Office Depot 2012 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

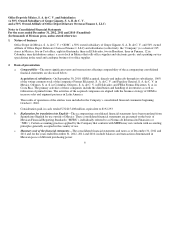

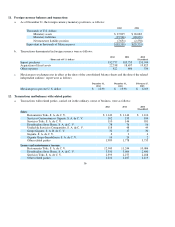

Significant intercompany balances and transactions have been eliminated in the accompanying consolidated financial

statements.

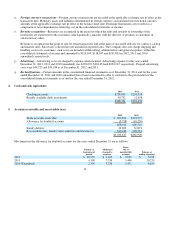

The currency in which transactions are recorded and the functional currency of foreign operations and the exchange rates

used in the different translation processes are as follows:

8

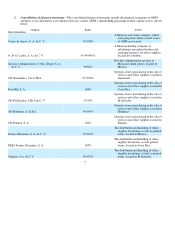

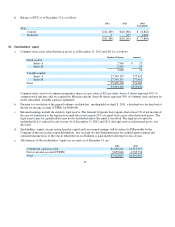

Company Equity Activity

Indirect subsidiaries:

Centro de A

p

o

y

o Caribe S. A. de C. V.

90.00%

The acquisition and leasing of all types

of real estate. This company has not

initiated operations as of the date of

these consolidated financial

statements (subsidiary of Centro de

Apoyo, S. A. de C. V.), located in

Mexico.

OD Colombia, S. A. S.

89.90%

Stores specializing in the sale of services

and office supplies (subsidiary of

ODG Caribe, S. A. de C. V.), located

in Colombia.

Pa

p

elera General, S. A. de C. V.

99.99%

The distribution of office supplies

(subsidiary of Formas Eficientes,

S. A. de C. V.), located in México.

Ofix

p

res, S. A. S.

100%

The distribution and handling of office

supplies inventories as well as

fabrication of printed forms, located

in Colombia, (subsidiary of OD

Colombia, S. A. S.).

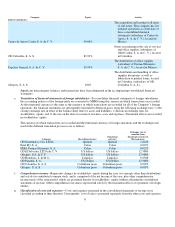

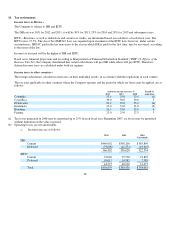

e. Translation of financial statements of foreign subsidiaries

—

To consolidate financial statements of foreign subsidiaries,

the accounting policies of the foreign entity are converted to MFRS using the currency in which transactions are recorded.

As the functional currency is the same as the currency in which transactions are recorded for all of the Company’s foreign

operations, the financial statements are subsequently translated to Mexican pesos using the following exchange rates: 1) the

closing exchange rate in effect at the balance sheet date for assets and liabilities; 2) historical exchange rates for

stockholders’ equity, and 3) the rate on the date of accrual of revenues, costs and expenses. Translation effects are recorded

in stockholders’ e

q

uit

y

.

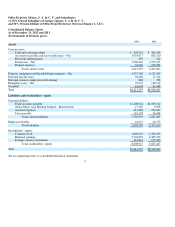

Com

p

an

y

Recordin

g

currenc

y

Functional

currenc

y

Exchange rate to

translate from

functional currency to

Mexican

p

esos

OD Guatemala

y

Cía. LTDA

Quetzal

Quetzal

1.6436

Erial BQ, S. A.

Colon

Colon

0.0253

FESA Formas Eficientes, S. A.

Colon

Colon

0.0253

OD El Salvador, LTDA de C. V.

US dollars

US dollars

12.988

0

Ofix

p

res, S.A. de C.V.

US dollars

US dollars

12.988

0

OD Honduras, S. de R. L.

Lem

p

iras

Lem

p

iras

0.6508

OD Panamá, S. A.

US Dollars

US Dollars

12.988

0

OD Colombia, S. A. S.

Colombian

p

esos

Colombian

p

esos

0.0073

Ofix

p

res, S. A. S.

Colombian

p

esos

Colombian

p

esos

0.0073

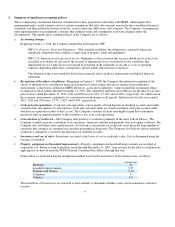

f. Comprehensive income

—

Represents changes in stockholders’ equity during the year, for concepts other than distributions

and activity in contributed common stock, and is comprised of the net income of the year, plus other comprehensive

income items of the same period, which are presented directly in stockholders’ equity without affecting the consolidated

statements of income. Other comprehensive income is represented solely by the translation effects of operations of foreign

entities.

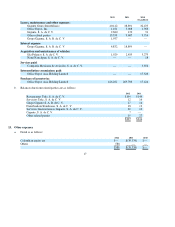

g. Classification of costs and expenses

—

Costs and expenses presented in the consolidated statements of income were

classified accordin

g

to their function. Conse

q

uentl

y

, cost of sales is

p

resented se

p

aratel

y

from the other costs and ex

p

enses.