Foot Locker 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

Quoted market prices of the same or similar instruments are used to determine fair value of long-term debt

and forward foreign exchange contracts. Discounted cash flows are used to determine the fair value of long-term

investments and notes receivable if quoted market prices on these instruments are unavailable.

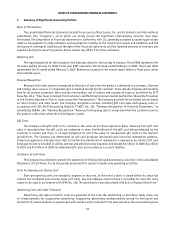

Income Taxes

On February 4, 2007, the Company adopted FASB Interpretation No. 48, “Accounting for Uncertainty in Income

Taxes” (“FIN 48”). Interpretation No. 48 clarifies the accounting for uncertainty in income taxes recognized in an

enterprise’s financial statements in accordance with Statement of Financial Accounting Standards No. 109, “Accounting

for Income Taxes.” FIN 48 prescribes a recognition threshold and measurement standard for the financial statement

recognition and measurement of a tax position taken or expected to be taken in a tax return. Upon the adoption of

FIN 48, the Company recognized a $1 million increase to retained earnings to reflect the change of its liability for the

unrecognized income tax benefits as required. The Company recognizes interest and penalties related to unrecognized

tax benefits in income tax expense.

The Company determines its deferred tax provision under the liability method, whereby deferred tax assets and

liabilities are recognized for the expected tax consequences of temporary differences between the tax bases of assets

and liabilities and their reported amounts using presently enacted tax rates. Deferred tax assets are recognized for tax

credits and net operating loss carryforwards, reduced by a valuation allowance, which is established when it is more

likely than not that some portion or all of the deferred tax assets will not be realized. The effect on deferred tax assets

and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

A taxing authority may challenge positions that the Company adopted in its income tax filings. Accordingly,

the Company may apply different tax treatments for transactions in filing its income tax returns than for income tax

financial reporting. The Company regularly assesses its tax position for such transactions and records reserves for those

differences when considered necessary.

Provision for U.S. income taxes on undistributed earnings of foreign subsidiaries is made only on those amounts in

excess of the funds considered to be permanently reinvested.

Pension and Postretirement Obligations

The discount rate selected to measure the present value of the Company’s U.S. benefit obligations as of

January 31, 2009 was derived using a cash flow matching method whereby the Company compares the plans’ projected

payment obligations by year with the corresponding yield on the Citibank Pension Discount Curve. The cash flows are

then discounted to their present value and an overall discount rate is determined. The discount rate selected to measure

the present value of the Company’s Canadian benefit obligations as of January 31, 2009 was developed by using the plan’s

bond portfolio indices, which match the benefit obligations.

Insurance Liabilities

The Company is primarily self-insured for health care, workers’ compensation and general liability costs.

Accordingly, provisions are made for the Company’s actuarially determined estimates of discounted future claim costs

for such risks for the aggregate of claims reported and claims incurred but not yet reported. Self-insured liabilities

totaled $16 million and $17 million at January 31, 2009 and February 2, 2008, respectively. The Company discounts its

workers’ compensation and general liability using a risk-free interest rate. Imputed interest expense related to these

liabilities was not significant for the year ended January 31, 2009 and was $1 million in both 2007 and 2006.

Accounting for Leases

The Company recognizes rent expense for operating leases as of the possession date for store leases or the

commencement of the agreement for a non-store lease. Rental expense, inclusive of rent holidays, concessions

and tenant allowances are recognized over the lease term on a straight-line basis. Contingent payments based

upon sales and future increases determined by inflation related indices cannot be estimated at the inception of the

lease and accordingly, are charged to operations as incurred.