Office Depot 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Other companies may present shipping and handling costs in cost of goods sold. Accordingly, the Company’s presentation of cost o

f

goods sold and gross profit may not be comparable to similarly titled captions used by other companies.

Store and Warehouse Operating and Selling Expenses: This caption includes employee payroll and benefits and other operating

costs incurred relating to selling activities, as well as shipping and handling activities described above. It also includes advertising

expenses and accretion, gains and losses relating to closed facilities. Asset impairments have been presented separately on the

Consolidated Statements of Operations.

General and Administrative Expenses: General and administrative expenses include, employee payroll and benefits, as well as

other expenses for executive management and various staff functions, such as information technology, most human resources

functions, finance, legal, internal audit, and certain merchandising and product development functions. Gains and losses relating to

assets used to support these functions, as well as certain charges related to Company-directed activities are included in this caption.

General and administrative expenses are allocated to business segments in determination of Division operating income to the extent

those costs are considered to be directly or closely related to segment activity.

Advertising: Advertising costs are charged either to expense when incurred or, in the case of direct marketing advertising, capitalized

and amortized in proportion to the related revenues over the estimated life of the material, which range from several months to up to

one year.

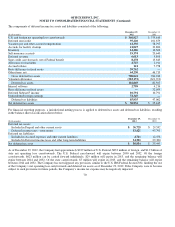

Advertising expense recognized was $402.4 million in 2012, $434.6 million in 2011 and $469.5 million in 2010. Prepaid advertising

costs were $27.3 million as of December 29, 2012 and $28.3 million as of December 31, 2011.

Accounting for Stock-Based Compensation: Stock-based compensation is accounted for using the fair value method of expense

recognition. The Company uses the Black-Scholes valuation model and recognize compensation expense on a straight-line basis ove

r

the requisite service period of the grant. Alternative models are considered if grants have characteristics that cannot be reasonably

estimated using this model.

Pre-opening Expenses: Pre-opening expenses related to opening new stores and warehouses or relocating existing stores and

warehouses are expensed as incurred and included in Store and warehouse operating and selling expenses.

Self-insurance: Office Depot is primarily self-insured for workers’ compensation, auto and general liability and employee medical

insurance programs. Self-insurance liabilities are based on claims filed and estimates of claims incurred but not reported. These

liabilities are not discounted.

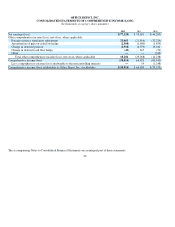

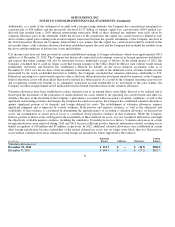

Comprehensive Income (Loss): Comprehensive income (loss) represents the change in stockholders’ equity from transactions and

other events and circumstances arising from non-stockholder sources. Comprehensive income consists of net earnings (loss), foreign

currency translation adjustments, deferred pension gains (losses), and elements of qualifying cash flow hedges. Because of valuation

allowances in U.S. and several international taxing jurisdictions, these items generally have little or no tax impact. The component

balances are net of immaterial tax impacts, where applicable. As of December 29, 2012, and December 31, 2011, the Consolidated

Balance Sheet reflected Accumulated OCI in the amount of $212.7 million and $194.5 million, which consisted of $216.0 million and

$192.5 million in foreign currency translation adjustments, $0.6 million and $3.0 million in unamortized gain on hedge and $3.9

million and $1.0 million in deferred pension loss, respectively. During 2012, approximately $3.3 million of the cumulative translation

adjustment balance was recognized upon disposition of an international subsidiary. Additionally, the cumulative translation

adjustment balance was reduced by $4.7 million in 2012 as a result of providing U.S. deferred taxes on certain foreign earnings

following a change in the Company’s permanent reinvestment assertion for the related entity. Refer to Note F for additional

discussion of income taxes.

61