Office Depot 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174

|

|

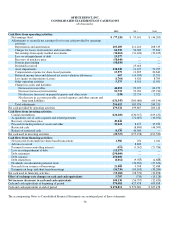

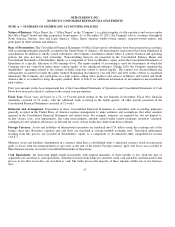

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

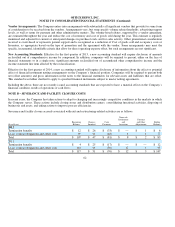

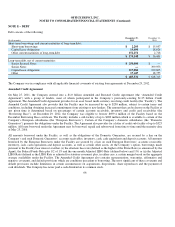

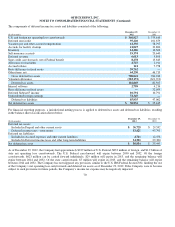

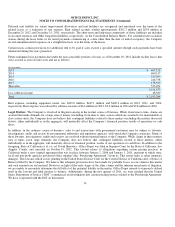

Estimated future amortization expense for the next five years related to capitalized software at December 29, 2012 is as follows:

The weighted average amortization period for the remaining capitalized software is 3.6 years.

In 2010, the Company recognized a $51.3 million asset impairment associated with the abandonment of a certain capitalized software

application. This asset impairment is included in Asset impairments in the Consolidated Statement of Operations.

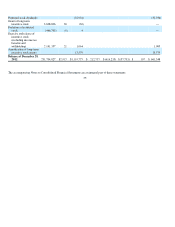

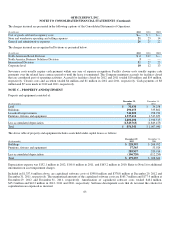

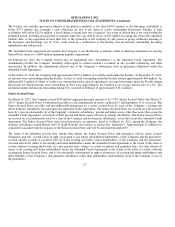

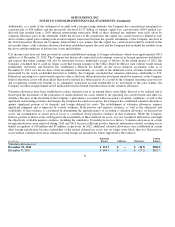

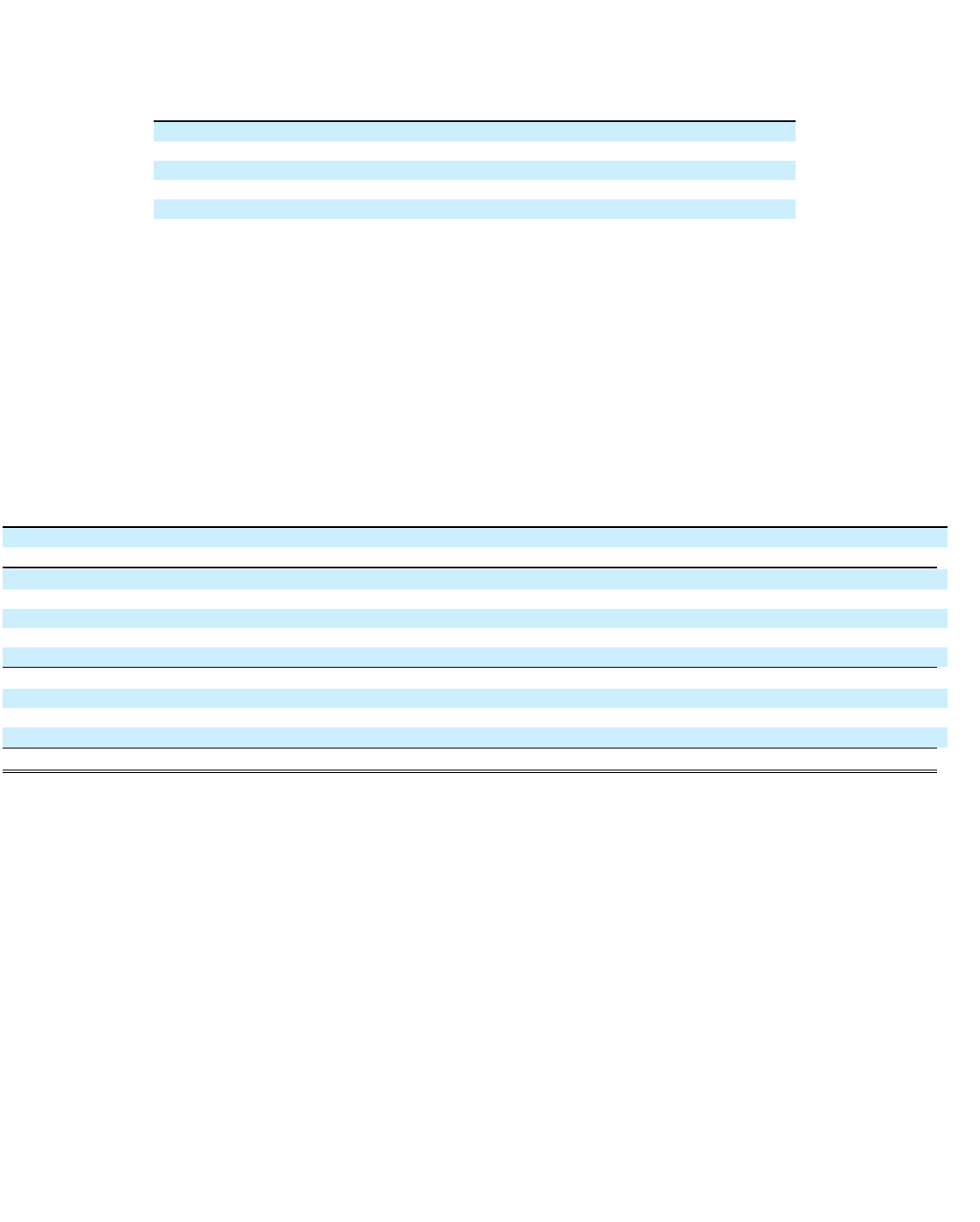

NOTE D – GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

The components of goodwill by segment are provided in the following table:

Refer to Note I for additional discussion of the 2012 goodwill valuation considerations.

64

(In millions)

2013

$49.4

2014

47.8

2015

43.4

2016

18.7

2017

6.3

Thereafter

0.1

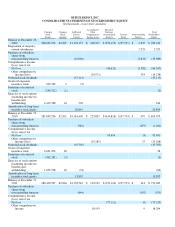

(In thousands)

North

American

Retail

Division

North

American

Business

Solutions

Division

International

Division Total

Goodwill

$1,842

$367,790

$863,134

$1,232,766

Accumulated im

p

airment losses

(1,842)

(348,359)

(863,134)

(1,213,335)

Balance as of December 25, 2010

—

19,431

—

19,431

Goodwill

1,842

367,790

863,134

1,232,766

Accumulated im

p

airment losses

(1,842)

(348,359)

(863,134)

(1,213,335)

Goodwill ac

q

uired durin

g

the

y

ear

__

__

45,805

45,805

Forei

g

n currenc

y

rate im

p

act

__

__

(3,337)

(3,337)

Balance as of December 31, 2011

—

19,431

42,468

61,899

Goodwill

1,842

367,790

905,60

2

1,275,234

Accumulated im

p

airment losses

(1,842)

(348,359)

(863,134)

(1,213,335)

Forei

g

n currenc

y

rate im

p

act

—

_

_

2,413

2,413

Balance as of December 29, 2012

$

—

$19,431

$ 44,881

$ 64,312