Office Depot 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

(Mark One)

For the fiscal year ended December 29, 2012

or

For the transition period from to

Commission file number 1-10948

Office Depot, Inc.

(Exact name of registrant as specified in its charter)

(561) 438-4800

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days: Yes No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

and post such files): Yes No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to

the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large

accelerated filer” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No

The aggregate market value of voting stock held by non-affiliates of the registrant as of June 30, 2012 (based on the closing market price on the Composite Tape on June 29,

2012) was approximately $608,746,476 (determined by subtracting from the number of shares outstanding on that date the number of shares held by affiliates of Office Depot,

Inc.).

The number of shares outstanding of the registrant’s common stock, as of the latest practicable date: At January 26, 2013, there were 285,522,659 outstanding shares of Office

Depot, Inc. Common Stock, $0.01 par value.

Documents Incorporated by Reference:

Certain information required for Part III of this Annual Report on Form 10-K is incorporated by reference to the Office Depot, Inc. definitive Proxy Statement for its 2013Annual

Meeting of Shareholders, which shall be filed with the Securities and Exchange Commission pursuant to Regulation 14A of the Securities Act of 1934, as amended, within 120

days of Office Depot, Inc.’s fiscal year end.

Annual Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Transition Report Pursuant to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Delaware 59-2663954

(State or other jurisdiction of

incorporation or organization)

(I.R.S. Employer

Identification No.)

6600 North Military Trail, Boca Raton, Florid

a

33496

(Address of principal executive offices) (Zip Code)

Title of each class Name of each exchan

g

e on which re

g

istered

Common Stock, par value $0.01 per share

New York Stock Exchange

Large accelerated filer Accelerated filer Non-accelerated filer Smaller reporting company

(Do not check if a smaller re

p

ortin

g

com

p

an

y

)

Table of contents

-

Page 1

... by Reference: Certain information required for Part III of this Annual Report on Form 10-K is incorporated by reference to the Office Depot, Inc. definitive Proxy Statement for its 2013Annual Meeting of Shareholders, which shall be filed with the Securities and Exchange Commission pursuant to... -

Page 2

... with Accountants on Accounting and Financial Disclosure Item 9A. Controls and Procedures Item 9B. Other Information PART III Item 10. Directors, Executive Officers and Corporate Governance Item 11. Executive Compensation Item 12. Security Ownership of Certain Beneficial Owners and Management and... -

Page 3

... account management sales force, Internet sites, direct marketing catalogs and call centers, all supported by a network of supply chain facilities and delivery operations. In this Annual Report on Form 10-K ("Annual Report"), unless the context otherwise requires, the "Company", "Office Depot... -

Page 4

...our new inside sales office in Austin, Texas in 2012. Part of our contract business is with various schools, local, state and national governmental agencies. We also enter into agreements with consortiums to sell to governmental and non-profit entities for non-exclusive buying arrangements. Sales to... -

Page 5

... International Division sells office products and services through direct mail catalogs, contract sales forces, Internet sites and retail stores, using a mix of Company-owned operations, joint ventures, licensing and franchise agreements, alliances and other arrangements. The Company maintains DCs... -

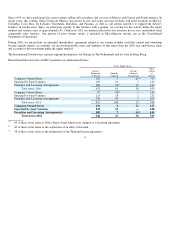

Page 6

... 2010 year end balance sheet and account for this investment under the equity method. The International Division has separate regional headquarters for Europe in The Netherlands and for Asia in Hong Kong. International Division store and DC operations are summarized below: Office Supply Stores Open... -

Page 7

...Opened/ Acquired Closed/ Deconsolidated 2010 2011 2012 (4) 39 26 27 1 1 1 14(4) - 5 26 27 23 10 of these locations relate to the deconsolidation of Office Depot India. Merchandising Our merchandising strategy is to meet our customers' needs by offering a broad selection of nationally branded... -

Page 8

... to the in-store locations, we operate nine regional print facilities, which support copy and print orders taken in our North American Retail and North American Business Solutions Divisions. We also offer copy and print services to our customers in Europe through our e-commerce business and certain... -

Page 9

... paper and technology recycling services in our retail stores. Office Depot continues to implement environmental programs in line with our stated environmental vision to "increasingly buy green, be green and sell green" - including environmental sensitivity in our packaging, operations and sales... -

Page 10

... of Human Resources for National City Bank. Elisa Garcia - Age: 55 Ms. Garcia was appointed Executive Vice President, General Counsel and Corporate Secretary in July 2007 with overall responsibility for global legal and compliance matters and governmental relations. Prior to joining Office Depot, Ms... -

Page 11

...Mr. Peters resigned from Office Depot effective January 4, 2013. He was appointed President, North American in July 2011. He previously served as President of the North American Retail Division since April 2010 and as Executive Vice President, Supply Chain and Information Technology since March 2009... -

Page 12

... financial resources to devote to sourcing, marketing and selling their products. Product pricing is also becoming ever more competitive, particularly among competitors on the Internet. In order to achieve and maintain expected profitability levels, we must continue to grow by adding new customers... -

Page 13

... invest in business expansion through new store openings, capital improvements and acquisitions. Due to the downturn in the global economy, our operating results have declined. Further deterioration in our financial results could negatively impact our credit ratings, our liquidity and our access to... -

Page 14

... that our new store openings, including some newly sized or formatted stores or retail concepts, will be successful. There may be unintended consequences of adding joint venture and franchising partners to the Office Depot model, such as the potential for compromised operational control in certain... -

Page 15

... result in significant long-term costs to us, which could in turn adversely affect our future profitability and financial condition. Increases in fuel and other commodity prices could have an adverse impact on our earnings. We operate a large network of stores and delivery centers around the globe... -

Page 16

... that our customers provide to purchase products or services, enroll in promotional programs, register on our web site, or otherwise communicate and interact with us. This may include names, addresses, phone numbers, email addresses, contact preferences, and payment account information. We... -

