Logitech 2010 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

205

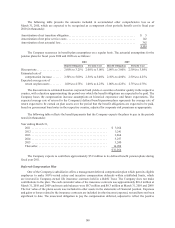

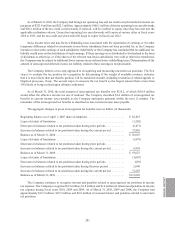

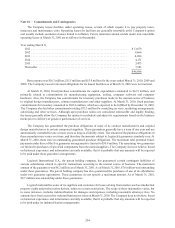

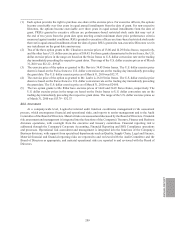

The Company provides various third parties with irrevocable letters of credit in the normal course of business

to secure its obligations to pay or perform pursuant to the requirements of an underlying agreement or the provision

of goods and services. These standby letters of credit are cancelable only at the option of the beneficiary who is

authorized to draw drafts on the issuing bank up to the face amount of the standby letter of credit in accordance

with its terms. At March 31, 2010, the Company had $3.4 million of letters of credit in place, of which $0.3 million

was outstanding. These letters of credit relate primarily to equipment purchases by a subsidiary in China, and

expire between April and June 2010. At March 31, 2009, The Company had $0.4 million of letters of credit in place,

with no balance outstanding.

In November 2007, the Company acquired WiLife, Inc., a privately held company offering PC-based

video cameras for self-monitoring a home or a small business. The purchase agreement provides for a possible

performance-based payment, payable in the first calendar quarter of 2011. The performance-based payment is

based on net revenues attributed to WiLife during calendar 2010. No payment is due if the applicable net revenues

total $40.0 million or less. The maximum performance-based payment is $64.0 million. The total performance-

based payment amount, if any, will be recorded in goodwill and will not be known until the end of calendar year

2010. As of March 31, 2010, no amounts were payable towards performance-based payments under the WiLife

acquisition agreement.

The Company is involved in a number of lawsuits and claims relating to commercial matters that arise in

the normal course of business. The Company believes these lawsuits and claims are without merit and intends to

vigorously defend against them. However, there can be no assurances that its defenses will be successful, or that

any judgment or settlement in any of these lawsuits would not have a material adverse impact on the Company’s

business, financial condition, cash flows and results of operations. The Company’s accruals for lawsuits and claims

as of March 31, 2010 were not material.

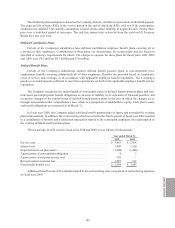

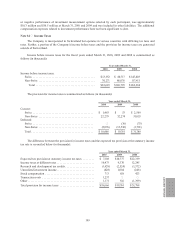

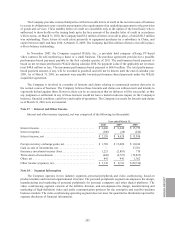

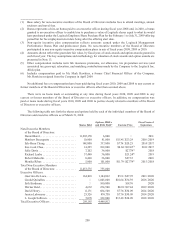

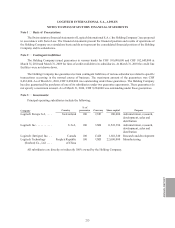

Note 17 — Interest and Other Income

Interest and other income (expense), net was comprised of the following (in thousands):

Year ended March 31,

2010 2009 2008

Interest income ...................................... $ 2,406 $ 8,648 $ 15,752

Interest expense ..................................... (286)(20)(244)

Interest income, net .................................. $ 2,120 $8,628 $15,508

Foreign currency exchange gains, net . . . . . . . . . . . . . . . . . . . . $ 1,720 $13,680 $10,616

Gain on sale of investments, net ......................... — — 27,761

Insurance investment income (loss) ...................... 1,221 (2,883)710

Write-down of investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . (643)(2,727)(79,823)

Other, net .......................................... 841 441 1,362

Other income (expense), net ............................ $3,139 $8,511 $(39,374)

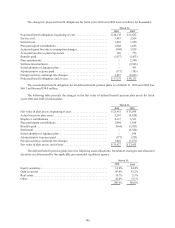

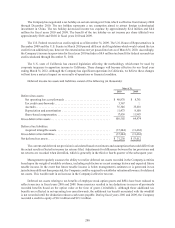

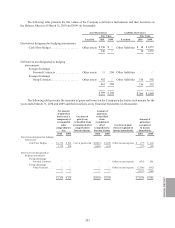

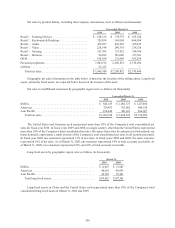

Note 18 — Segment Information

The Company operates in two industry segments, personal peripherals and video conferencing, based on

product markets and internal organizational structure. The personal peripherals segment encompasses the design,

manufacturing and marketing of personal peripherals for personal computers and other digital platforms. The

video conferencing segment consists of the LifeSize division, and encompasses the design, manufacturing and

marketing of high-definition video and audio communication products for the enterprise and small-to-medium

business markets. The video conferencing operating segment does not meet the quantitative thresholds required for

separate disclosure of financial information.