such assets may not be recoverable. Impairment is

assessed at the individual store level which is the lowest level of identifiable cash flows, and considers the estimated undiscounted

cash flows over the asset’s remaining life. If estimated undiscounted cash flows are insufficient to recover the investment, an

impairment loss is recognized equal to the estimated fair value of the asset less its carrying value and any costs of disposition, net o

f

salvage value. The fair value estimate is generally the discounted amount of estimated store-specific cash flows. Impairment losses o

f

$124.2 million, $11.4 million and $2.3 million were recognized in 2012, 2011 and 2010, respectively. Because of the significance, the

2012 and 2011 amounts are included in Asset impairments in the Consolidated Statements of Operations. These impairment losses

relate to certain under-performing retail stores and changes in assumptions following the Company’s adoption in the third quarter o

f

2012 of the North American Retail Division retail strategy (“ NA Retail Strategy”). Refer to Note I for additional discussion.

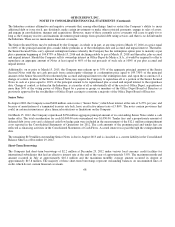

Facility Closure Costs: Store performance is regularly reviewed against expectations and stores not meeting performance

requirements may be closed. Costs associated with store or other facility closures, principally accrued lease costs, are recognized

when the facility is no longer used in an operating capacity or when a liability has been incurred. Store assets are also reviewed fo

r

possible impairment, or reduction of estimated useful lives.

59