Page 17

...This may discourage, delay or prevent a change in control of our Company, which could deprive our shareholders of an opportunity to receive a premium for their common stock as part of a sale of our Company. We also entered into a related Investor Rights Agreement pursuant to which we granted certain... -

Page 18

... Retail Division of $11 million during 2011. We assess past performance and make estimates and projections of future performance quarterly at an individual store level. Reduced sales, our shift in strategy to be less promotional, as well as competitive factors and changes in consumer spending... -

Page 19

.... The following table sets forth our retail stores by location as of December 29, 2012. STORES State/Country # State/Country # UNITED STATES: Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas... -

Page 20

... feet and we lease other administrative offices. Each of our facilities is considered to be in good condition, adequate for its purpose and suitably utilized according to the individual nature and requirements of the relevant operations. Although we own a small number of our retail store locations... -

Page 21

... v. Office Depot was filed in Superior Court for the State of California, Los Angeles County, and unsealed on October 19, 2012. This action seeks as relief monetary damages. This lawsuit relates to allegations regarding certain pricing practices in California under a now expired agreement that... -

Page 22

... Matters and Issuer Purchases of Equity Securities. Our common stock is listed on the New York Stock Exchange ("NYSE") under the symbol "ODP." As of the close of business on January 26, 2013, there were 6,255 holders of record of our common stock. The last reported sale price of the common stock on... -

Page 23

... shall not be deemed to be filed as part of this Annual Report and does not constitute soliciting material and should not be deemed filed or incorporated by reference into any other filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended... -

Page 24

... Statistical Data: Facilities open at end of period: United States: Office supply stores Distribution centers Crossdock facilities International(7): Office supply stores Distribution centers Call centers Total square footage - North American Retail Division Percentage of sales by segment: North... -

Page 25

... to Office Depot, Inc. and Net loss available to common shareholders include impairment charges for goodwill and trade names of $1.27 billion and other asset impairment charges of $222 million. Facilities of wholly-owned or majority-owned entities operated by our International Division. 23... -

Page 26

... a copy and print center offering printing, reproduction, mailing and shipping. The North American Business Solutions Division sells office supply products and services in the U.S. and Canada directly to businesses through catalogs, Internet web sites and a dedicated sales force. Our International... -

Page 27

...closure of stores in Canada. Gross margins increased in both 2012 and 2011 from lower promotional activity and a change in the mix of sales away from technology products, as well as continuing benefits from lower occupancy costs. Operating expenses in 2012 included lower supply chain costs and lower... -

Page 28

... small- to mid-sized store formats. The inventory selections in these stores are the higher-volume items that customers seek and the stores provide for an expanded services offering. At the stores, customers also have the ability to order our inventory products from our web site. We continue to make... -

Page 29

... and changing terms and conditions in the Office Depot private label credit card program and adjustments relating to customer incentives. The impact of the 53rd week was relatively neutral to the Division's overall operating income for 2011. INTERNATIONAL DIVISION (In millions) 2012 2011 2010 Sales... -

Page 30

... the mix of direct and contract sales, product costs not passed along to customers, partially offset by lower occupancy costs. Operating expenses decreased across the Division in both 2012 and 2011, reflecting benefits from restructuring activities initiated in prior periods. For U.S. reporting, the... -

Page 31

... charges and credits on Operating income (loss) recognized by line item presentation in the Consolidated Statements of Operations are as follows. (In millions) 2012 2011 2010 Cost of goods sold and occupancy costs Store and warehouse operating and selling expenses Recovery of purchase price Asset... -

Page 32

... income and recognized at the corporate level: (In millions) 2012 2011 2010 North American Retail Division North America Business Solutions Division International Division Corporate level, recovery of purchase price Corporate level, other Total charges and credits impact on Operating income General... -

Page 33

... of Operations for 2012. Our net miscellaneous income consists of our earnings of joint venture investments, gains and losses related to foreign exchange transactions, and investment results from our deferred compensation plan. We recognized earnings from our joint venture in Mexico, Office Depot de... -

Page 34

... the U.S. Internal Revenue Service ("IRS") Appeals Division to close the previouslydisclosed IRS deemed royalty assessment relating to 2009 and 2010 foreign operations. The settlement is subject to the Congressional Joint Committee on Taxation approval which is anticipated in 2013. The resolution... -

Page 35

..., in 2012, 2011 and 2010, respectively, as discussed above. In 2012, we recognized a credit in earnings as recovery from a business combination. The cash portion of this recovery is reclassified out of earnings and reflected as a source of cash in investing activities. That cash was required by the... -

Page 36

... the year depending on a variety of factors, including the flow of goods, credit terms, timing of promotions, vendor production planning, new product introductions and working capital management. For our accounting policy on cash management, refer to Note A of the Consolidated Financial Statements... -

Page 37

... operating lease obligations presented reflect future minimum lease payments due under the non-cancelable portions of our leases, as of December 29, 2012. Our operating lease obligations are described in Note G of the Consolidated Financial Statements. In the table above, sublease income operating... -

Page 38

...letters of credit totaling $0.2 million at December 29, 2012. CRITICAL ACCOUNTING POLICIES Our Consolidated Financial Statements have been prepared in accordance with accounting principles generally accepted in the United States of America. Preparation of these statements requires management to make... -

Page 39

...uses input from retail store operations and the Company's accounting and finance personnel that organizationally report to the chief financial officer. These projections are based on management's estimates of store-level sales, gross margins, direct expenses, exercise of future lease renewal options... -

Page 40

...anticipated sublease income, and costs associated with vacating the premises. Lease commitments with no economic benefit to the Company are discounted at the credit-adjusted discount rate at the time of each location closure. With assistance from independent third parties to assess market conditions... -

Page 41

... with valuation accounts, our current tax provision can be affected by our mix of income and identification or resolution of uncertain tax positions. Because income from domestic and international sources may be taxed at different rates, the shift in mix during a year or over years can cause... -

