Foot Locker 2008 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

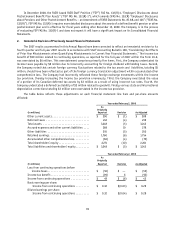

48

16. Long-Term Debt

During 2008, simultaneously with entering the Credit Agreement, the Company repaid the $88 million balance

that was outstanding on its term loan, which was scheduled to mature in May 2009.

During 2007, the Company purchased and retired $5 million of its 8.50 percent debentures payable in 2022. During

2008, the Company purchased and retired an additional $6 million, bringing the outstanding amount to $123 million as

of January 31, 2009. The Company has various interest rate swap agreements, which effectively convert $100 million

of the 8.50 percent debentures from a fixed interest rate to a variable interest rate, which are collectively classified as

a fair value hedge. The net fair value of the interest rate swaps at January 31, 2009 and February 2, 2008 was an asset

of $19 million and $4 million, respectively, which was included in other assets. The carrying value of the 8.50 percent

debentures was increased by the corresponding amounts.

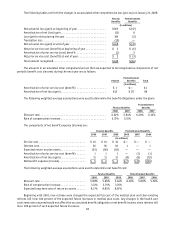

Following is a summary of long-term debt:

2008 2007

(in millions)

8.50% debentures payable 2022 ............................................ $142 $133

$175 million term loan.................................................... — 88

Total long-term debt ................................................... 142 221

Less: Current portion .................................................. — —

$142 $221

Interest expense related to long-term debt, including the effect of the interest rate swaps and the amortization

of the associated debt issuance costs, was $9 million in 2008, $18 million in 2007 and $20 million in 2006. The effect of

the interest rate swaps for the year ended January 31, 2009 was a benefit of $2 million and was not significant for the

years ended February 2, 2008 and February 3, 2007.

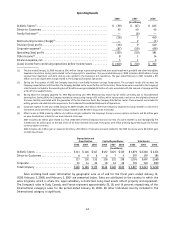

17. Leases

The Company is obligated under operating leases for almost all of its store properties. Some of the store leases

contain renewal options with varying terms and conditions. Management expects that in the normal course of business,

expiring leases will generally be renewed or, upon making a decision to relocate, replaced by leases on other premises.

Operating lease periods generally range from 5 to 10 years. Certain leases provide for additional rent payments based

on a percentage of store sales. Rent expense includes insurance, maintenance, and other costs as required by some of

the Company’s leases.

Rent expense consists of the following:

2008 2007 2006

(in millions)

Minimum rent ..................................................... $527 $521 $496

Other occupancy expenses ........................................... 147 151 145

Contingent rent based on sales ........................................ 14 17 21

Sublease income ................................................... (2) (1) (1)

Total rent expense ................................................. $686 $688 $661

Future minimum lease payments under non-cancelable operating leases are:

(in millions)

2009 ....................................................................... $ 456

2010 ....................................................................... 424

2011 ....................................................................... 381

2012 ....................................................................... 325

2013 ....................................................................... 262

Thereafter .................................................................. 719

Total operating lease commitments ............................................... $2,567