Office Depot 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

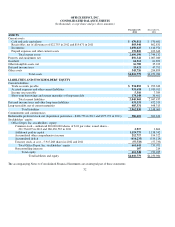

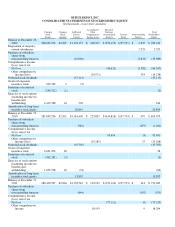

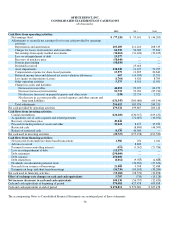

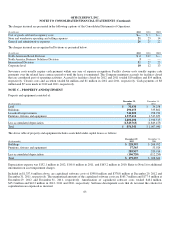

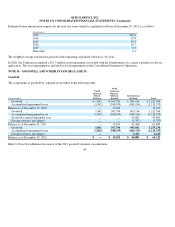

OFFICE DEPOT, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands, except share amounts)

Common

Stock

Shares

Common

Stock

Amount

Additional

Paid-in

Ca

p

ital

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

(Accumulated

Deficit)

Treasury

Stock

Noncontrolling

Interest

Total

Stockholders’

E

q

uit

y

Balance at December 26,

2009

280,652,278

$2,807

$1,193,157

$238,379

$(590,195)

$(57,733)

$2,827

$789,242

Disposition of majority-

owned subsidiaries

2,523

2,523

Purchase of subsidiary

shares from

noncontrollin

g

interests

(16,066)

(3,623)

(19,689)

Comprehensive income

(loss), net of tax:

Net loss

(44,623)

(1,582)

(46,205)

Other comprehensive

income (loss)

(14,572)

334

(14,238)

Preferred stock dividends

(37,113)

(37,113)

Grant of long-term

incentive stoc

k

223,762

2

(2)

—

Forfeiture of restricted

stoc

k

(236,512)

(2)

(2)

Exercise of stock options

(including income tax

benefits and

withholdin

g

)

2,419,708

24

59

0

614

Amortization of long-term

incentive stock

g

rants

20,843

20,843

Balance at December 25,

201

0

283,059,236

$2,831

$1,161,409

$223,807

$ (634,818)

$(57,733)

$479

$ 695,975

Purchase of subsidiary

shares from

noncontrollin

g

interests

(983)

(279)

(1,262)

Comprehensive income

(loss), net of tax

Net loss

95,694

(3)

95,691

Other comprehensive

income (loss)

(29,285)

17

(29,268)

Preferred stock dividends

(35,705)

(35,705)

Grant of long-term

incentive stoc

k

2,641,074

26

26

Forfeiture of restricted

stoc

k

(342,281)

(3)

(3)

Exercise of stock options

(including income tax

benefits and

withholdin

g

)

1,072,538

1

0

(74)

(64)

Amortization of long-term

incentive stock

g

rants

13,895

13,895

Balance at December 31,

2011

286,430,567

$2,864

$1,138,542

$194,522

$ (539,124)

$(57,733)

$214

$ 739,285

Purchase of subsidiary

shares from

noncontrollin

g

interests

(444)

(107)

(551)

Comprehensive income

(loss), net of tax

Net loss

(77,111)

(9)

(77,12

0

)

Other comprehensive

income

18,195

9

18,204