Page 42

... of our overall business strategy and operating plans. Economic Factors - Our customers in the North American Retail Division and the International Division and many of our customers in the North American Business Solutions Division are predominantly small and home office businesses. Accordingly... -

Page 43

... year-end. Foreign Exchange Rate Risk We conduct business through entities in various countries outside the United States where their functional currency is not the U.S. dollar. While we sell directly or indirectly to customers in 59 countries, the principal operations of our International Division... -

Page 44

... into U.S. dollars, as the latter is impacted by external factors. Commodities Risk We operate a large network of stores and delivery centers around the world. As such, we purchase significant amounts of fuel needed to transport products to our stores and customers as well as pay shipping costs to... -

Page 45

... Sensitive Risks and Positions" subsection of Part II - Item 7. MD&A of this Annual Report. Item 8. Financial Statements and Supplementary Data. Refer to Part IV - Item 15(a) of this Annual Report. Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. None. 43 -

Page 46

... our assessment, management has concluded that the Company's internal control over financial reporting was effective as of December 29, 2012. Our internal control over financial reporting as of December 29, 2012, has been audited by Deloitte & Touche LLP, an independent registered public accounting... -

Page 47

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Office Depot, Inc.: We have audited the internal control over financial reporting of Office Depot, Inc. and subsidiaries (the "Company") as of December 29, 2012, based on criteria established in Internal Control... -

Page 48

... customary closing conditions. PART III Item 10. Directors, Executive Officers and Corporate Governance. Information concerning our executive officers is set forth in Part 1 - Item 1. "Business" of this Annual Report under the caption "Executive Officers of the Registrant." Information required by... -

Page 49

... the Proxy Statement under the headings "Related Person Transactions Policy" and "Director Independence," respectively, and is incorporated by reference in this Annual Report. Item 14. Principal Accountant Fees and Services. Information with respect to principal accounting fees and services and pre... -

Page 50

...as a part of this report: 1. The financial statements listed in "Index to Financial Statements." 2. The financial statement schedules listed in "Index to Financial Statement Schedules." 3. The exhibits listed in the "Index to Exhibits." (b)Exhibit 99 1. Financial statements of Office Depot de Mexico... -

Page 51

... of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized on this 20th day of February 2013. OFFICE DEPOT, INC. By: /s/ NEIL R. AUSTRIAN Neil R. Austrian Chief Executive... -

Page 52

...Consolidated Statements of Operations Consolidated Statements of Comprehensive Income (Loss) Consolidated Statements of Stockholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm on Financial Statement... -

Page 53

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the... -

Page 54

... liabilities Long-term debt, net of current maturities Total liabilities Commitments and contingencies Redeemable preferred stock, net (liquidation preference - $406,773 in 2012 and $377,729 in 2011) Stockholders' equity: Office Depot, Inc. stockholders' equity: Common stock - authorized 800,000,000... -

Page 55

OFFICE DEPOT, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) 2012 2011 2010 Sales Cost of goods sold and occupancy costs Gross profit Store and warehouse operating and selling expenses Recovery of purchase price Asset impairments General and administrative ... -

Page 56

OFFICE DEPOT, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (In thousands, except per share amounts) 2012 2011 2010 Net earnings (loss) Other comprehensive income (loss), net of tax, where applicable: Foreign currency translation adjustments Amortization of gain on cash flow hedge ... -

Page 57

... tax benefits and withholding) 2,419,708 24 590 Amortization of long-term incentive stock grants 20,843 Balance at December 25, 2010 283,059,236 $2,831 $1,161,409 $ 223,807 $ (634,818) $(57,733) $ Purchase of subsidiary shares from noncontrolling interests (983) Comprehensive income (loss), net of... -

Page 58

...064 Amortization of long-term incentive stock grants 13,579 Balance at December 29, 2012 291,734,027 $2,917 $1,119,775 $ 212,717 (32,934) - - 1,085 13,579 $ (616,235) $(57,733) $ 107 $ 661,548 The accompanying Notes to Consolidated Financial Statements are an integral part of these statements. 55 -

Page 59

OFFICE DEPOT, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) 2012 2011 2010 Cash flows from operating activities: Net earnings (loss) Adjustments to reconcile net earnings (loss) to net cash provided by operating activities: Depreciation and amortization Charges for losses on inventories... -

Page 60

... ACCOUNTING POLICIES Nature of Business: Office Depot, Inc. ("Office Depot" or the "Company") is a global supplier of office products and services under the Office Depot® brand and other proprietary brand names. As of December 29, 2012, the Company sold to customers throughout North America, Europe... -

Page 61

... programs. The Company sells selected accounts receivables on a non-recourse basis to an unrelated financial institution under a factoring agreement in France. The Company accounts for this transaction as a sale of receivables, removes receivables sold from its financial statements, and records cash... -

Page 62

... carrying value and any costs of disposition, net of salvage value. The fair value estimate is generally the discounted amount of estimated store-specific cash flows. Impairment losses of $124.2 million, $11.4 million and $2.3 million were recognized in 2012, 2011 and 2010, respectively. Because of... -

Page 63

...sales return rates. The Company also records reductions to revenue for customer programs and incentive offerings including special pricing agreements, certain promotions and other volume-based incentives. Revenue from sales of extended warranty service plans is either recognized at the point of sale... -

Page 64

... and included in Store and warehouse operating and selling expenses. Self-insurance: Office Depot is primarily self-insured for workers' compensation, auto and general liability and employee medical insurance programs. Self-insurance liabilities are based on claims filed and estimates of claims... -

Page 65

...are as follows: Non-cash Settlements and Accretion Currency and Other Adjustments (In millions) Beginning Balance Charges Incurred Cash Payments Ending Balance 2012 Termination benefits Lease, contract obligations and, other costs Total 2011 Termination benefits Lease, contract obligations and... -

