Office Depot 2012 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

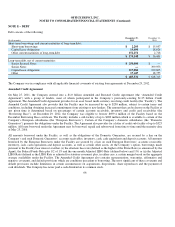

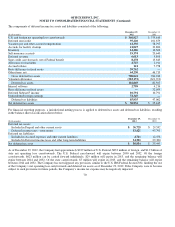

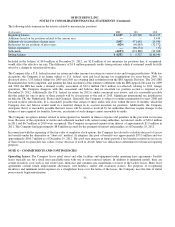

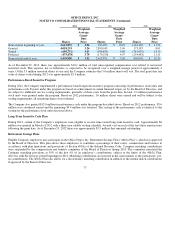

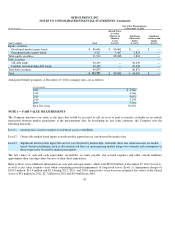

Deferred rent liability for tenant improvement allowances and rent holidays are recognized and amortized over the terms of the

related leases as a reduction of rent expense. Rent related accruals totaled approximately $262.7 million and $254 million at

December 29, 2012 and December 31, 2011, respectively. The short-term and long-term components of these liabilities are included

in Accrued expenses and Other long-term liabilities, respectively, on the Consolidated Balance Sheets. For scheduled rent escalation

clauses during the lease terms or for rental payments commencing at a date other than the date of initial occupancy, the Company

records minimum rental expenses on a straight-line basis over the terms of the leases.

Certain leases contain provisions for additional rent to be paid if sales exceed a specified amount, though such payments have been

immaterial during the years presented.

