Logitech 2010 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134

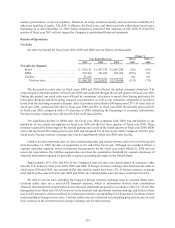

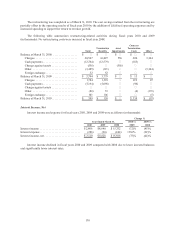

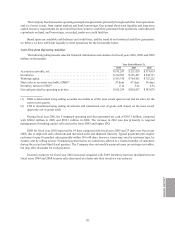

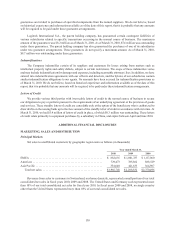

Cash Flow from Investing Activities

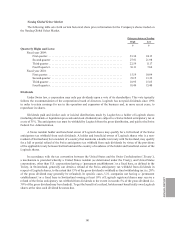

Cash flows from investing activities during fiscal years 2010, 2009 and 2008 were as follows (in thousands):

Year Ended March 31,

2010 2009 2008

Acquisitions and investments, net of cash acquired. . . . . . . . . . . . . . . $(388,809) $ (64,430) $ (59,722)

Purchases of property, plant and equipment . . . . . . . . . . . . . . . . . . . . (39,834)(48,263)(57,900)

Purchases of investment securities ............................ — — (379,793)

Sales of investment securities ................................ — — 538,479

Sale of investment ......................................... — — 13,308

Proceeds from cash surrender of life insurance policies ........... 813 — —

Premiums paid on cash surrender value life insurance policies . . . . . — (427)(1,151)

Net cash provided by (used in) investing activities . . . . . . . . . . . . . . . $(427,830) $(113,120) $ 53,221

In fiscal year 2010, we acquired LifeSize Communications for $378.6 million, net of cash acquired of

$3.7 million, and certain assets of TV Compass for $10 million. In fiscal year 2009, we acquired the Ultimate

Ears companies for $32.3 million, net of cash acquired of $0.2 million, including transaction costs of $0.5 million

and excluding a $1.8 million holdback provision which was recorded as a liability in the consolidated financial

statements. We also acquired SightSpeed in fiscal year 2009 for $30.9 million in cash including transaction costs of

$0.8 million. In addition, we paid $2.0 million for a pre-acquisition contingency recorded during the third quarter

of fiscal year 2009 related to our WiLife acquisition and $0.4 million for patent rights acquired pursuant to a patent

settlement agreement. In fiscal year 2008, we acquired WiLife, Inc. for $22.0 million, net of cash acquired of

$0.1 million and including $0.5 million in transaction costs. We also paid a deferred payment in fiscal year 2008 of

$37.7 million to the former shareholders of Intrigue Technologies, Inc., which we acquired in May 2004.

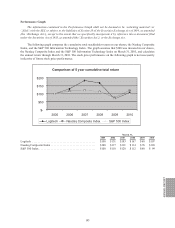

Our purchases of plant and equipment during fiscal years 2010 and 2009 were principally for computer hardware

and software purchases, machinery and equipment and normal expenditures for tooling. In fiscal year 2008, we also

purchased machinery and equipment for two new production and manufacturing facilities, including a new surface

mount technology factory in China, and leasehold improvements for a new office facility in Switzerland. Purchasing

activity was lower in fiscal years 2010 and 2009 as we focused our cash outlays on critical capital needs.

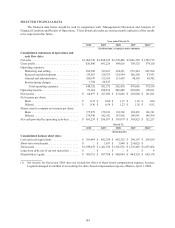

During the third quarter of fiscal year 2008, we sold 50% of our investment securities as part of a confidential

settlement agreement and received $84.3 million in cash. In addition, we sold our remaining investments

collateralized by corporate debt for $28.3 million, at a realized loss of $6.0 million. We also reinvested $130.9 million

into short-term bank deposits, which are classified as cash equivalents in the Company’s balance sheet. The balance

of the activity in investments related to purchases and sales made during the first quarter of fiscal year 2008. The

Company no longer invests in auction rate securities.

We received $11.3 million during fiscal year 2008 from the sale in fiscal year 2007 of the balance of our

investment in Anoto Group A.B. We also received $2.0 million from the sale of our ioPen retail product line in

fiscal year 2008.

The proceeds from cash surrender and the premiums paid on life insurance relate to investments of a

management deferred compensation plan offered by one of the Company’s subsidiaries.