Page 66

... 2012 2011 2010 North American Retail Division North America Business Solutions Division International Division Corporate level $ 2 3 32 10 $12 - 27 12 $- - 23 13 Severance costs usually require cash payment within one year of expense recognition. Facility closure costs usually require cash... -

Page 67

... American Retail Division North American Business Solutions Division (In thousands) International Division Total Goodwill Accumulated impairment losses Balance as of December 25, 2010 Goodwill Accumulated impairment losses Goodwill acquired during the year Foreign currency rate impact Balance... -

Page 68

... $4.9 million in 2012, $5.2 million in 2011, and $2.9 million in 2010 (at average foreign currency exchange rates). For 2012, $2.6 million and $2.3 million are included in the Consolidated Statement of Operations in Selling and warehouse operating and selling expenses and General and administrative... -

Page 69

..., subject to certain terms and conditions, including obtaining increased commitments from existing or new lenders. The amount that can be drawn on the Facility at any given time is determined based on percentages of certain accounts receivable, inventory and credit card receivables (the "Borrowing... -

Page 70

... and future indebtedness under the Amended Credit Agreement to the extent of the value of certain collateral securing the Senior Secured Notes; and (v) be structurally subordinated in right of payment to all existing and future indebtedness and other liabilities of the Company's non-guarantor... -

Page 71

... debt rating services and there is no default under the Indenture. There are no maintenance financial covenants. The Senior Secured Notes may be redeemed by the Company, in whole or in part, at any time prior to March 15, 2016 at a price equal to 100% of the principal amount plus a make-whole... -

Page 72

... current portion Total long-term debt NOTE F - INCOME TAXES The income tax expense (benefit) related to earnings (loss) from operations consisted of the following: (In thousands) 2012 $ 191,026 38,061 37,606 31,315 30,888 443,588 772,484 (113,005) 659,479 (174,148) $ 485,331 2011 2010 Current... -

Page 73

... of deferred income tax assets and liabilities consisted of the following: (In thousands) December 29, 2012 December 31, 2011 U.S. and foreign net operating loss carryforwards Deferred rent credit Vacation pay and other accrued compensation Accruals for facility closings Inventory Self-insurance... -

Page 74

...Depot de Mexico joint venture would remain permanently reinvested, and therefore has established a deferred tax liability on the excess financial accounting value as of December 29, 2012 over the tax basis of the investment. Concurrently, as a result of the additional source of future taxable income... -

Page 75

..., as provided below. Additionally, the 2012 tax rate includes an accrued benefit based on a ruling from the IRS allowing the Company to amend the 2009 tax year to make certain tax accounting method changes previously reflected in the 2010 tax year and to file an additional claim for refund for the... -

Page 76

... future tax deficiencies determined for financial reporting purposes. NOTE G - COMMITMENTS AND CONTINGENCIES Operating Leases: The Company leases retail stores and other facilities and equipment under operating lease agreements. Facility leases typically are for a fixed non-cancellable term with... -

Page 77

... during the years presented. Future minimum lease payments due under the non-cancelable portions of leases as of December 29, 2012 include facility leases that were accrued as store closure costs and are as follows. (In thousands) 2013 2014 2015 2016 2017 Thereafter Less sublease income Total... -

Page 78

...the date of grant. Employee share-based awards are generally issued in the first quarter of the year. Long-Term Incentive Stock Plan During 2010, the Company implemented a one-time voluntary stock option exchange program that had been approved by the Company's Board of Directors and the shareholders... -

Page 79

... on December 31, 2012 and April 30, 2014. In addition, 336,000 shares were granted to the Board of Directors as part of their annual compensation and vested immediately. A summary of the status of the Company's nonvested shares and changes during 2012, 2011 and 2010 is presented below. 76 -

Page 80

...that remained outstanding. Retirement Savings Plans Eligible Company employees may participate in the Office Depot, Inc. Retirement Savings Plan ("401(k) Plan"), which was approved by the Board of Directors. This plan allows those employees to contribute a percentage of their salary, commissions and... -

Page 81

... in General and administrative expenses, resulting in a net increase in operating profit for 2012 of $63.1 million. Similar to the presentation of goodwill impairment in 2008, this recovery and related charge is reported at the corporate level, not part of International Division operating income. 78 -

Page 82

... loss is not expected to be amortized into income during 2012. The components of net periodic cost (benefit) are presented below: (In thousands) 2012 2011 2010 Service cost Interest cost Expected return on plan assets Net periodic pension cost (benefit) 79 $ - 8,639 (10,674) $ (2,035) $ - 9,838... -

Page 83

... FINANCIAL STATEMENTS (Continued) Assumptions used in calculating the funded status included: 2012 2011 2010 Long-term rate of return on plan assets Discount rate Salary increases Inflation 6.00% 4.40% - 3.00% 6.00% 4.70% - 3.00% 6.77% 5.40% - 3.40% The plan's investment policies and strategies... -

Page 84

...$ Anticipated benefit payments, at December 29, 2012 exchange rates, are as follows: (In thousands) 2013 2014 2015 2016 2017 Next five years NOTE I - FAIR VALUE MEASUREMENTS $ 4,764 4,906 5,053 5,204 5,361 29,316 The Company measures fair value as the price that would be received to sell an... -

Page 85

...uses input from retail store operations and the Company's accounting and finance personnel that organizationally report to the Chief Financial Officer. These projections are based on management's estimates of store-level sales, gross margins, direct expenses, exercise of future lease renewal options... -

Page 86

... end of 2012, the impairment analysis reflects the Company's best estimate of future performance, including the intended future use of the Company's retail store assets. International Division During 2011, the Company acquired an office supply company in Sweden to supplement the existing business in... -

Page 87

... 2012 and December 31, 2011, except as disclosed above. NOTE J - DERIVATIVE INSTRUMENTS AND HEDGING As a global supplier of office products and services the Company is exposed to risks associated with changes in foreign currency exchange rates, commodity prices and interest rates. Foreign operations... -

