Office Depot 2012 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

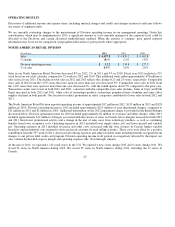

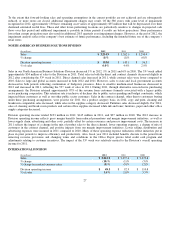

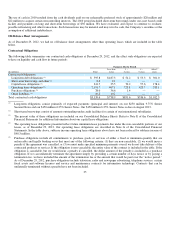

The impact of asset impairments, severance and other charges and credits on Operating income (loss) recognized by line ite

m

presentation in the Consolidated Statements of Operations are as follows.

The 2012 charges and credits relate to $68.3 million recovery of purchase price, $138.5 million asset impairments, restructuring-

related activity, store closures, and process improvement actions at the corporate level. Non-cash asset impairment charges of $138.5

million includes $123.4 million in the North American Retail Division related to the NA Retail Strategy and under-performing stores

and $15.1 million recognized in the International Division, as discussed above. Refer to Note I of the Consolidated Financial

Statements for additional information.

R

ecovery of Purchase Price

The sale and purchase agreement (“SPA”) associated with a 2003 European acquisition included a provision whereby the seller was

required to pay an amount to the company if a specified acquired pension plan was calculated to be underfunded based on 2008 plan

data. The amount calculated by the plan’s actuary was disputed by the seller but upheld by an independent arbitrator. The selle

r

continued to dispute the award until both parties reached a settlement agreement in January 2012 and the seller paid approximately

GBP 37.7 million to the company, including GBP 5.5 million placed in escrow in 2011. Under the terms of the SPA, and in

agreement with the pension plan trustees, the company contributed the cash received, net of certain fees, to the pension plan. This

contribution caused the plan to go from a net liability position at the end of 2011 to a net asset position of approximately $8 million at

December 29, 2012. Because goodwill associated with this transaction was fully impaired in 2008, this recovery is recognized in the

2012 statement of operations. Also, consistent with the presentation in 2008, this recovery is reported at the corporate level and not

included in the determination of International Division operating income.

The $68.3 million Recovery of purchase price includes recognition of the cash received from the seller, certain fees incurred and

reimbursed, as well as the release of an accrued liability as the settlement agreement releases any and all claims under the SPA. An

additional expense of approximately $5.2 million related to this arrangement is included in General and administrative expenses,

resulting in a net increase in operating income for 2012 of $63.1 million. The transaction is treated as a non-taxable return of purchase

price for tax purposes.

The cash payment from the seller was received by a subsidiary of the company with the Euro as its functional currency and the

pension plan funding was made by a subsidiary with Pound Sterling as its functional currency, resulting in certain translation

differences between amounts reflected in the Consolidated Statements of Operations and the Consolidated Statements of Cash Flows

for 2012. The receipt of cash from the seller is presented as a source of cash in investing activities. The contribution of cash to the

pension plan is presented as a use of cash in operating activities. Refer to Note H of the Consolidated Financial Statements fo

r

additional information.

Charges in 2011 and 2010

The 2011 charges primarily relate to the consolidation and elimination of functions in Europe, the closure of stores in Canada and

Company-wide process improvement initiatives. In the Consolidated Statements of Operations, for comparability to the 2012

presentation, we have reclassified $11.4 million related to 2011 store level impairment to Asset impairments line, which was

previously reported in Store and warehouse operating and selling expenses in the Consolidated Statements of Operations. However,

those asset impairment charges have not been reflected in the table above.

29

(In millions) 2012 2011 2010

Cost of

g

oods sold and occu

p

anc

y

costs

$

—

$ 2

$

—

Store and warehouse o

p

eratin

g

and sellin

g

ex

p

enses

22

25

14

Recover

y

of

p

urchase

p

rice

(68)

—

—

Asset im

p

airments

139

—

51

General and administrative ex

p

enses

34 31

22

Total char

g

es and credits im

p

act on O

p

eratin

g

income (loss)

$ 127

$ 58

$ 87