Foot Locker 2008 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

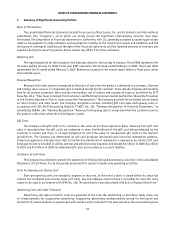

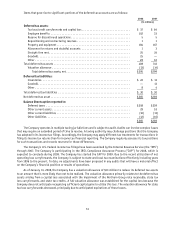

Operating Results

2008 2007 2006

(in millions)

Athletic Stores(1) ............................................. $ (59) $ (27) $ 405

Direct-to-Customers .......................................... 43 40 45

Family Footwear(2) ............................................ — (6) —

(16) 7 450

Restructuring income (charge)(3) ................................. — 2 (1)

Division (loss) profit .......................................... (16) 9 449

Corporate expense(4) .......................................... (87) (59) (68)

Operating (loss) profit ........................................ (103) (50) 381

Other income(5) .............................................. 8 1 14

Interest expense, net ......................................... 5 1 3

(Loss) income from continuing operations before income taxes ......... $ (100) $ (50) $ 392

(1) The year ended January 31, 2009 includes a $241 million charge representing long-lived store asset impairment, goodwill and other intangibles

impairment and store closing costs related to the Company’s U.S. operations. The year ended February 2, 2008 includes a $128 million charge

representing impairment and store closing costs related to the Company’s U.S. operations. The year ended February 3, 2007 included a $17

million non-cash impairment charge related to the Company’s European operations.

(2) During the first quarter of 2007, the Company launched a new family footwear concept, Footquarters. The concept’s results did not meet the

Company’s expectations and, therefore, the Company decided not to invest further in this business. These stores were converted to the Company’s

other formats. Included in the operating loss of $6 million was approximately $2 million of costs associated with the removal of signage and the

write-off of unusable fixtures.

(3) During 2007, the Company adjusted its 1993 Repositioning and 1991 Restructuring reserve by $2 million primarily due to favorable lease

terminations. During 2006, the Company recorded a restructuring charge of $1 million, which represented a revision to the original estimate of

the lease liability associated with the guarantee of The San Francisco Music Box Company distribution center. These amounts are included in

selling, general and administrative expenses in the Condensed Consolidated Statements of Operations.

(4) Corporate expense for the year ended January 31, 2009 includes a $3 million other-than-temporary impairment charge related to a short-term

investment and a $15 million impairment charge related to the Northern Group note receivable.

(5) Other income in 2008 primarily reflects a $4 million net gain related to the Company’s foreign currency options contracts and $3 million gain

on lease terminations related to two lease interests in Europe.

2007 includes a $1 million gain related to a final settlement with the Company’s insurance carriers of a claim related to a store damaged by fire

in 2006 and a $1 million gain on the sale of two of its lease interests in Europe. These gains were offset primarily by premiums paid for foreign

currency option contracts.

2006 includes a $4 million gain on lease terminations, a $8 million of insurance proceeds related to the 2005 hurricane, and a $2 million gain

on debt repurchases.

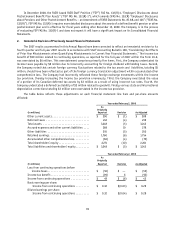

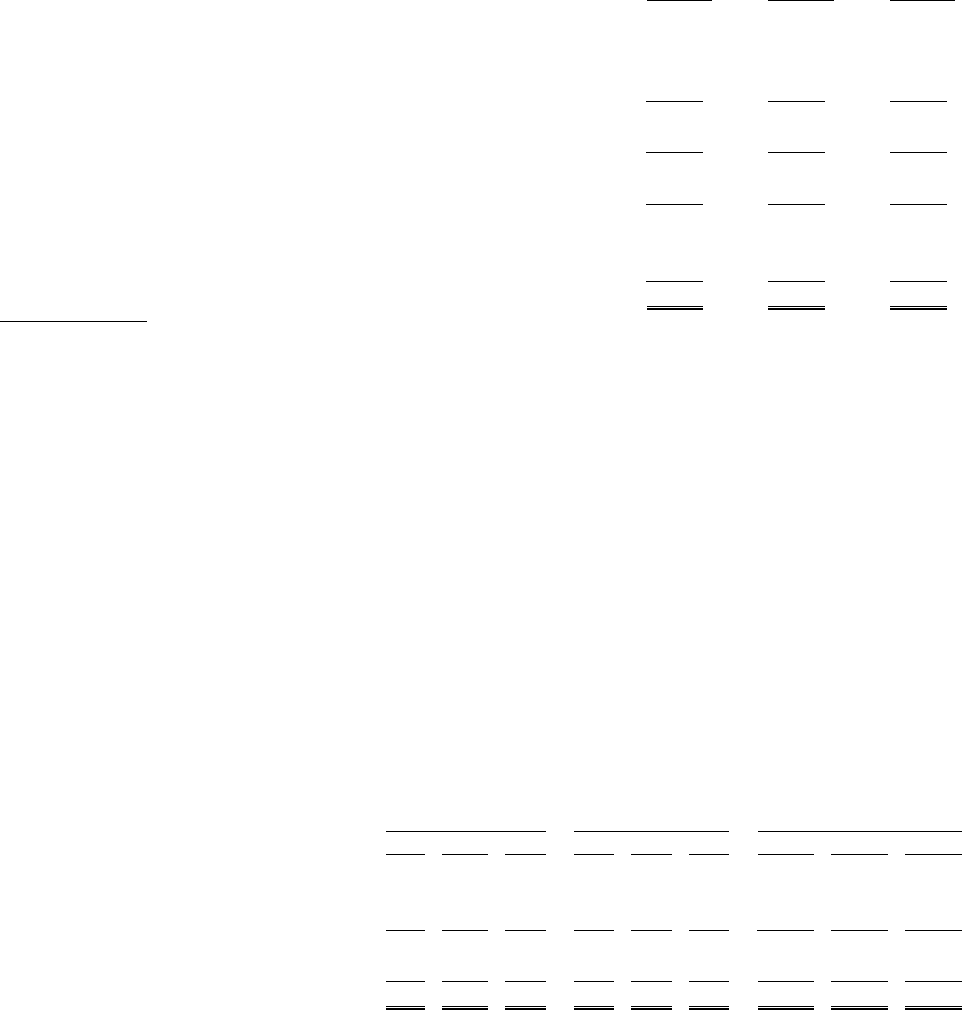

Depreciation and

Amortization Capital Expenditures Total Assets

2008 2007 2006 2008 2007 2006 2008 2007 2006

(in millions)

Athletic Stores ....................... $111 $146 $147 $122 $125 $135 $1,879 $2,300 $2,374

Direct-to-Customers ................... 6 6 6 6 7 4 297 197 195

117 152 153 128 132 139 2,176 2,497 2,569

Corporate ........................... 13 14 22 18 16 26 701 746 680

Total Company ....................... $130 $166 $175 $146 $148 $165 $2,877 $3,243 $3,249

Sales and long-lived asset information by geographic area as of and for the fiscal years ended January 31,

2009, February 2, 2008, and February 3, 2007 are presented below. Sales are attributed to the country in which the

sales originate, which is where the legal subsidiary is domiciled. Long-lived assets reflect property and equipment.

The Company’s sales in Italy, Canada, and France represent approximately 22, 18, and 14 percent, respectively, of the

International category’s sales for the period ended January 31, 2009. No other individual country included in the

International category is significant.