Foot Locker 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

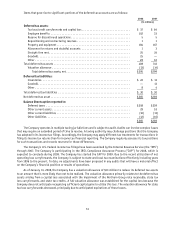

Based upon the level of historical taxable income and projections for future taxable income over the periods

in which the temporary differences are anticipated to reverse, management believes it is more likely than not that

the Company will realize the benefits of these deductible differences, net of the valuation allowances at January 31,

2009. However, the amount of the deferred tax asset considered realizable could be adjusted in the future if estimates

of taxable income are revised.

At January 31, 2009, the Company’s tax loss/credit carryforwards include international operating loss

carryforwards with a potential tax benefit of $2 million, expiring between 2009 and 2017. The Company has a $5

million capital loss arising from a note receivable that expires 5 years from recognition. The Company also has state

net operating loss carryforwards with a potential tax benefit of $15 million, which principally relate to the 15 states

where the Company does not file combined or consolidated returns. These loss carryforwards expire between 2009

and 2029. The Company has state and Canadian provincial credit carryforwards that total approximately $3 million,

expiring between 2010 and 2018. The Company also has federal foreign tax credits totaling $16 million, $4 million of

which can be carried back to 2006 and $12 million of which can be carried forward, expiring in 2017.

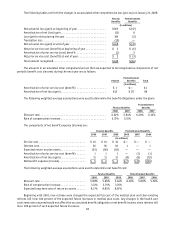

The Company adopted FIN 48, “Accounting for Uncertainty in Income Taxes” effective February 4, 2007, that

resulted in the recognition of an additional $1 million of previously unrecognized tax benefits, which was reflected

as an adjustment to opening retained earnings. The Company had $71 million of gross unrecognized tax benefits,

$68 million of net unrecognized tax benefits, as of February 3, 2008. The Company has classified certain income tax

liabilities as current or noncurrent based on management’s estimate of when these liabilities will be settled. Interest

expense and penalties related to unrecognized tax benefits are classified as income tax expense. During the year

ended January 31, 2009, the Company recognized $1 million of interest expense. The total amount of accrued interest

and penalties was $4 million in 2008 and accrued interest in 2007 was $5 million.

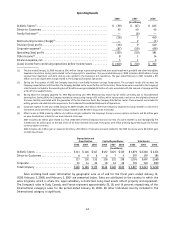

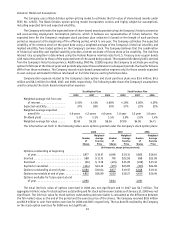

The following table summarizes the activity related to unrecognized tax benefits:

(in millions)

Balance as of February 3, 2008 ..................... $ 71

Increases related to current year tax positions ......... 4

Increases related to prior period tax positions ......... 1

Decreases related to prior period tax positions ......... (15)

Settlements ................................... (2)

Lapse of statute of limitations ..................... (1)

Balance as of January 31, 2009 ..................... $ 58

Of the unrecognized tax benefits, $55 million would, if recognized, affect the Company’s annual effective tax

rate. It is reasonably possible that the liability associated with the Company’s unrecognized tax benefits will increase

or decrease within the next twelve months. These changes may be the result of foreign currency fluctuations, ongoing

audits or the expiration of statutes of limitations. Settlements could increase earnings in an amount ranging from

$0 to $10 million based on current estimates. Audit outcomes and the timing of audit settlements are subject to

significant uncertainty. Although management believes that adequate provision has been made for such issues, the

ultimate resolution of these issues could have an adverse effect on the earnings of the Company. Conversely, if these

issues are resolved favorably in the future, the related provision would be reduced, generating a positive effect on

earnings. Due to the uncertainty of amounts and in accordance with its accounting policies, the Company has not

recorded any potential impact of these settlements.

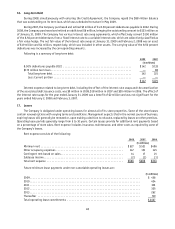

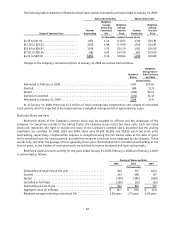

22. Financial Instruments and Risk Management

Derivative Holdings Designated as Hedges

The Company operates internationally and utilizes certain derivative financial instruments to mitigate its foreign

currency exposures, primarily related to third party and intercompany forecasted transactions.

For a derivative to qualify as a hedge at inception and throughout the hedged period, the Company formally

documents the nature of the hedged items and the relationships between the hedging instruments and the hedged

items, as well as its risk-management objectives, strategies for undertaking the various hedge transactions, and

the methods of assessing hedge effectiveness and hedge ineffectiveness. Additionally, for hedges of forecasted