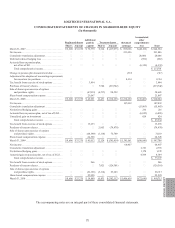

Logitech 2010 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2010 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAl REPORT

181

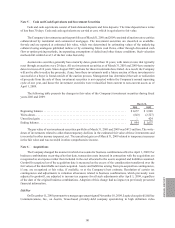

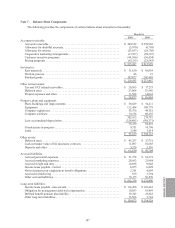

Note 5 — Cash and Cash Equivalents and Investment Securities

Cash and cash equivalents consist of bank demand deposits and time deposits. The time deposits have terms

of less than 30 days. Cash and cash equivalents are carried at cost, which is equivalent to fair value.

The Company’s investment securities portfolio as of March 31, 2010 and 2009 consisted of auction rate securities

collateralized by residential and commercial mortgages. The investment securities are classified as available-

for-sale and are reported at estimated fair value, which was determined by estimating values of the underlying

collateral using analogous published indices or by estimating future cash flows, either through discounted cash

flow or option pricing methods, incorporating assumptions of default and other future conditions. Such valuation

methods fall within Level 3 of the fair value hierarchy.

Auction rate securities generally have maturity dates greater than 10 years, with interest rates that typically

reset through an auction every 28 days. All our investment securities as of March 31, 2010 and 2009 have maturity

dates in excess of 10 years. Since August 2007, auctions for these investments have failed. As a result, the Company

will not be able to realize the proceeds, if any, from these investments until a future auction of these investments is

successful or a buyer is found outside of the auction process. Management has determined that sale or realization

of proceeds from the sale of these investment securities is not expected within the Company’s normal operating

cycle of one year, and hence the investment securities were reclassified from current to non-current assets as of

April 1, 2009.

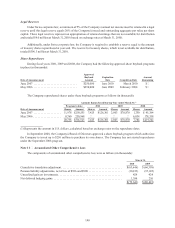

The following table presents the changes in fair value of the Company’s investment securities during fiscal

years 2010 and 2009:

March 31,

2010 2009

Beginning balance ......................................................... $1,637 $3,940

Write-down ............................................................... (643)(2,727)

Unrealized gain ............................................................ —424

Ending balance ............................................................ $994 $1,637

The par value of our investment securities portfolio at March 31, 2010 and 2009 was $47.5 million. The write-

down of investments related to other-than-temporary declines in the estimated fair value of these investments and

is recorded in other income (expense), net. The unrealized gain as of March 31, 2009 related to temporary increases

in the fair value and was recorded in other comprehensive income.

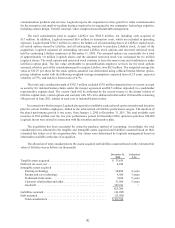

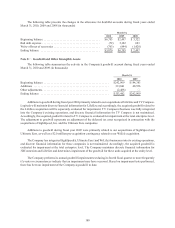

Note 6 — Acquisitions

The Company changed the manner in which it accounts for business combinations effective April 1, 2009. For

business combinations occurring after that date, transaction costs incurred in connection with the acquisition are

recognized as an expense rather than included in the cost allocated to the assets acquired and liabilities assumed.

Goodwill recognized as of the acquisition date is measured as the excess of the consideration transferred over the

fair values of the identifiable net assets acquired. Assets and liabilities arising from pre-acquisition contingencies,

if any, are recognized at fair value, if available, or at the Company’s best estimate. Resolution of certain tax

contingencies and adjustments to valuation allowances related to business combinations, which previously were

adjusted to goodwill, are adjusted to income tax expense for all such adjustments after April 1, 2009, regardless

of the date of the original business combinations. Adoption of this change had no impact on previously presented

financial information.

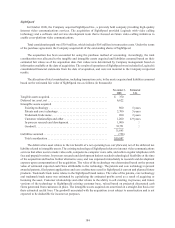

LifeSize

On December 11, 2009, pursuant to a merger agreement signed November 10, 2009, Logitech acquired LifeSize

Communications, Inc., an Austin, Texas-based privately-held company specializing in high definition video