Logitech 2010 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

201

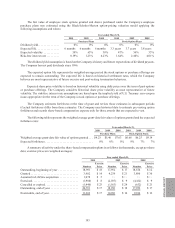

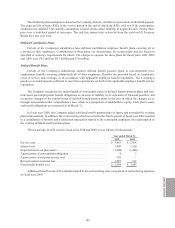

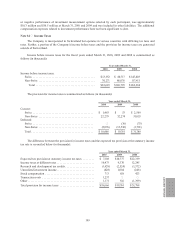

As of March 31, 2010, the Company had foreign net operating loss and tax credit carryforwards for income tax

purposes of $332.4 million and $22.3 million. Approximately $168.1 million of the net operating loss carryforwards

and $20.2 million of the tax credit carryforwards, if realized, will be credited to equity since they have not met the

applicable realization criteria. Unused net operating loss carryforwards will expire at various dates in fiscal years

2014 to 2031, and the tax credit carryforwards will begin to expire in fiscal year 2012.

Swiss income taxes and non-Swiss withholding taxes associated with the repatriation of earnings or for other

temporary differences related to investments in non-Swiss subsidiaries have not been provided for, as the Company

intends to reinvest the earnings of such subsidiaries indefinitely or the Company has concluded that no additional tax

liability would arise on the distribution of such earnings. If these earnings were distributed to Switzerland in the form

of dividends or otherwise, or if the shares of the relevant non-Swiss subsidiaries were sold or otherwise transferred,

the Company may be subject to additional Swiss income taxes and non-Swiss withholding taxes. Determination of the

amount of unrecognized deferred income tax liability related to these earnings is not practicable.

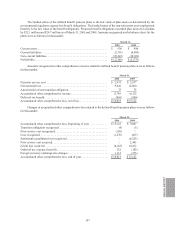

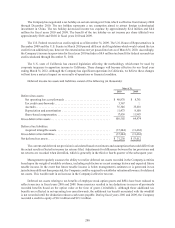

The Company follows a two-step approach to recognizing and measuring uncertain tax positions. The first

step is to evaluate the tax position for recognition by determining if the weight of available evidence indicates

that it is more likely than not that the position will be sustained on audit, including resolution of related appeals or

litigation processes, if any. The second step is to measure the tax benefit as the largest amount that is more than

50% likely of being realized upon ultimate settlement.

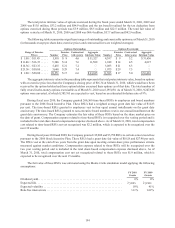

As of March 31, 2010, the total amount of unrecognized tax benefits was $125.2, of which $101.4 million

would affect the effective income tax rate if realized. The Company classified $2.4 million of unrecognized tax

benefits as current income taxes payable as the Company anticipates payment within the next 12 months. The

remainder of the unrecognized tax benefits is classified as non-current income taxes payable.

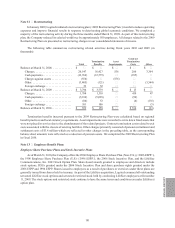

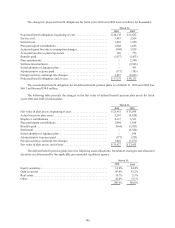

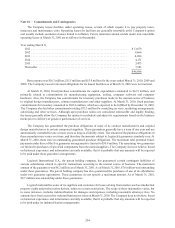

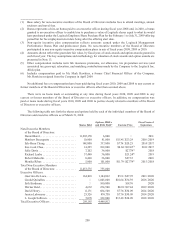

The aggregate changes in gross unrecognized tax benefits were as follow (in thousands):

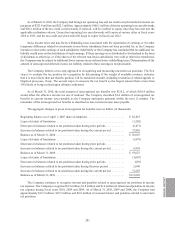

Beginning balance as of April 1, 2007 (date of adoption) .......................... $82,435

Lapse of statute of limitations ............................................... (1,202)

Decreases in balances related to tax positions taken during prior periods . . . . . . . . . . . . . (6,471)

Increases in balances related to tax positions taken during the current period .......... 17,885

Balance as of March 31, 2008 ................................................ $92,647

Lapse of statute of limitations ............................................... (1,978)

Decreases in balances related to tax positions taken during prior periods . . . . . . . . . . . . . —

Increases in balances related to tax positions taken during the current period .......... 6,958

Balance as of March 31, 2009 ................................................ $97,627

Lapse of statute of limitations ............................................... (3,667)

Decreases in balances related to tax positions taken during prior periods . . . . . . . . . . . . . (229)

Increases in balances related to tax positions taken during the prior period ............ 2,690

Increases in balances related to tax positions taken during the current period .......... 17,207

Balance as of March 31, 2010 ................................................ $113,628

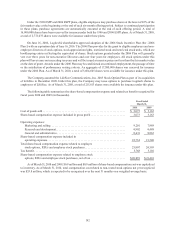

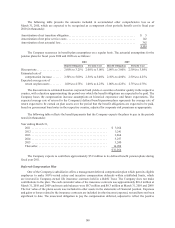

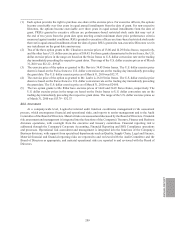

The Company continues to recognize interest and penalties related to unrecognized tax positions in income

tax expense. The Company recognized $1.9 million, $1.8 million and $1.6 million in interest and penalties in income

tax expense during fiscal years 2010, 2009 and 2008. As of March 31, 2010, 2009 and 2008, the Company had

approximately $12.5 million, $10.7 million and $8.8 million of accrued interest and penalties related to uncertain

tax positions.