Foot Locker 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

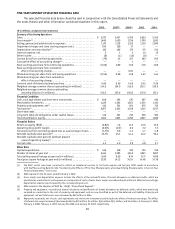

The Company’s processes, procedures and controls related to financial reporting were not effective

to ensure that amounts related to current taxes payable, certain deferred tax assets and liabilities, the

current and deferred income tax expense were recorded in accordance with generally accepted accounting

principles. Specifically, the Company did not maintain effective controls over the preparation and review of

the calculations and related supporting documentation for the tax accounts noted above. As a result, there

were errors in the aforementioned tax accounts in the preliminary consolidated financial statements that

were corrected prior to issuance of the Company’s consolidated financial statements.

KPMG LLP, the independent registered public accounting firm that audits the Company’s consolidated

financial statements included in this annual report, has issued an attestation report on the Company’s

effectiveness of internal control over financial reporting, which is included in Item 9A(e).

(c) Changes in Internal Control over Financial Reporting.

During the Company’s last fiscal quarter there were no changes in internal control over financial reporting

that materially affected, or is reasonably likely to materially affect, the Company’s internal control over

financial reporting.

(d) Remediation Plan for Material Weakness in Internal Control Over Financial Reporting.

In response to the identified material weaknesses, management has identified several enhancements to the

Company’s internal control over financial reporting to remediate the material weakness described above.

These ongoing efforts include the following:

• Enhancing procedures for quality review and analysis of the provision for income tax.

• Accelerating certain year end tax analysis and reporting activities to periods earlier in the year

in order to provide additional analysis and reconciliation time.

• Identifying opportunities to automate the tax provision process including software tools that

would reduce the number of manual spreadsheets that are used to calculate the income tax

provision on a quarterly and annual basis.

• Evaluating the need for additional resources in the preparation and review of the provision of

income taxes.

We anticipate the actions described above and resulting improvements in controls will strengthen our

internal control over financial reporting and will, over time, address the related material weakness that

we identified as of January 31, 2009. However, because the remedial actions relate to the training of

personnel and many of the controls in our system of internal controls rely extensively on manual review and

approval, the successful operations of these controls, for at least several quarters, may be required prior to

management being able to conclude that the material weakness has been remediated.

(e) Report of Independent Registered Public Accounting Firm on Internal Control Over Financial Reporting