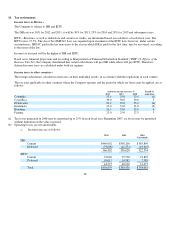

Office Depot 2012 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

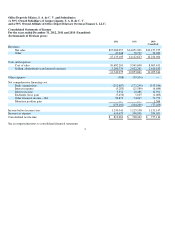

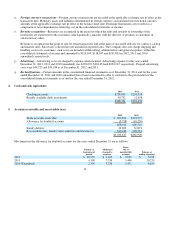

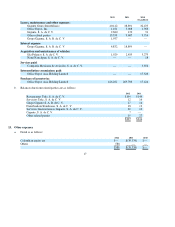

Amortization expense for the years ended December 31, 2012, 2011 and 2010 (unaudited) was $98,801, $94,890 and $65,859,

respectively, which includes amortization of leasehold improvements as well as intangibles detailed in Note 8.

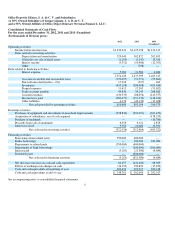

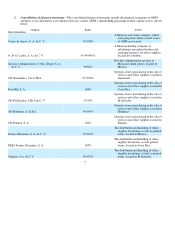

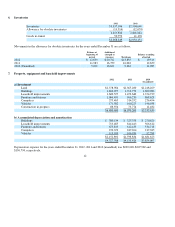

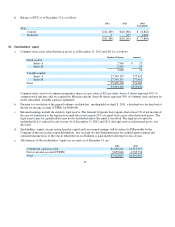

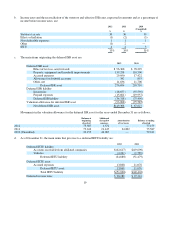

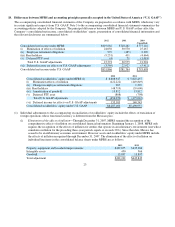

Intangible assets as of December 31, are as follows:

Amortization expense of intangible assets for the years ended December 31, 2012, 2011 and 2010 (unaudited) was $23,266,

$36,641 and $0, respectively. The estimated amortization expense of intangible assets with finite lives for each of the three

following years is as follows:

13

8. Intangible assets

2012 2011

Intan

g

ible assets with finite useful lives:

Non-com

p

ete a

g

reement

$ 22,412

$ 24,121

Customer list

105,908

103,346

128,32

0

127,467

Accumulated amortization

(63,575)

(40,308)

64,745

87,159

Intan

g

ible asset with indefinite useful life:

Trademar

k

13,55

0

12,99

0

$78,295

$100,149

2013

$23,340

2014

23,340

2015

18,065

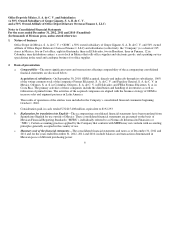

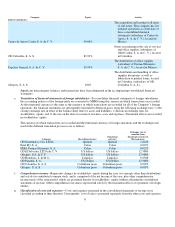

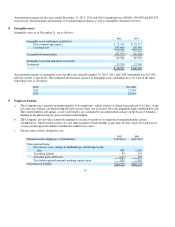

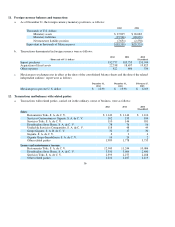

9. Employee benefits

a. The Company pays seniority premium benefits to its employees, which consist of a lump sum payment of 12 days’ wage

for each year worked, calculated using the most recent salary, not to exceed twice the minimum wage established by law.

The related liability and annual cost of such benefits are calculated by an independent actuary on the basis of formulas

defined in the

p

lans usin

g

the

p

ro

j

ected unit credit method.

b. The Company also provides statutorily mandated severance benefits to its employees terminated under certain

circumstances. Such benefits consist of a one-time payment of three months wages plus 20 days wages for each year of

service

p

a

y

able u

p

on involuntar

y

termination without

j

ust cause.

