Office Depot 2012 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174

|

|

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

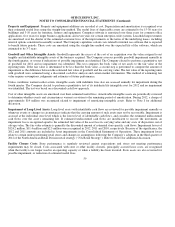

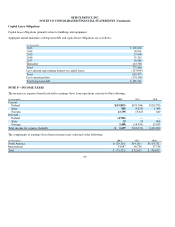

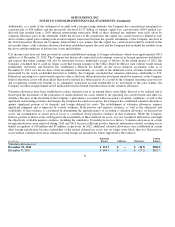

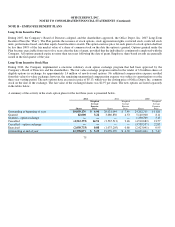

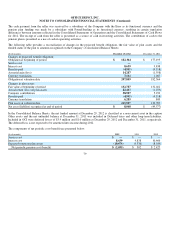

Capital Lease Obligations

Capital lease obligations primarily relate to buildings and equipment.

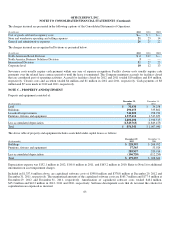

Aggregate annual maturities of long-term debt and capital lease obligations are as follows:

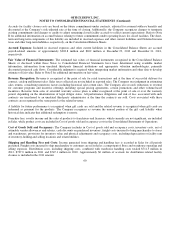

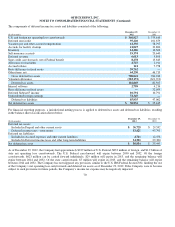

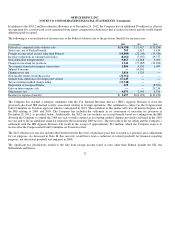

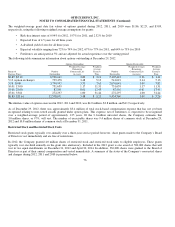

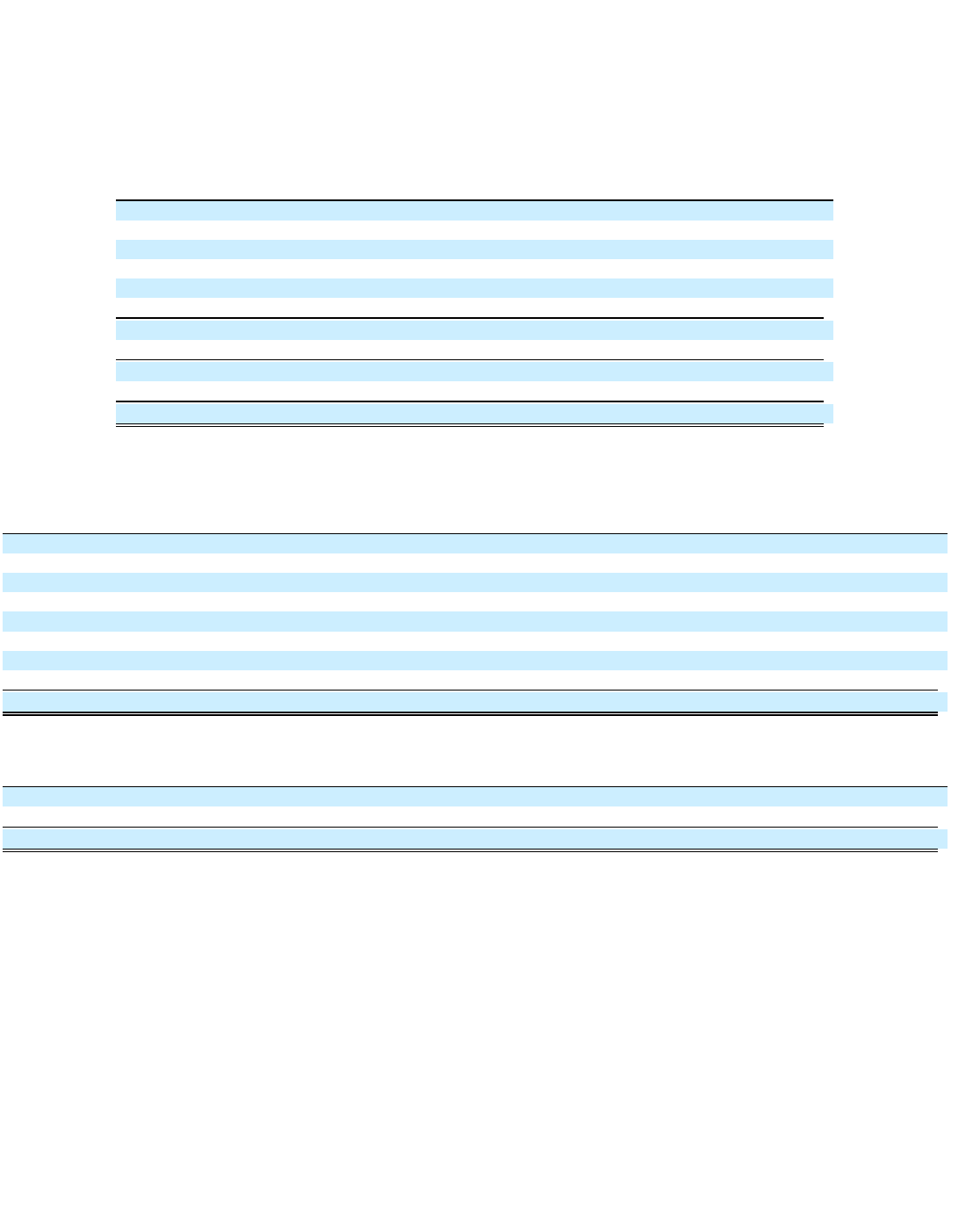

NOTE F – INCOME TAXES

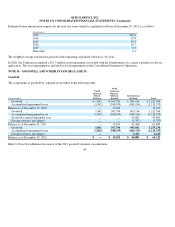

The income tax expense (benefit) related to earnings (loss) from operations consisted of the following:

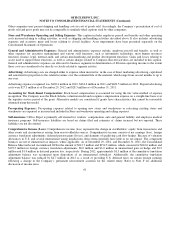

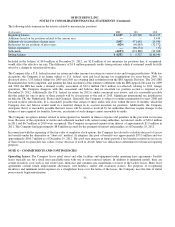

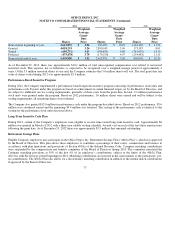

The components of earnings (loss) before income taxes consisted of the following:

69

(In thousands)

2013

$191,026

2014

38,061

2015

37,606

2016

31,315

2017

30,888

Thereafter

443,588

Total

772,484

Less amount re

p

resentin

g

interest on ca

p

ital leases

(113,005)

Total

659,479

Less current

p

ortion

(174,148)

Total lon

g

-term debt

$485,331

(In thousands) 2012 2011 2010

Current:

Federal

$(13,819)

$(59,504)

$(28,278)

State

90

2

(3,625)

1,408

Forei

g

n

13,795

15,023

849

Deferred :

Federal

(4,700)

—

—

State

33

33

(64)

Forei

g

n

5,486

(14,999)

15,615

Total income tax ex

p

ense (benefit)

$1,69

7

$(63,072)

$(10,470)

(In thousands) 2012 2011 2010

North America

$(129,310)

$(4,131)

$(114,231)

International

53,887

36,750

57,556

Total

$(75,423)

$32,619

$(56,675)