Logitech 2010 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

185

Ultimate Ears

In August 2008, the Company acquired the Ultimate Ears companies, a privately held group of companies

offering a range of earphones for portable-music enthusiasts as well as a line of custom-fit in-ear monitors for music

professionals. The acquisition is part of the Company’s strategy to expand its portfolio of digital audio products,

providing more options for portable music listening.

Total consideration paid was $34.5 million, which includes $0.7 million in transaction costs. Under the terms

of the purchase agreement, the Company acquired all of the outstanding equity interests of Ultimate Ears for

$33.8 million, including a $6.9 million holdback provision relating to potential indemnification claims, of which

$6.0 million has been disbursed and $0.9 million is recorded as a liability in the accompanying consolidated

financial statements. The holdback provision has been included as part of the purchase price allocation below.

The acquisition has been accounted for using the purchase method of accounting. Accordingly, the total

consideration was allocated to the tangible and intangible assets acquired and liabilities assumed based on their

estimated fair values as of the acquisition date. Fair values were determined by Company management based

on information available at the date of acquisition. The results of operations of Ultimate Ears were included in

Logitech’s consolidated financial statements from the date of acquisition, and were not material to the Company’s

reported results.

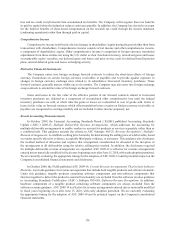

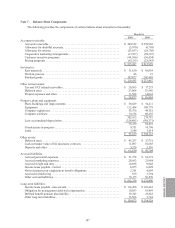

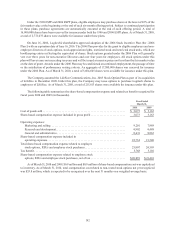

The allocation of total consideration, including transaction costs, to the assets acquired and liabilities assumed

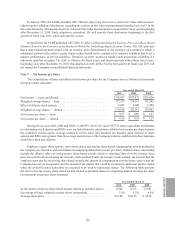

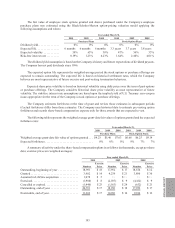

based on the estimated fair value of Ultimate Ears was as follows (in thousands):

August 19,

2008 Estimated

Life

Tangible assets acquired ......................................... $4,132

Intangible assets acquired

Existing technology .......................................... 5,900 4 years

Patents and core technology ................................... 1,900 4 years

Trademark/trade name........................................ 2,900 5 years

Customer relationships and other ............................... 2,500 5 years

Goodwill................................................... 25,254 —

42,586

Liabilities assumed ............................................. (2,845)

Deferred tax liability, net......................................... (5,235)

Total consideration........................................... $34,506

The existing technology of Ultimate Ears relates to the technical components used in the in-ear monitors and

earplugs. The value of the technology was determined based on the present value of estimated expected cash flows

attributable to the technology. The patents and core technology represent awarded patents, filed patent applications

and core architectures used in Ultimate Ears’ current and planned future products. Trademark/trade name relates to

the Ultimate Ears brand names. The value of the patents, core technology and trademark/trade name was estimated

by capitalizing the estimated profits saved as a result of acquiring or licensing the asset. Customer relationships and

other relates to Ultimate Ears’ existing customer base, valued based on projected discounted cash flows generated

from customers in place. The intangible assets acquired are amortized on a straight-line basis over their estimated

useful lives. The goodwill associated with the acquisition is not subject to amortization and is not expected to be

deductible for income tax purposes. The deferred tax liability relates to the acquired intangible assets which are

also not expected to be deductible for income tax purposes.