Page 88

... business and are for physical delivery. Accordingly, these arrangements are not included in the tables below. Financial instruments authorized under the Company's established risk management policy include spot trades, swaps, options, caps, collars, forwards and futures. Use of derivative financial... -

Page 89

... in Store and warehouse operating and selling expenses. (c) Included in Cost of goods sold and occupancy costs. The existing designated hedge contracts are highly effective and the ineffective portion is considered immaterial. As of December 29, 2012, the foreign exchange contracts extend through... -

Page 90

...paid in cash, an amount equal to the cash dividend due will be added to the liquidation preference and measured for accounting purposes at fair value. After the third anniversary of issuance, the dividend rate will be reduced to: (i) 7.87% if at any time after June 23, 2010, the closing price of the... -

Page 91

...plan (the "Rights Agreement"). Pursuant to the Rights Agreement, the Board of Directors declared a dividend distribution of one Right (a "Right") for each outstanding share of the Company's common stock, par value $0.01 per share to shareholders of record at the close of business on November 9, 2012... -

Page 92

OFFICE DEPOT, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) NOTE M - EARNINGS PER SHARE The following table presents the calculation of net earnings (loss) per common share - basic and diluted: (In thousands, except per share amounts) 2012 2011 2010 Basic Earnings Per Share Numerator:... -

Page 93

... segments is managed separately primarily because it serves a different customer group. The accounting policies for each segment are the same as those described in Note A. Division operating income is determined based on the measure of performance reported internally to manage the business and for... -

Page 94

...business with a partner, the Company accounts for this investment using the equity method. The Company's proportionate share of Office Depot de Mexico's net income is presented in Miscellaneous income, net in the Consolidated Statements of Operations. The investment balance at year end 2012 and 2011... -

Page 95

... of income for Office Depot de Mexico: (In thousands) December 29, 2012 December 31, 2011 Current assets Non-current assets Current liabilities Non-current liabilities (In thousands) 2012 $ 377,405 333,788 219,774 7,344 2011 $ 303,404 295,033 199,588 5,895 2010 Sales Gross profit Net income NOTE... -

Page 96

... Retail Division fixed asset impairment. First Quarter Second Quarter Third Quarter(1) Fourth Quarter(2) (2) (3) (4) (In thousands, except per share amounts) Fiscal Year Ended December 31, 2011 Net sales Gross profit Net earnings (loss) Net earnings (loss) attributable to Office Depot, Inc. Net... -

Page 97

...time of the merger, the Company would issue 2.69 new shares of common stock for each outstanding share of OfficeMax common stock. In addition, at the effective time of the merger, the Company's board of directors will be reconstituted to include an equal number of directors designated by the Company... -

Page 98

...three fiscal years in the period ended December 29, 2012, and the Company's internal control over financial reporting as of December 29, 2012, and have issued our reports thereon dated February 20, 2013; such consolidated financial statements and reports are included elsewhere in this Form 10-K. Our... -

Page 99

INDEX TO FINANCIAL STATEMENT SCHEDULES Page Schedule II - Valuation and Qualifying Accounts and Reserves 97 All other schedules have been omitted because they are not applicable, not required or the information is included elsewhere herein. 96 -

Page 100

... (In thousands) Column A Column B Column C Column D Deductions- Write-offs, Payments and Other Adjustments Column E Description Balance at Beginning of Period Additions- Charged to Expense Balance at End of Period Allowance for doubtful accounts: 2012 2011 2010 97 $19,671 $28,047 $32,802 15,013... -

Page 101

... named in the Registration Rights Agreement (Incorporated by reference from Office Depot, Inc.'s Current Report on Form 8-K, filed with the SEC on June 23, 2009.) Indenture, dated as of March 14, 2012, relating to the $250 million 9.75% Senior Secured Notes due 2019, among Office Depot, Inc., the... -

Page 102

... 15, 2013, between Office Depot, Inc. and U.S. Bank National Association (as successor to SunTrust Bank) (Incorporated by reference from Office Depot, Inc.'s Current Report on Form 8-K, filed with the SEC on March 15, 2012.) Rights Agreement, dated October 24, 2012, by and between Office Depot, Inc... -

Page 103

....'s Current Report on Form 8-K, filed with the SEC on April 1, 2011.) First Amendment to the Office Depot, Inc. 2007 Long-Term Incentive Plan (Incorporated by reference from Office Depot, Inc.'s Current Report on Form 8-K, filed with the SEC on April 25, 2011.)* Letter Agreement between Office Depot... -

Page 104

... 2010 (Incorporated by reference from Office Depot, Inc.'s Annual Report on Form 10-K for the year ended December 31, 2011, filed with the SEC on February 28, 2012.)* First Amendment, dated February 24, 2012, to the Amended and Restated Credit Agreement, dated as of May 25, 2011, among Office Depot... -

Page 105

... of CFO required by Securities and Exchange Commission Rule 13a-14(a) or 15d-14(a) Certification of CEO and CFO Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 Consolidated financial statements of Office Depot de Mexico, S. A. de C. V. and... -

Page 106

... create, authorize and provide for the issuance of a series of Preferred Stock, $0.01 par value, of the Corporation, designated as "Series C Junior Participating Preferred Stock," having the voting powers, designation, preferences and relative, participating, optional and other special rights, and... -

Page 107

...Corporation shall at any time after the Rights Dividend Declaration Date (as that term is defined in the Rights Agreement dated October 24, 2012 by and between the Corporation and Computershare Shareowner Services... Stock into a small number of shares, then in each such case the number of votes per ... -

Page 108

... Directors to the Board of Directors of the Corporation at the Corporation's next annual meeting of stockholders, and so long as such default period continues, shall have the right to elect a successor to each of the two Directors so elected upon the expiration of their respective terms, such right... -

Page 109

... a purchase offer made in writing or by publication (as determined by the Board of Directors) to all holders of such shares upon such terms as the Board of Directors, after consideration of the respective annual dividend rates, and other relative rights and preferences of the respective series and... -

