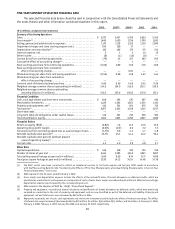

Foot Locker 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

There were no disagreements between the Company and its independent registered public accounting firm on

matters of accounting principles or practices.

Item 9A. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures.

The Company’s management performed an evaluation under the supervision and with the participation

of the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), and completed an

evaluation of the effectiveness of the design and operation of the Company’s disclosure controls and

procedures (as that term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of

1934, as amended (the “Exchange Act”)) as of January 31, 2009. Based on that evaluation, the Company’s

CEO and CFO concluded that, due to a material weakness in internal control over financial reporting

described below in Management’s Annual Report on Internal Control over Financial Reporting, the

Company’s disclosure controls and procedures were not effective to ensure that information relating to

the Company that is required to be disclosed in the reports that we file or submit under the Exchange Act

is recorded, processed, summarized and reported, within the time periods specified in the SEC rules and

form, and is accumulated and communicated to management, including the CEO and CFO, as appropriate

to allow timely decisions regarding required disclosure.

In light of this material weakness, in preparing the consolidated financial statements as of and for the fiscal

year ended January 31, 2009, the Company performed additional reconciliations and analyses and other

post-closing procedures designed to ensure that our consolidated financial statements included in this

Annual Report for the fiscal year ended January 31, 2009 have been prepared in accordance with generally

accepted accounting principles. The Company’s CEO and CFO have certified that, based on their knowledge,

the consolidated financial statements included in this report fairly present in all material respects our

financial condition, results of operations and cash flows for each of the periods presented in this report.

(b) Management’s Annual Report on Internal Control over Financial Reporting.

The Company’s management is responsible for establishing and maintaining adequate internal control over

financial reporting (as that term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f)). To evaluate the

effectiveness of the Company’s internal control over financial reporting, the Company uses the framework

in Internal Control-Integrated Framework issued by the Committee of Sponsoring Organizations of the

Treadway Commission (the “COSO Framework”). Using the COSO Framework, the Company’s management,

including the CEO and CFO, evaluated the Company’s internal control over financial reporting. During this

evaluation, management identified a material weakness in our internal control over financial reporting.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial

reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual

or interim financial statements will not be prevented or detected on a timely basis. As a result of the

following material weakness, management has concluded that our internal control over financial reporting

was not effective as of January 31, 2009 based upon the COSO Framework.