Logitech 2010 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

195

The dividend yield assumption is based on the Company’s history and future expectations of dividend payouts.

The expected life of these RSUs is the service period at the end of which the RSUs will vest if the performance

conditions are satisfied. The volatility assumption is based on the actual volatility of Logitech’s daily closing share

price over a look-back period of two years. The risk free interest rate is derived from the yield on US Treasury

Bonds for a two year term.

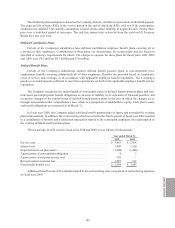

Defined Contribution Plans

Certain of the Company’s subsidiaries have defined contribution employee benefit plans covering all or

a portion of their employees. Contributions to these plans are discretionary for certain plans and are based on

specified or statutory requirements for others. The charges to expense for these plans for fiscal years 2010, 2009

and 2008, were $8.2 million, $8.3 million and $7.0 million.

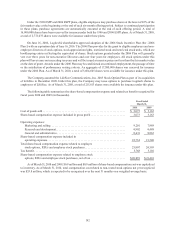

Defined Benefit Plans

Certain of the Company’s subsidiaries sponsor defined benefit pension plans or non-retirement post-

employment benefits covering substantially all of their employees. Benefits are provided based on employees’

years of service and earnings, or in accordance with applicable employee benefit regulations. The Company’s

practice is to fund amounts sufficient to meet the requirements set forth in the applicable employee benefit and tax

regulations.

The Company recognizes the underfunded or overfunded status of defined benefit pension plans and non-

retirement post-employment benefit obligations as an asset or liability in its statement of financial position, and

recognizes changes in the funded status of defined benefit pension plans in the year in which the changes occur

through accumulated other comprehensive loss, which is a component of stockholders’ equity. Each plan’s assets

and benefit obligations are measured as of March 31.

In fiscal year 2009, the Company added a defined benefit pension plan in Japan, and amended the existing

plan in Switzerland. In addition, the restructuring which occurred in the fourth quarter of fiscal year 2009 resulted

in a curtailment of benefits and a settlement transaction related to the terminated employees who participated in

the existing defined benefit pension plans.

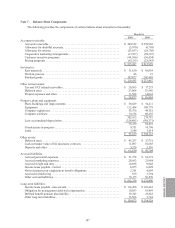

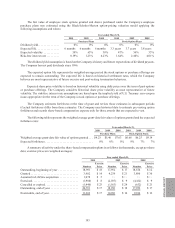

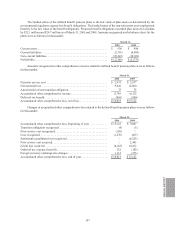

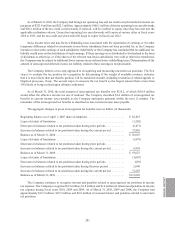

The net periodic benefit cost for fiscal years 2010 and 2009 was as follows (in thousands):

Year ended March 31,

2010 2009

Service cost .................................................. $3,983 $2,814

Interest cost .................................................. 1,430 1,520

Expected return on plan assets ................................... (1,200)(1,488)

Amortization of net transition obligation ........................... 4 5

Amortization of net prior service cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 138 —

Recognized net actuarial loss .................................... 1,239 232

Net periodic benefit cost ........................................ $5,594 $3,083

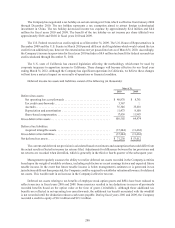

Additional benefit costs of $3.4 million related to the restructuring were recognized in restructuring expenses

in fiscal year 2009.