Logitech 2010 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

192

Under the 1996 ESPP and 2006 ESPP plans, eligible employees may purchase shares at the lower of 85% of the

fair market value at the beginning or the end of each six-month offering period. Subject to continued participation

in these plans, purchase agreements are automatically executed at the end of each offering period. A total of

16,000,000 shares have been reserved for issuance under both the 1996 and 2006 ESPP plans. As of March 31, 2010,

a total of 2,772,075 shares were available for issuance under these plans.

On June 16, 2006, Logitech’s shareholders approved adoption of the 2006 Stock Incentive Plan (the “2006

Plan”) with an expiration date of June 16, 2016. The 2006 Plan provides for the grant to eligible employees and non-

employee directors of stock options, stock appreciation rights, restricted stock and restricted stock units, which are

bookkeeping entries reflecting the equivalent of shares. Stock options granted under the 2006 Plan will generally

vest over three years for non-executive Directors and over four years for employees. All stock options under this

plan will have terms not exceeding ten years and will be issued at exercise prices not less than the fair market value

on the date of grant. Awards under the 2006 Plan may be conditioned on continued employment, the passage of time

or the satisfaction of performance vesting criteria. An aggregate of 17,500,000 shares was reserved for issuance

under the 2006 Plan. As of March 31, 2010, a total of 5,664,605 shares were available for issuance under this plan.

The Company assumed the LifeSize Communications, Inc. 2003 Stock Option Plan as part of its acquisition

of LifeSize in December 2009. Under this plan, the Company may issue options to purchase Logitech shares to

employees of LifeSize. As of March 31, 2010, a total of 215,813 shares were available for issuance under this plan.

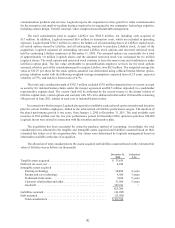

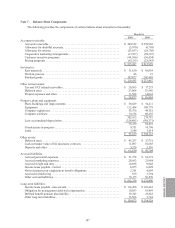

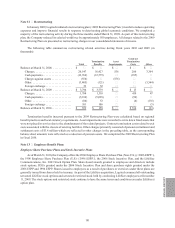

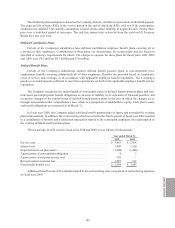

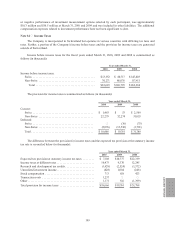

The following table summarizes the share-based compensation expense and related tax benefit recognized for

fiscal years 2010 and 2009 (in thousands).

Year Ended

March 31,

2010 2009

Cost of goods sold ......................................................... $3,073 $3,163

Share-based compensation expense included in gross profit ........................ 3,073 3,163

Operating expenses:

Marketing and selling ................................................... 9,201 7,989

Research and development................................................ 4,902 4,488

General and administrative ............................................... 8,631 8,863

Share-based compensation expense included in

operating expenses...................................................... 22,734 21,340

Total share-based compensation expense related to employee

stock options, RSUs and employee stock purchases ............................ 25,807 24,503

Tax benefit ............................................................... 5,768 3,102

Share-based compensation expense related to employee stock

options, RSUs and employee stock purchases, net of tax ........................ $20,039 $21,401

As of March 31, 2010 and 2009, $0.9 million and $0.8 million of share-based compensation cost was capitalized

to inventory. As of March 31, 2010, total compensation cost related to non-vested stock options not yet recognized

was $53.8 million, which is expected to be recognized over the next 31 months on a weighted-average basis.