Foot Locker 2008 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

3. Acquisition

The Company consummated its purchase of CCS from dELiA*s, Inc. on November 5, 2008. CCS is the leading direct-

to-consumer retailer in the United States that sells skateboard and snowboard equipment, apparel, footwear and

accessories through catalogs and the Internet. The Company’s consolidated results of operations include those of CCS

beginning with the date that the acquisition was consummated. The Company believes that this acquisition will provide

the Company with a unique growth opportunity, which supplements its current direct-to-customers operations.

The Company integrated the CCS business into the Direct-to-Customers segment. The purchase price was $106

million and consisted of $103 million in cash consideration and $3 million of direct transaction costs. Direct costs

include investment banking, legal and accounting fees, and other costs. The Company has allocated the purchase

price based, in part, upon internal estimates of cash flows and considering the report of a third-party valuation expert

retained to assist the Company, with the remainder allocated to tax deductible goodwill. The purchase price allocation

may be revised as more definitive facts and evidence become available. Pro forma effects of the acquisition have not

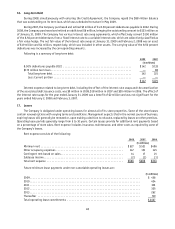

been presented, as their effects were not significant to the consolidated results of operations. The allocation of the

purchase price is detailed below:

(in millions)

Inventory ........................................ $ 13

Intangible assets

Tradenames – non-amortizing ...................... 25

Customer relationship – amortizing .................. 21

Goodwill ......................................... 47

Total purchase price .............................. $106

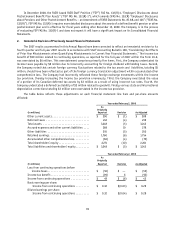

4. Impairment Charges and Store Closing Program

Northern Group Note Impairment

On January 23, 2001, the Company announced that it was exiting its Northern Group segment. During the second

quarter of 2001, the Company completed the liquidation of the 324 stores in the United States. On September 28,

2001, the Company completed the stock transfer of the 370 Northern Group stores in Canada through one of its wholly

owned subsidiaries for approximately CAD$59 million, which was paid in the form of a note. Over the last several years,

the note has been amended and payments have been received; however, the interest and payment terms remained

unchanged. The CAD$15.5 million note was required to be repaid upon the occurrence of “payment events,” as defined

in the purchase agreement, but no later than September 28, 2008. During the first quarter of 2008, the principal owners

of the Northern Group requested an extension on the repayment of the note. The Company determined, based on the

Northern Group’s current financial condition and projected performance, that repayment of the note pursuant to the

original terms of the purchase agreement was not likely. Accordingly, a non-cash impairment charge of $15 million was

recorded during the first quarter of 2008 in accordance with SFAS No. 114, “Accounting by Creditors for Impairment

of a Loan.” This charge has been recorded with no tax benefit. The tax benefit is a capital loss that can only be used

to offset capital gains. The Company does not anticipate recognizing sufficient capital gains to utilize these losses.

Therefore, the Company determined that a full valuation allowance was required.

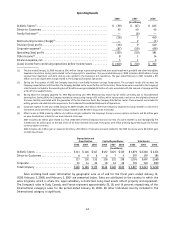

Another wholly owned subsidiary of the Company was the assignor of the store leases involved in the Northern

Group transaction and, therefore, retains potential liability for such leases. As the assignor of the Northern

Canada leases, the Company remained secondarily liable under these leases. As of January 31, 2009, the Company

estimates that its gross contingent lease liability is CAD$2 million. The Company currently estimates the expected

value of the lease liability to be insignificant. The Company believes that, because it is secondarily liable on the

leases, it is unlikely that it would be required to make such contingent payments.