Logitech 2010 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

148

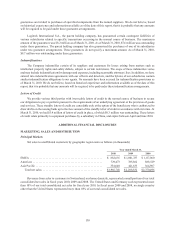

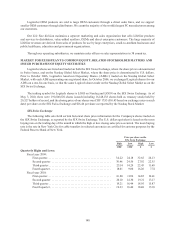

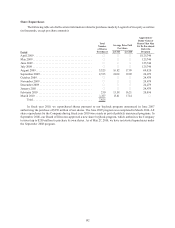

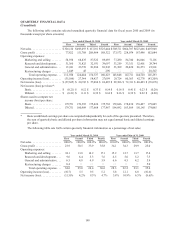

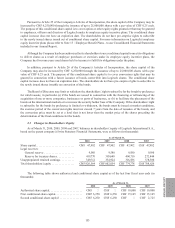

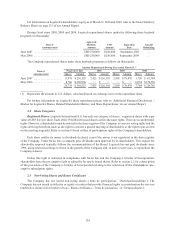

QUARTERLY FINANCIAL DATA

(Unaudited)

The following table contains selected unaudited quarterly financial data for fiscal years 2010 and 2009 (in

thousands except per share amounts):

Year ended March 31, 2010 Year ended March 31, 2009

First Second Third Fourth First Second Third Fourth

Net sales..................... $326,110 $498,093 $617,101 $525,444 $508,711 $664,707 $627,466 $407,948

Gross profit .................. 77,822 151,788 208,964 188,322 173,572 228,074 187,496 102,084

Operating expenses:

Marketing and selling ....... 58,938 68,835 87,322 89,693 77,280 84,740 86,046 71,101

Research and development.... 31,360 31,825 32,931 39,697 33,259 33,351 32,401 29,744

General and administrative ... 21,181 23,739 30,284 30,943 33,309 29,620 26,273 23,901

Restructuring charges ....... 1,449 45 —290 — — — 20,547

Total operating expense ... 112,928 124,444 150,537 160,623 143,848 147,711 144,720 145,293

Operating income (loss)......... (35,106)27,344 58,427 27,699 29,724 80,363 42,776 (43,209)

Net income (loss) .............. $(37,365) $ 20,743 $57,086 $24,493 $29,306 $72,311 $40,493 $(35,078)

Net income (loss) per share*:

Basic..................... $(0.21) $ 0.12 $0.33 $0.14 $0.16 $0.41 $0.23 $(0.20)

Diluted ................... $(0.21) $ 0.11 $0.32 $0.14 $0.16 $0.39 $0.22 $(0.20)

Shares used to compute net

income (loss) per share:

Basic..................... 179,751 178,395 175,426 175,738 179,046 178,630 178,497 179,065

Diluted ................... 179,751 180,989 177,668 177,967 184,692 183,509 181,145 179,065

* Basic and diluted earnings per share are computed independently for each of the quarters presented. Therefore,

the sum of quarterly basic and diluted per share information may not equal annual basic and diluted earnings

per share.

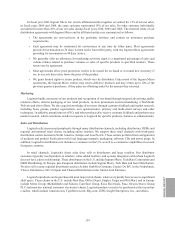

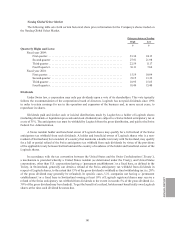

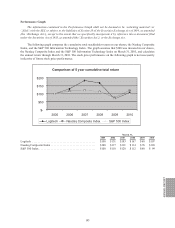

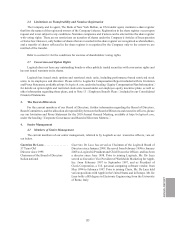

The following table sets forth certain quarterly financial information as a percentage of net sales:

Year ended March 31, 2010 Year ended March 31, 2009

First Second Third Fourth First Second Third Fourth

Net sales..................... 100.0%100.0%100.0%100.0%100.0%100.0%100.0%100.0%

Gross profit .................. 23.9 30.5 33.9 35.8 34.1 34.3 29.9 25.0

Operating expenses:

Marketing and selling ....... 18.1 13.8 14.2 17.1 15.2 12.7 13.7 17.4

Research and development.... 9.6 6.4 5.3 7.6 6.5 5.0 5.2 7.3

General and administrative ... 6.5 4.8 4.9 5.9 6.6 4.5 4.2 5.9

Restructuring charges ....... 0.4 — — — — — — 5.0

Total operating expense ... 34.6 25.0 24.4 30.6 28.3 22.2 23.1 35.6

Operating income (loss)......... (10.7)5.5 9.5 5.2 5.8 12.1 6.8 (10.6)

Net income (loss) .............. (11.5)% 4.2%9.3%4.7%5.8%10.9%6.5%(8.6)%