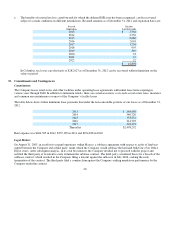

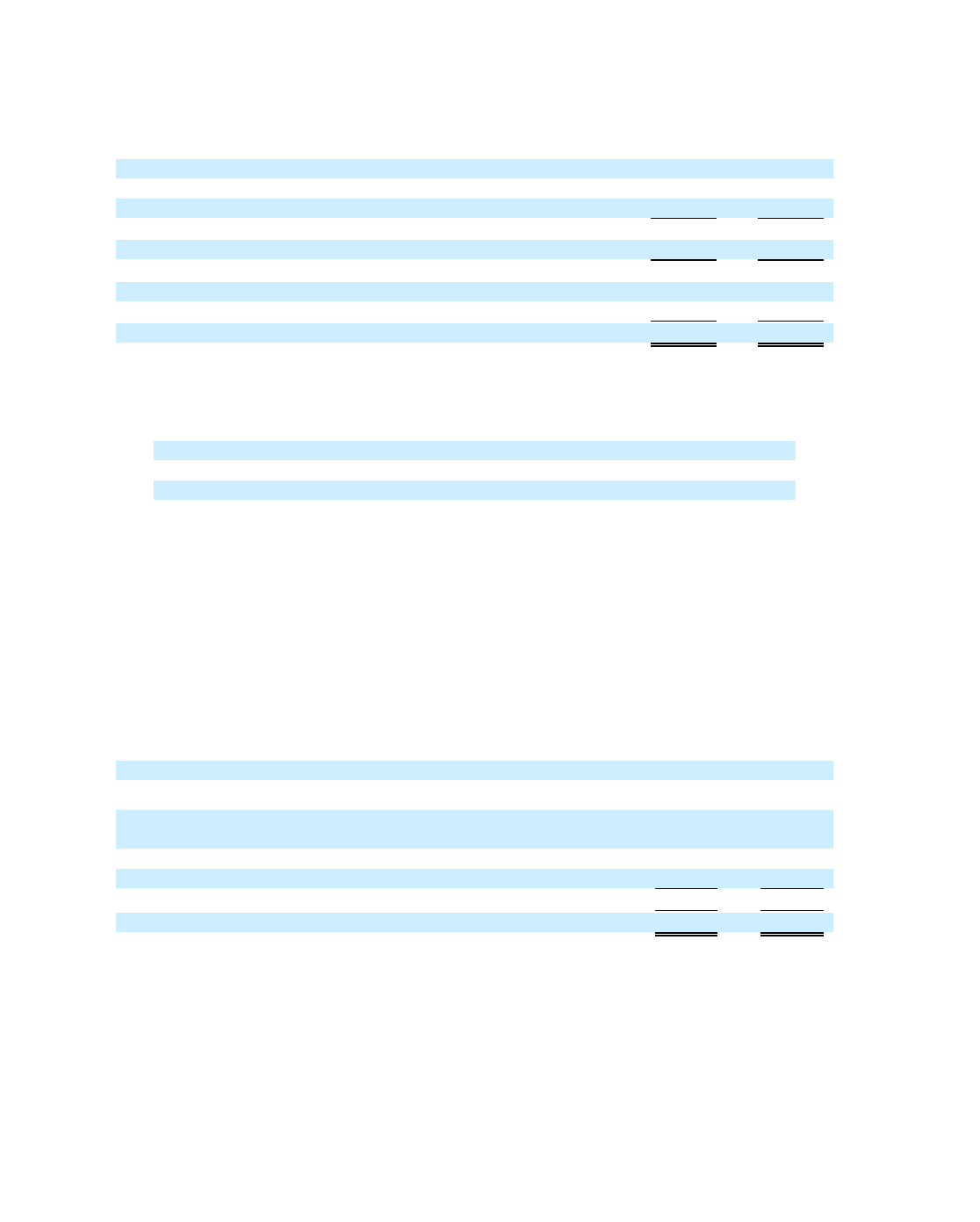

c. Present value of these obli

g

ations are:

2012 2011

Defined benefit obli

g

ation

—

Underfunded

$(45,804)

$(42,316)

Unreco

g

nized items:

Past service costs, change in methodology and changes to the

plan

989

1,02

0

Transition liabilit

y

83

291

Actuarial

g

ains and losses

(219)

23

0

Total unreco

g

nized amounts

p

endin

g

amortization

853

1,541

Net

p

ro

j

ected liabilit

y

$(44,951)

$(40,775)