Logitech 2010 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236

|

|

144

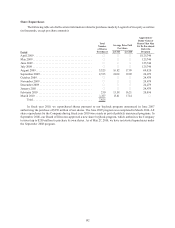

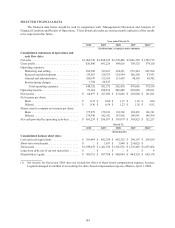

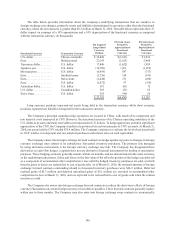

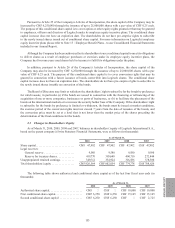

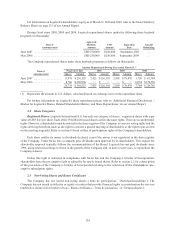

SELECTED FINANCIAL DATA

The financial data below should be read in conjunction with “Management’s Discussion and Analysis of

Financial Condition and Results of Operations.” These historical results are not necessarily indicative of the results

to be expected in the future.

Year ended March 31,

2010 2009 2008 2007 2006(1)

(In thousands, except per share amounts)

Consolidated statements of operations and

cash flow data:

Net sales ................................ $1,966,748 $2,208,832 $2,370,496 $2,066,569 $1,796,715

Gross profit .............................. 626,896 691,226 849,118 709,525 574,110

Operating expenses:

Marketing and selling ................... 304,788 319,167 324,451 272,264 221,504

Research and development . . . . . . . . . . . . . . . 135,813 128,755 124,544 108,256 87,953

General and administrative ............... 106,147 113,103 113,443 98,143 65,742

Restructuring charges ................... 1,784 20,547 — — —

Total operating expenses .............. 548,532 581,572 562,438 478,663 375,199

Operating income ......................... 78,364 109,654 286,680 230,862 198,911

Net income .............................. $ 64,957 $107,032 $231,026 $229,848 $181,105

Net income per share:

Basic ................................ $ 0.37 $0.60 $1.27 $1.26 $1.00

Diluted ............................... $0.36 $0.59 $1.23 $1.20 $0.92

Shares used to compute net income per share:

Basic ................................ 177,279 178,811 181,362 182,635 181,361

Diluted ............................... 179,340 182,911 187,942 190,991 198,769

Net cash provided by operating activities . . . . . . $ 365,259 $200,587 $393,079 $303,825 $152,217

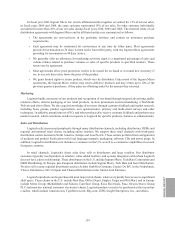

March 31,

2010 2009 2008 2007 2006(1)

(In thousands)

Consolidated balance sheet data:

Cash and cash equivalents . . . . . . . . . . . . . . . . . . $ 319,944 $492,759 $482,352 $196,197 $245,014

Short-term investments. . . . . . . . . . . . . . . . . . . . . $ — $ 1,637 $3,940 $214,625 $ —

Total assets .............................. $1,599,678 $1,421,530 $1,526,932 $1,327,463 $1,057,064

Long-term debt, net of current maturities . . . . . . $ — $ — $ — $ — $ 4

Shareholders’ equity ....................... $999,715 $997,708 $960,044 $844,524 $685,176

(1) Net income for fiscal year 2006 does not include the effect of share-based compensation expense, because

Logitech changed its method of accounting for share-based compensation expense effective April 1, 2006.