Foot Locker 2008 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

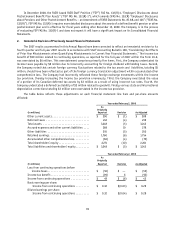

8. Merchandise Inventories

2008 2007

(in millions)

LIFO inventories ................................................... $ 788 $ 907

FIFO inventories ................................................... 332 374

Total merchandise inventories ........................................ $1,120 $1,281

The value of the Company’s LIFO inventories, as calculated on a LIFO basis, approximates their value as calculated

on a FIFO basis.

9. Other Current Assets

2008 2007

(in millions)

Net receivables .................................................... $ 53 $ 50

Prepaid expenses and other current assets ............................... 33 34

Prepaid rent ...................................................... 62 65

Prepaid income taxes ............................................... 47 69

Deferred taxes .................................................... 29 53

Northern Group note receivable ....................................... — 14

Current tax asset .................................................. — 1

Income tax receivable ............................................... 7 —

Fair value of derivative contracts ...................................... 5 3

$ 236 $ 289

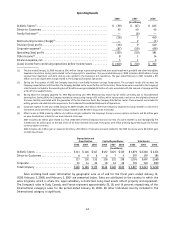

10. Property and Equipment, Net

2008 2007

(in millions)

Land ............................................................ $ 3 $ 3

Buildings:

Owned ........................................................ 31 30

Furniture, fixtures and equipment:

Owned ........................................................ 1,018 1,117

1,052 1,150

Less: accumulated depreciation ..................................... (829) (903)

223 247

Alterations to leased and owned buildings

Cost .......................................................... 724 799

Less: accumulated amortization ..................................... (515) (525)

209 274

$432 $521

11. Goodwill

2008 2007

(in millions)

Athletic Stores .................................................... $ 17 $186

Direct-to-Customers ................................................ 127 80

$144 $266

Goodwill for the Direct-to-Customers segment increased by $47 million due to the Company’s purchase of CCS

from dELiA*s, Inc. during the fourth quarter of 2008. The effect of foreign exchange fluctuations for the year ended

January 31, 2009 decreased goodwill by $2 million, resulting from the strengthening of the U.S. dollar in relation to

the euro. During the fourth quarter of 2008, the Company recorded impairment charges of $167 million, as more fully

described in note 4.