Logitech 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

137

ANNUAl REPORT

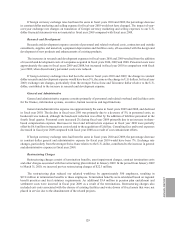

(2) Other liabilities at March 31, 2010 included $118.9 million related to our income tax liability for uncertain

tax positions, $22.1 million in pension liabilities related to our defined benefit pension plans and non-

retirement post-employment benefit obligations, of which $0.6 million is payable in the next 12 months,

$10.3 million related to a management deferred compensation plan, $5.7 million of royalties payable,

$4.4 million in deferred service revenue, and $3.4 million related to various other obligations. As the

specific payment dates for most of these obligations are unknown, the related balances have not been

reflected in the “Payments Due by Period” section of the table.

Operating Leases

The remaining terms on our non-cancelable operating leases expire in various years through 2028. Our asset

retirement obligations on these leases as of March 31, 2010 were not material.

Purchase Commitments

We expect to continue making capital expenditures in the future to support product development activities and

ongoing and expanded operations. At March 31, 2010, fixed purchase commitments for capital expenditures amounted

to $12.9 million, and primarily relate to commitments for manufacturing equipment, tooling, computer software

and computer hardware. We also have commitments for inventory purchases made in the normal course of business

to original design manufacturers, contract manufacturers and other suppliers. At March 31, 2010, fixed purchase

commitments for inventory amounted to $183.6 million, which are expected to be fulfilled by December 31, 2010. We

also had other commitments of $33.3 million for consulting, marketing arrangements, advertising and other services.

Although open purchase commitments are considered enforceable and legally binding, the terms generally allow us the

option to reschedule and adjust our requirements based on business needs prior to the delivery of the purchases.

Income Taxes Payable

At March 31, 2010, we had $116.5 million in non-current income taxes payable and $2.4 million in current income

taxes payable, including interest and penalties, related to our income tax liability for recognized uncertain tax positions.

Although we have adequately provided for uncertain tax positions, the provisions on these positions may change as revised

estimates are made or the underlying matters are settled or otherwise resolved. Within the next 12 months, we anticipate

that it is reasonably possible that unrecognized tax benefits may decrease due to the resolution of income tax audits with

foreign governments. However, an estimate of such decreases cannot reasonably be made as of March 31, 2010.

Defined Benefit Pension Plan Obligations

At March 31, 2010, we had $22.1 million in pension liability related to our defined benefit pension plans and

non-retirement post-employment benefit obligations, of which $0.6 million is payable in the next 12 months. See

Note 13 – Employee Benefit Plans for more information.

Off-Balance Sheet Arrangements

The Company has not entered into any transactions with unconsolidated entities whereby we have financial

guarantees, subordinated retained interests, derivative instruments or other contingent arrangements that expose

us to material continuing risks, contingent liabilities, or any other obligation under a variable interest in an

unconsolidated entity that provides financing, liquidity, market risk or credit risk support to the Company.

Guarantees

The Company has guaranteed the purchase obligations of some of its contract manufacturers and original

design manufacturers to certain component suppliers. These guarantees generally have a term of one year and are

automatically extended for one or more years as long as a liability exists. The amount of the purchase obligations

of these manufacturers varies over time, and therefore the amounts subject to the Company’s guarantees similarly

varies. At March 31, 2010, there were no outstanding guaranteed purchase obligations. The maximum potential

future payments for three of the five guarantee arrangements is limited to $30.8 million in total. The remaining two