Page 110

...) equal to 5,000 times the aggregate amount of stock, securities, cash, and/or other property (payable in kind), as the case may be, into which or for which each share of Common Stock is converted or exchanged. In the event the Corporation shall at any time after the Rights Dividend Declaration Date... -

Page 111

...including, without limitation, this Certificate of Designation shall not hereafter be amended, either directly or indirectly, or through merger or consolidation with another corporation in any manner that would alter or change the powers, preferences or special rights of the Series C Preferred Stock... -

Page 112

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Designation to be signed by its authorized officer this 30th day of October, 2012. OFFICE DEPOT, INC. By: /s/ Elisa D. Garcia C. Name: Elisa D. Garcia C. Title: Executive Vice President, General Counsel and Secretary -

Page 113

... or a ban to manage a company. - Companies that own and/or control the majority of shares of the Customer, are the object of a judgment of liquidation. - The Customer has taken over a company rated P by the Bank of France and existing management team of the P rated company is not substantially... -

Page 114

... the balance of transferred receivables without a corresponding cash entry in the dedicated bank account and particularly include credits, discounts, year-end rebates, advertising costs, direct payments (except by Acquisition card) and disputes. Disputes: failure of a debtor to pay, for any reason... -

Page 115

... at its initiative (Title 3). This facility should not be used by Office Depot Inc. to avoid a breach of any of the covenants stated in the Amended and Restated Credit Agreement dated May 25, 2011 Title 2: Back-up line of confirmed financing Article 1: Amount, term ABN AMRO COM FIN grants the Client... -

Page 116

... to a subcontracted activity. - Receivables owed by the Client's suppliers. - Receivables owed by companies over which the Client has effective control via membership of their management or executive board, or of their financial structure or which exercise the same type of effective reciprocal... -

Page 117

... Article 5: Management of receivables a) Opening of debit accounts Prior to the activation of the financing line, and no more than once a week, the Client shall transmit to ABN AMRO COM FIN the file meeting the requirements defined in the specifications document appended to this Agreement (Appendix... -

Page 118

...is above â,¬ â,¬ 80,000 (eighty thousand euros), in which case it shall inform the Client of its decision by any means and at the best delays. Such decisions shall have immediate effect, although receivables corresponding to services rendered before the date on which the Client received notice shall... -

Page 119

... registration in the account. The amount of the transferred receivables shall be credited to the current account within a maximum of 48 (forty-eight) hours of receipt of the form. To that effect, and at the latest on activation of the Agreement, the Client shall sign a permanent subrogation form... -

Page 120

... and Financial code, pursuant to a security document which shall be signed at the latest upon the date of the first remittance of receivables. The template for the assignment agreement for receivables is appended as Appendix 3 and the protocols regarding the operation of the cashing accounts will... -

Page 121

...the transfer of the receivables credited to these cashing accounts. Pursuant to the terms of a particular functioning agreement to be concluded with each of the aforementioned banks, the Client shall refrain from operating those cashing accounts in debit or changing the domiciliation of the payments... -

Page 122

... in Appendix 4 Article 8: Remuneration 8-1 Service fee: ABN AMRO COM FIN shall receive a factoring fee, excl. VAT, of 0.17% (zero point one seven) of the net amount of the transferred New Eligible Receivables (incl. VAT) at the time of each transfer. The minimum annual fee comprising the factoring... -

Page 123

... defined in Title 1, as service commission, the two commissions shall be calculated on a pro-rata temporis basis. 8-2 Financing fee: The financing shall result in a post accounted financing fee, subject to VAT and calculated on a pro rata basis at the rate of 1-month Euribor + a margin of 2.40% (two... -

Page 124

...services, allowing it to view and manage its current accounts and debtor accounts, as well as to make financing and/or approval requests, via the secure website located at the following URL address: www.abnamrocommfin-direct.fr. The Client declares that it has received and accepted the General Terms... -

Page 125

Independently of the audits referred to in Title 3 below, the Client authorises ABN AMRO COM FIN at any time to carry out any verifications (particularly of accounting items) which it shall deem useful. These audits will generate no invoicing from ABN AMRO COM FIN. The Client undertakes to do the ... -

Page 126

...initial period, in order to discuss whether or not to renew the Agreement. ABN AMRO COM FIN may terminate the Agreement with 15 (fifteen) days' notice, sent by registered letter with acknowledgment of receipt in the event of: - change of control of the Client or the OFFICE DEPOT Group; - significant... -

Page 127

Managing Director THE CLIENT Write before the signature and company stamp the hand-written words "lu et approuvé" ("read and approved"). /s/Arben Bora Arben Bora Managing Director ABN AMRO Commercial Finance -

Page 128

... and Companies Register 324 559 970 Hereinafter referred to as "the Client", party of the second part 1 - The a) opening of accounts receivable in ARTICLE 5: Receivables Management is cancelled and replaced by the following: a) Opening of accounts receivable Prior to activation of the line of credit... -

Page 129

..., in general, to pay utmost attention to safeguarding the rights of ABN AMRO COM FIN. Collection of payments: the payments received by the Client, corresponding to the receivables transferred, and the payments by transfer will be paid by banker's order into the Client's bank accounts opened with the... -

Page 130

... Agreement with the bank, the Client is prohibited from having the said Collection Account operate in debit or from modifying the address of payments without the prior consent of ABN AMRO COM FIN. Information: The Client will report, on first submission of receivables and at least twice per month... -

Page 131

... 49 93 93 / Fax: 01 47 48 93 60 Bank address: Banque Neuflize OBC - 3, avenue Hoche 75008 PARIS Bank account particulars: (sent in a separate letter) Receivable assigned to ABN AMRO Commercial Finance pursuant to Articles L.313-23 to L.313-35 of the French Monetary and Financial Code. In return for... -

