Office Depot 2012 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

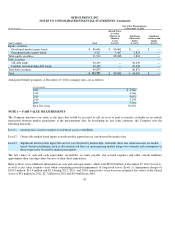

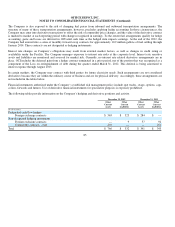

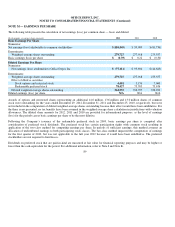

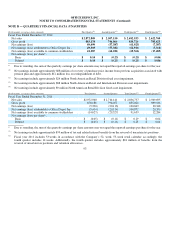

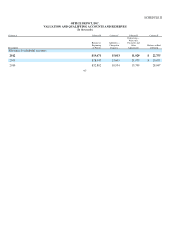

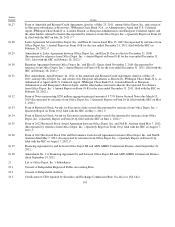

A reconciliation of the measure of Division operating income to Earnings (loss) before income taxes follows.

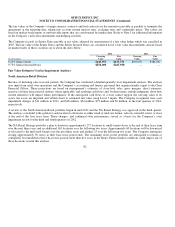

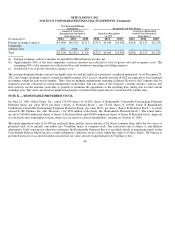

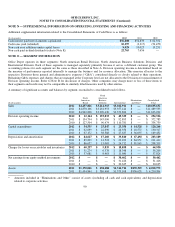

As of December 29, 2012, the Company sold to customers throughout North America, Europe, Asia and Latin America. The

Company operates through wholly-owned and majority-owned entities and participates in other ventures and alliances. There is no

single country outside of the United States in which the Company generates 10% or more of the Company’s total sales. Geographic

financial information relating to the Company’s business is as follows (in thousands).

The Company classifies products into three categories: (1) supplies, (2) technology, and (3) furniture and other. The supplies category

includes products such as paper, binders, writing instruments, school supplies, and ink and toner. The technology category includes

products such as desktop and laptop computers, monitors, tablets, printers, cables, software, digital cameras, telephones, and wireless

communications products. The furniture and other category includes products such as desks, chairs, luggage, sales in the copy and

print centers, and other miscellaneous items.

Total Company sales by product group were as follows:

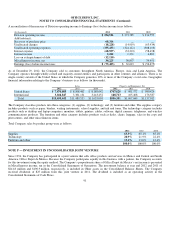

NOTE P — INVESTMENT IN UNCONSOLIDATED JOINT VENTURE

Since 1994, the Company has participated in a joint venture that sells office products and services in Mexico and Central and South

America, Office Depot de Mexico. Because the Company participates equally in this business with a partner, the Company accounts

for this investment using the equity method. The Company’s proportionate share of Office Depot de Mexico’s net income is presented

in Miscellaneous income, net in the Consolidated Statements of Operations. The investment balance at year end 2012 and 2011 o

f

$241.8 million and $196.9 million, respectively, is included in Other assets in the Consolidated Balance Sheets. The Company

received dividends of $25 million from this joint venture in 2011. The dividend is included as an operating activity in the

Consolidated Statements of Cash Flows.

91

(In thousands) 2012 2011 2010

Division o

p

eratin

g

income

$254,526

$372,785

$334,759

Add/(subtract):

Recover

y

of

p

urchase

p

rice

68,314

_

_

__

Unallocated char

g

es

(18,228)

(14,919)

(63,934)

Unallocated o

p

eratin

g

ex

p

enses

(335,453) (324,112)

(308,116)

Interest ex

p

ense

(68,937)

(33,223)

(58,498)

Interest income

2,240

1,231

4,663

Loss on extin

g

uishment of debt

(12,110)

_

_

__

Miscellaneous income, net

34,225

30,857

34,451

Earnin

g

s (loss) before income taxes

$(75,423)

$32,619

$(56,675)

Sales Property and Equipment, Net

2012 2011 2010 2012 2011 2010

United States

$7,670,805

$8,108,402

$8,189,642

$707,628

$901,572

$980,426

International

3,024,847

3,381,131

3,443,452

148,713

165,468

176,587

Total

$10,695,652

$11,489,533

$11,633,094

$856,341

$1,067,040

$1,157,013

2012 2011 2010

Su

pp

lies

65.5%

65.1%

65.2%

Technolo

gy

20.9%

21.9%

22.4%

Furniture and other

13.6%

13.0%

12.4%

100.0%

100.0%

100.0%