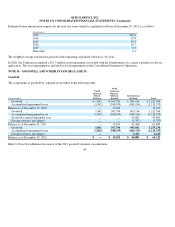

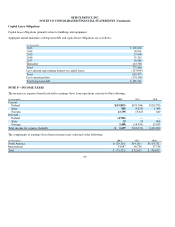

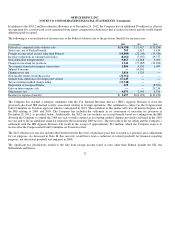

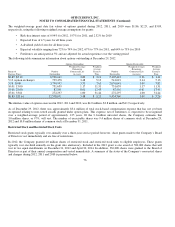

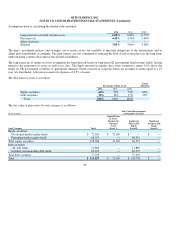

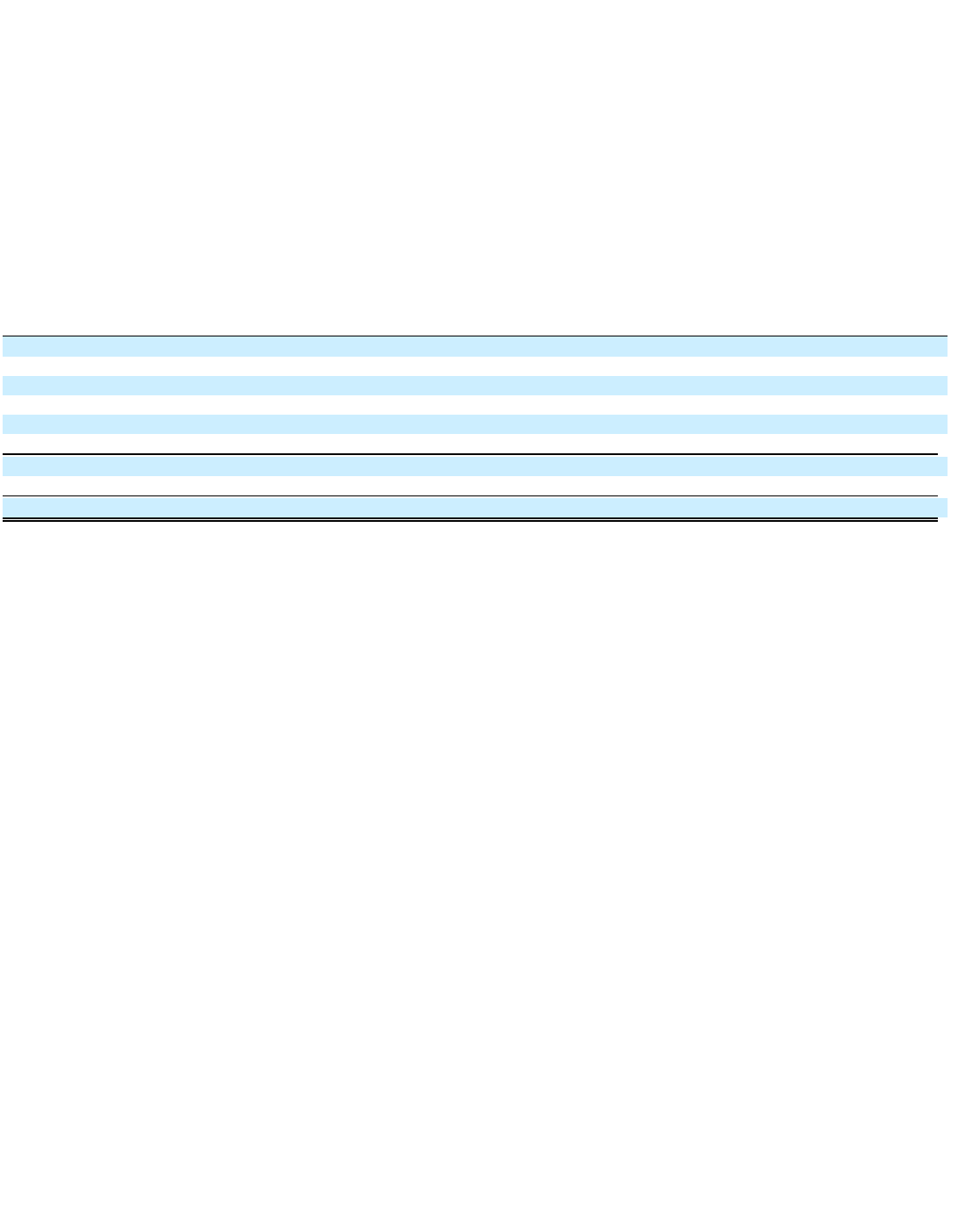

Future minimum lease payments due under the non-cancelable portions of leases as of December 29, 2012 include facility leases that

were accrued as store closure costs and are as follows.

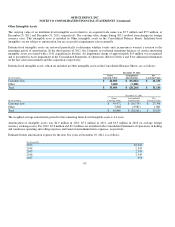

Rent expense, including equipment rental, was $429.0 million, $447.1 million and $469.4 million in 2012, 2011, and 2010,

respectively. Rent expense was reduced by sublease income of $4.6 million in 2012, $3.0 million in 2011and $2.8 million in 2010.

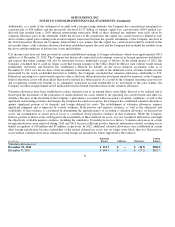

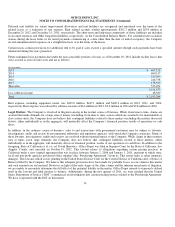

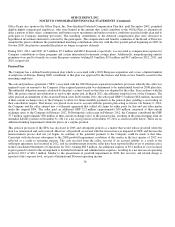

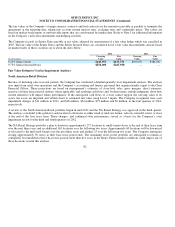

Legal Matters: The Company is involved in litigation arising in the normal course of business. While, from time to time, claims are

asserted that make demands for a large sum of money (including, from time to time, actions which are asserted to be maintainable as

class action suits), the Company does not believe that contingent liabilities related to these matters (including the matters discussed

below), either individually or in the aggregate, will materially affect the Company’s financial position, results of operations or cash

flows.

In addition, in the ordinary course of business, sales to and transactions with government customers may be subject to lawsuits,

investigations, audits and review by governmental authorities and regulatory agencies, with which the Company cooperates. Many o

f

these lawsuits, investigations, audits and reviews are resolved without material impact to the Company. While claims in these matters

may at times assert large demands, the Company does not believe that contingent liabilities related to these matters, eithe

r

individually or in the aggregate, will materially affect our financial position, results of our operations or cash flows. In addition to the

foregoing, State of California et. al. ex. rel. David Sherwin v. Office Depot was filed in Superior Court for the State of California, Los

Angeles County, and unsealed on October 19, 2012. This lawsuit relates to allegations regarding certain pricing practices in

California under a now expired agreement that was in place between January 2, 2006 and January 1, 2011, pursuant to which state,

local and non-profit agencies purchased office supplies (the “Purchasing Agreement”) from us. This action seeks as relief monetary

damages. This lawsuit, which is now pending in the United States District Court for the Central District of California after a Notice o

f

Removal filed by the Company. We believe that adequate provisions have been made for probable losses on one claim in this matte

r

and such amounts are not material. However, in light of the early stages of the other claims and the inherent uncertainty of litigation,

we are unable to reasonably determine the full effect of the potential liability in the matter. Office Depot intends to vigorously defend

itself in this lawsuit and filed motions to dismiss. Additionally, during the first quarter of 2011, we were notified that the United

States Department of Justice (“DOJ”) commenced an investigation into certain pricing practices related to the Purchasing Agreement.

We have cooperated with the DOJ on this matter.

74

(In thousands)

2013

$467,126

2014

400,317

2015

325,509

2016

246,738

2017

178,929

Thereafter

533,054

2,151,673

Less sublease income

48,389

Total

$2,103,284