Page 132

... Write the following by hand above the signature and company stamp Read and approved /s/Arben Bora Name of the signatory: Arben Bora ABN AMRO Commercial Finance Position: Managing Director ABN AMRO Commercial Finance 39, rue Anatole France 92532 Levallois-Perret Cedex Tel.: 01 41 49 93 93 SIRET... -

Page 133

...LP, LLC North American Card and Coupon Services, LLC Viking Direkt GesmbH Office Depot International BVBA Office Depot Overseas Holding Limited Office Depot Brasil Participacoes Limitada AsiaEC.com Limited The Office Depot Network Technology Ltd. Office Depot Merchandising (Shenzhen) Company Ltd. OD... -

Page 134

...CV Papelera General, SA de CV Viking Direct B.V. Office Depot B.V. Office Depot International B.V. Office Depot Latin American Holdings B.V. Office Depot Finance B.V. Office Depot Netherland B.V. Office Depot (Netherlands) C.V. Heteyo Holdings BV. Guilbert International B.V. Office Depot (Operations... -

Page 135

Viking Direct (Holdings) Limited Office Depot UK Limited Guilbert UK Pension Trustees Ltd Guilbert UK Holdings Ltd Niceday Distribution Centre Ltd Office 1 (1995) Ltd Office 1 Ltd Reliable UK Ltd Office Depot (Holdings) Ltd. Office Depot (Holdings) 2 Ltd. Office Depot Europe Holdings Ltd. Office ... -

Page 136

... Inc., and the effectiveness of Office Depot, Inc.'s internal control over financial reporting, appearing in this Annual Report on Form 10-K of Office Depot, Inc. for the fiscal year ended December 29, 2012. /s/ DELOITTE & TOUCHE LLP Certified Public Accountants Boca Raton, Florida February 20, 2013 -

Page 137

... from accounting principles generally accepted in the United States of America, the nature and effects of which are presented in Note 18 in such consolidated financial statements), appearing in this Annual Report on Form 10-K of Office Depot, Inc. for the fiscal year ended December 29, 2012. Galaz... -

Page 138

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who... -

Page 139

... in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who... -

Page 140

... of CEO and CFO Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 In connection with the Annual Report on Form 10-K of Office Depot, Inc. (the "Company") for the fiscal year ended December 29, 2012 as filed with the Securities and Exchange... -

Page 141

... (A 50% Owned Subsidiary of Grupo Gigante, S. A. B. de C. V. and 50% Owned Affiliate of Office Depot Delaware Overseas Finance 1, LLC) Consolidated Financial Statements for the Years Ended December 31, 2012, 2011 and 2010 (Unaudited) and Independent Auditors' Report Dated February 15, 2013 -

Page 142

...Financial Statements for 2012, 2011 and 2010 (Unaudited) Table of contents Page Independent Auditors' Report Consolidated Balance Sheets Consolidated Statements of Income Consolidated Statements of Changes in Stockholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial... -

Page 143

... December 31, 2012 and 2011, and the results of their operations and their cash flows for the years then ended in accordance with Mexican Financial Reporting Standards. MFRS vary in certain significant respects from accounting principles generally accepted in the United States of America ("U.S. GAAP... -

Page 144

...income taxes Deferred statutory employee profit sharing Intangible assets - Net Goodwill Total Liabilities and stockholders' equity Current liabilities: Trade accounts payable Office Depot Asia Holding Limited - Related party Accrued expenses Taxes payable Total current liabilities Employee benefits... -

Page 145

... pesos) 2012 2011 2010 (Unaudited) Revenues: Net sales Other Costs and expenses: Cost of sales Selling, administrative and general expenses Other expenses Net comprehensive financing cost: Bank commissions Interest expense Interest income Exchange (loss) gain Other financial income - Net Monetary... -

Page 146

... (Unaudited) Balances as of December 31, 2010 (Unaudited) Dividends paid ($10.81 pesos per share) Comprehensive income Balances as of December 31, 2011 Comprehensive income Balances as of December 31, 2012 See accompanying notes to consolidated financial statements. $1,266,239 - 1,266,239 - - 1,266... -

Page 147

...a 50% Owned Affiliate of Office Depot Delaware Overseas Finance 1, LLC) Consolidated Statements of Cash Flows For the years ended December 31, 2012, 2011 and 2010 (Unaudited) (In thousands of Mexican pesos) 2012 2011 2010 (Unaudited) Operating activities: Income before income taxes Items related to... -

Page 148

...the "Company") is a chain of 215 stores in Mexico, five in Costa Rica, eight in Guatemala, three in El Salvador, two in Honduras, three in Panama, 12 in Colombia, nine distribution centers, a cross dock in Mexico that sells office supplies and electronic goods, and a printing service specializing in... -

Page 149

... Operates stores specializing in the sale of services and office supplies, located in Panama. The distribution and handling of office supplies inventories as well as printed forms, located in Mexico. The distribution and handling of office supplies inventories as well printed forms, located in Costa... -

Page 150

... acquisition and leasing of all types of real estate. This company has not initiated operations as of the date of these consolidated financial statements (subsidiary of Centro de Apoyo, S. A. de C. V.), located in Mexico. Stores specializing in the sale of services and office supplies (subsidiary of... -

Page 151

... of three months or less to be cash equivalents. Concentration of credit risk-The Company sells products to customers primarily in the retail trade in Mexico. The Company conducts periodic evaluations of its customers' financial condition and generally does not require collateral. The Company does... -

Page 152

... projected unit credit method using nominal interest rates. Statutory employee profit sharing (PTU)-PTU is recorded in the results of the year in which it is incurred and presented under selling, administrative and general expenses in the accompanying consolidated statements of income. Deferred PTU... -

Page 153

... orders. Revenue is recognized at the point of sale for retail transactions and at the time of successful delivery for contract, catalog and internet sales. Sales taxes collected are not included in reported sales. The Company does not charge shipping and handling costs to its customers; such costs... -

