Logitech 2010 Annual Report Download - page 210

Download and view the complete annual report

Please find page 210 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

198

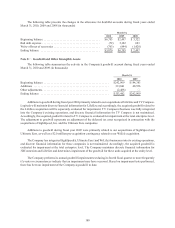

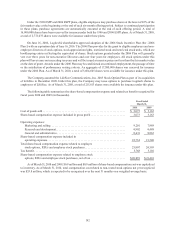

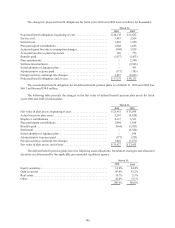

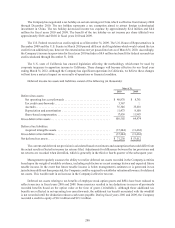

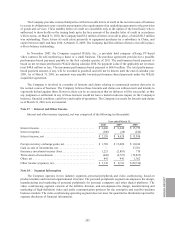

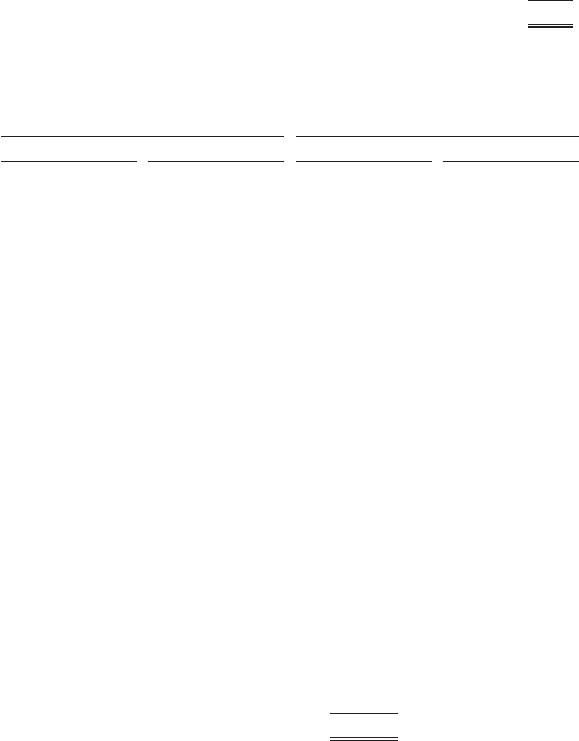

The following table presents the amounts included in accumulated other comprehensive loss as of

March 31, 2010, which are expected to be recognized as a component of net periodic benefit cost in fiscal year

2010 (in thousands):

Amortization of net transition obligation .............................................. $ 5

Amortization of net prior service costs ............................................... 142

Amortization of net actuarial loss ................................................... 362

$509

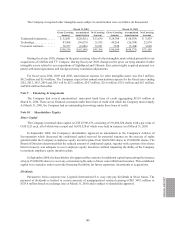

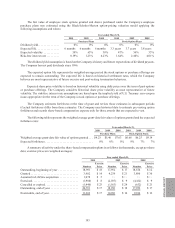

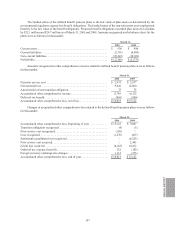

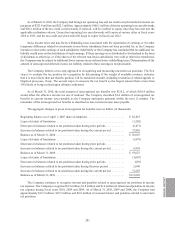

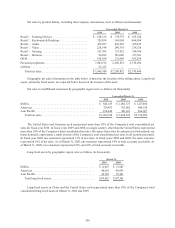

The Company reassesses its benefit plan assumptions on a regular basis. The actuarial assumptions for the

pension plans for fiscal years 2010 and 2009 are as follows:

2010 2009

Benefit Obligation Periodic Cost Benefit Obligation Periodic Cost

Discount rate ................. 2.00% to 3.25% 2.00% to 3.00% 2.00% to 3.00% 2.50% to 3.50%

Estimated rate of

compensation increase . . . . . . 2.50% to 5.00% 2.50% to 5.00% 2.50% to 4.00% 2.50% to 4.25%

Expected average rate of

return on plan assets ........ 1.00% to 4.75% 1.00% to 4.25% 1.00% to 4.25% 2.75% to 4.75%

The discount rate is estimated based on corporate bond yields or securities of similar quality in the respective

country, with a duration approximating the period over which the benefit obligations are expected to be paid. The

Company bases the compensation increase assumptions on historical experience and future expectations. The

expected average rate of return for the Company’s defined benefit pension plans represents the average rate of

return expected to be earned on plan assets over the period that the benefit obligations are expected to be paid,

based on government bond notes in the respective country, adjusted for corporate risk premiums as appropriate.

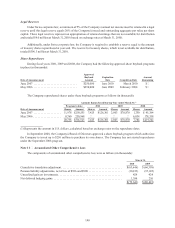

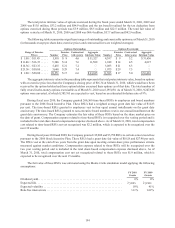

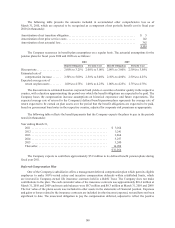

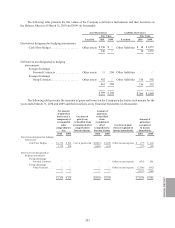

The following table reflects the benefit payments that the Company expects the plans to pay in the periods

noted (in thousands):

Year ending March 31,

2011 .................................................... $3,164

2012 .................................................... 3,241

2013 .................................................... 3,264

2014 .................................................... 3,257

2015 .................................................... 3,240

Thereafter................................................ 16,098

$32,264

The Company expects to contribute approximately $5.9 million to its defined benefit pension plans during

fiscal year 2011.

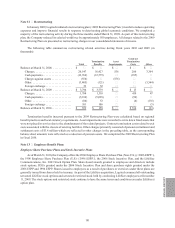

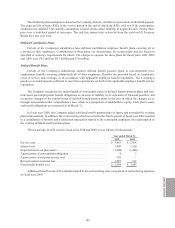

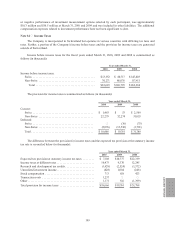

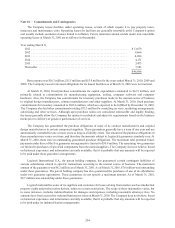

Deferred Compensation Plan

One of the Company’s subsidiaries offers a management deferred compensation plan which permits eligible

employees to make 100%-vested salary and incentive compensation deferrals within established limits, which

are invested in Company-owned life insurance contracts held in a Rabbi Trust. The Company does not make

contributions to the plan. The cash surrender value of the insurance contracts was approximately $10.4 million at

March 31, 2010 and 2009 and trust cash balances were $0.7 million and $0.3 million at March 31, 2010 and 2009.

The fair value of the plan’s assets was included in other assets in the statements of financial position. Expenses

and gains or losses related to the insurance contracts are included in other income (expense), net and have not been

significant to date. The unsecured obligation to pay the compensation deferred, adjusted to reflect the positive