Logitech 2010 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.178

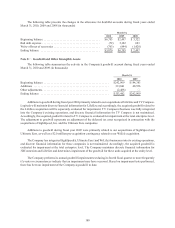

loss and tax credit carryforwards from accumulated tax benefits. The Company will recognize these tax benefits

in paid-in capital when the deduction reduces cash taxes payable. In addition, the Company has elected to account

for the indirect benefits of share-based compensation on the research tax credit through the income statement

(continuing operations) rather than through paid-in capital.

Comprehensive Income

Comprehensive income is defined as the total change in shareholders’ equity during the period other than from

transactions with shareholders. Comprehensive income consists of net income and other comprehensive income,

a component of shareholders’ equity. Other comprehensive income is comprised of foreign currency translation

adjustments from those entities not using the U.S. dollar as their functional currency, unrealized gains and losses

on marketable equity securities, net deferred gains and losses and prior service costs for defined benefit pension

plans, and net deferred gains and losses on hedging activity.

Derivative Financial Instruments

The Company enters into foreign exchange forward contracts to reduce the short-term effects of foreign

currency fluctuations on certain foreign currency receivables or payables and to provide against exposure to

changes in foreign currency exchange rates related to its subsidiaries’ forecasted inventory purchases. These

forward contracts generally mature within one to six months. The Company may also enter into foreign exchange

swap contracts to extend the terms of its foreign exchange forward contracts.

Gains and losses in the fair value of the effective portion of our forward contracts related to forecasted

inventory purchases are deferred as a component of accumulated other comprehensive loss until the hedged

inventory purchases are sold, at which time the gains or losses are reclassified to cost of goods sold. Gains or

losses in fair value on forward contracts which offset translation losses or gains on foreign currency receivables or

payables are recognized in earnings monthly and are included in other income (expense), net.

Recent Accounting Pronouncements

In October 2009, the Financial Accounting Standards Board (“FASB”) published Accounting Standards

Update (“ASU”) 2009-13, Multiple Deliverable Revenue Arrangements, which addresses the accounting for

multiple-deliverable arrangements to enable vendors to account for products or services separately rather than as

a combined unit. This guidance amends the criteria in ASC Subtopic 605-25, Revenue Recognition—Multiple-

Element Arrangements, to establish a selling price hierarchy for determining the selling price of a deliverable, based

on vendor specific objective evidence, acceptable third party evidence, or estimates. This guidance also eliminates

the residual method of allocation and requires that arrangement consideration be allocated at the inception of

the arrangement to all deliverables using the relative selling price method. In addition, the disclosures required

for multiple-deliverable revenue arrangements are expanded. ASU 2009-13 is effective for revenue arrangements

entered into or materially modified in fiscal years beginning on or after June 15, 2010, with early adoption permitted.

We are currently evaluating the appropriate timing for the adoption of ASU 2009-13 and its potential impact on the

Company’s consolidated financial statements and disclosures.

In October 2009, the FASB published ASU 2009-14, Certain Revenue Arrangements That Include Software

Elements, to provide guidance for revenue arrangements that include both tangible products and software elements.

Under this guidance, tangible products containing software components and non-software components that

function together to deliver the product’s essential functionality are excluded from the software revenue guidance

in Accounting Standards Codification (“ASC”) Subtopic 985-605, Software-Revenue Recognition. In addition,

hardware components of a tangible product containing software components are always excluded from the

software revenue guidance. ASU 2009-14 is effective for revenue arrangements entered into or materially modified

in fiscal years beginning on or after June 15, 2010, with early adoption permitted. We are currently evaluating

the appropriate timing for the adoption of ASU 2009-14 and its potential impact on the Company’s consolidated

financial statements.