Page 154

...$2,933,151 Movements in the allowance for obsolete inventories for the years ended December 31 are as follows: Balance at beginning of period Additional charged to expenses Balance at ending of period Shrinkage 2012 2011 2010 (Unaudited) 7. Property, equipment and leasehold improvements $ 12,659... -

Page 155

... in the plans using the projected unit credit method. The Company also provides statutorily mandated severance benefits to its employees terminated under certain circumstances. Such benefits consist of a one-time payment of three months wages plus 20 days wages for each year of service payable upon... -

Page 156

...) (3,775) (507) $ 33,997 Under Mexican legislation, the Company must make payments equivalent to 2% of its workers' daily integrated salary to a defined contribution plan that is part of the retirement savings system. The expense in 2012, 2011 and 2010 (unaudited) was $15,908, $14,348 and $12,552... -

Page 157

... stockholders' meeting held on April 8, 2011, a dividend was declared out of the net tax income account (CUFIN) for $600,000. Retained earnings include the statutory legal reserve. The General Corporate Law requires that at least 5% of net income of the year be transferred to the legal reserve until... -

Page 158

...944 19,825 534 Mexican peso exchange rates in effect at the dates of the consolidated balance sheets and the date of the related independent auditors' report were as follows: December 31, 2012 December 31, 2011 February 15, 2013 Mexican pesos per one U. S. dollar 12. Transactions and balances with... -

Page 159

2012 2011 2010 (Unaudited) Leases, maintenance and other expenses: Gigante Grupo Inmobiliario Office Depot, Inc. Gigante, S. A. ...Services paid: CompañÃa Mexicana de Aviación, S. A. de C. V. Intermediation commissions paid: Office Depot Asia Holding Limited Purchase of inventories: Office Depot... -

Page 160

... Income taxes in Mexico The Company is subject to ISR and IETU. The ISR rate was 30% for 2012 and 2011; it will be 30% for 2013, 29% for 2014 and 28% for 2015 and subsequent years. IETU-Revenues, as well as deductions and certain tax credits, are determined based on cash flows of each fiscal year... -

Page 161

...expressed in amounts and as a percentage of income before income taxes, are: 2012 % 2011 % 2010 (Unaudited) % Statutory tax rate Effects of inflation Non-deductible expenses Other IETU 30 (1) 1 (1) 4 33% 30 (2) 1 2 4 35% 30 (3) 1 - 3 31% c. The main items originating the deferred ISR asset are... -

Page 162

... payments due under the non-cancelable portions of our leases as of December 31, 2012. 2013 2014 2015 2016 2017 Thereafter Rent expense was $404,505 in 2012, $352,185 in 2011 and $294,838 in 2010. Legal Matters On August 31, 2005, in an effort to expand operations within Mexico, a sublease agreement... -

Page 163

...ordered under the counterclaim to comply with the terms of the sublease agreement, which requires the construction of an Office Depot store on the plot of land. The Company filed an appeal in January 2009. On August 19, 2010, the court rejected the Company's appeal of January 2009. The Company filed... -

Page 164

... that non-refundable payments related to leasehold rights must be deferred during the lease term and applied to results in proportion to the recognition of income or expense relating to the lessor or lessee, respectively. As of the date of these consolidated financial statements, the Company is... -

Page 165

...' equity, presentation of consolidated financial information and the relevant disclosures are summarized below: 2012 2011 2010 (Unaudited) Consolidated net income under MFRS (i) Elimination of effects of inflation (ii) Employee retirement obligations (iii) Rent holidays (v) Deferred PTU asset Total... -

Page 166

... to such benefits in 2010. In addition, U.S. GAAP requires certain additional disclosures as shown below: Employee benefits 2012 Employee benefits 2011 As of December 31: Projected benefit obligation Change in benefit obligation: Benefit obligation at beginning of year Service cost Interest cost... -

Page 167

... benefit obligations and net periodic benefit cost as of and for the year ended December 31, 2012 and 2011: 2012 % 2011 % Discount of the projected benefit obligation at present value Salary increase Minimum wage increase rate (iii) 8.19 5.73 4.27 7.98 5.86 4.27 Rent holidays-Under MFRS, rental... -

Page 168

... tax asset under U.S. GAAP is as follows: 2012 2011 Reconciliation of deferred income tax asset: Net deferred income tax asset under MFRS Effects of elimination of inflation Effects of employee retirement obligations Effects of rent holidays Effects of amortization of goodwill Effects of actuarial... -

Page 169

... the statutory rate mainly due to the effects of non-deductible expenses as well as different tax rates applicable in different tax jurisdiction in which the Company operates. 2012 2011 IETU Current deferred IETU liability: Account receivable from affiliated companies Non - current deferred IETU... -

Page 170

... GAAP requires disclosures of non-cash investing and financing activities. 2012 2011 2010 (Unaudited) Net income under U.S. GAAP Depreciation and amortization Allowance for doubtful accounts (Gain) loss on sale of fixed assets Deferred income tax Net periodic cost Unrealized foreign exchange loss... -

Page 171

2012 2011 2010 (Unaudited) Cash flows from investing activities: Purchases of equipment and investments in leasehold improvements Acquisitions of subsidiaries, net of cash acquired Purchases of trade mark Proceeds from the sale of equipment Net cash used in investing activities Cash flows from ... -

Page 172

(d) Statement of comprehensive income - The Company's statement of comprehensive income under U.S. GAAP is as follows: 2012 2011 2010 (Unaudited) Consolidated net income under U.S. GAAP Other comprehensive income: Translation effects of operations of foreign entities Effect of employee retirement ... -

Page 173

...financial statements on the basis of International Financial Reporting Standards ("IFRS"). The amended guidance is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The Company will adopt this ASU in 2013. (b) In July 2012... -

Page 174

... of changes in other comprehensive income and items reclassified out of AOCI in their financial statements. For public entities, the new disclosure requirements are effective for fiscal years, and interim periods within those years, beginning after December 15, 2012. However, for nonpublic entities...