Logitech 2010 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

177

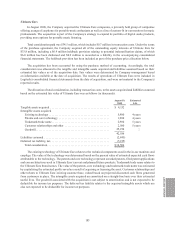

The Company’s assessment of uncertain tax positions requires that management make estimates and judgments

about the application of tax law, the expected resolution of uncertain tax positions and other matters. In the event

that uncertain tax positions are resolved for amounts different than the Company’s estimates, or the related statutes

of limitations expire without the assessment of additional income taxes, the Company will be required to adjust the

amounts of the related assets and liabilities in the period in which such events occur. Such adjustments may have a

material impact on the Company’s income tax provision and its results of operations.

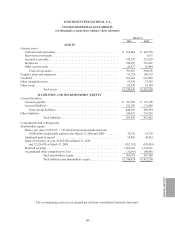

Fair Value of Financial Instruments

The carrying value of certain of the Company’s financial instruments, including cash, cash equivalents,

accounts receivable, accounts payable and accrued liabilities approximates fair value due to their short maturities.

The Company’s investment securities are reported at estimated fair value.

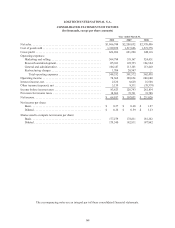

Net Income per Share

Basic net income per share is computed by dividing net income by the weighted average outstanding shares.

Diluted net income per share is computed using the weighted average outstanding shares and dilutive share

equivalents. Dilutive share equivalents consist of share-based compensation awards, including stock options and

restricted stock.

The dilutive effect of in-the-money share-based compensation awards is calculated based on the average share

price for each fiscal period using the treasury stock method, which assumes that the amount used to repurchase

shares includes the amount the employee must pay for exercising share-based awards, the amount of compensation

cost not yet recognized for future service, and the amount of tax impact that would be recorded in additional paid-in

capital when the award becomes deductible.

Share-Based Compensation Expense

Share-based compensation expense includes compensation expense, reduced for estimated forfeitures, for

share-based compensation awards granted after April 1, 2006 based on the grant-date fair value. The grant date

fair value for stock options and stock purchase rights is estimated using the Black-Scholes-Merton option-pricing

valuation model. The grant date fair value of restricted stock units (“RSUs”) which vest upon meeting certain market

conditions is estimated using the Monte-Carlo simulation method. The grant date fair value of time-based RSUs is

calculated based on the share market price on the date of grant. For stock options and restricted stock assumed by

Logitech when LifeSize was acquired, the grant date used to estimate fair value is deemed to be December 11, 2009,

the date of acquisition. Compensation expense for awards granted or assumed after April 1, 2006 is recognized on

a straight-line basis over the service period of the award, which is generally the vesting term of four years (single-

option approach) for stock options and one to four years for RSUs.

For share-based compensation awards granted prior to but not yet vested as of April 1, 2006, share-based

compensation expense is based on the grant-date fair value estimated using the Black-Scholes-Merton option-

pricing valuation model reduced for estimated forfeitures. Compensation expense for these awards is recognized

on a straight-line basis over the service period for each separately vesting portion of the award (multiple-option

approach).

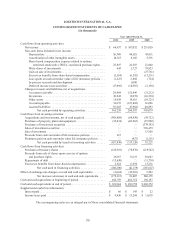

Tax benefits resulting from the exercise of stock options are classified as cash flows from financing activities

in the consolidated statement of cash flows. Excess tax benefits are realized tax benefits from tax deductions

for exercised options in excess of the deferred tax asset attributable to share-based compensation costs for

such options.

The Company will recognize a benefit from share-based compensation in paid-in capital only if an incremental

tax benefit is realized after all other available tax attributes have been utilized. For income tax footnote disclosure,

the Company has elected to offset deferred tax assets against the valuation allowance related to the net operating