Foot Locker 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.55

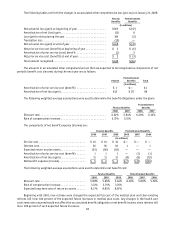

Business Risk

The retailing business is highly competitive. Price, quality, selection of merchandise, reputation, store location,

advertising and customer service are important competitive factors in the Company’s business. The Company operates

in 21 countries and purchased approximately 80 percent of its merchandise in 2008 from its top 5 vendors. In 2008,

the Company purchased approximately 64 percent of its athletic merchandise from one major vendor and approximately

9 percent from another major vendor. Each of our operating divisions is highly dependent on Nike; they individually

purchase 44 to 78 percent of their merchandise from Nike. The Company generally considers all vendor relations to be

satisfactory.

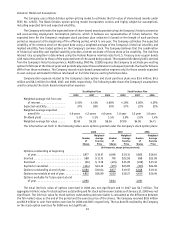

Included in the Company’s Consolidated Balance Sheet as of January 31, 2009, are the net assets of the Company’s

European operations, which total $545 million and which are located in 17 countries, 11 of which have adopted the euro

as their functional currency.

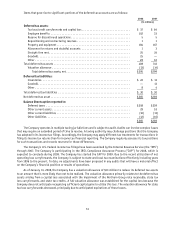

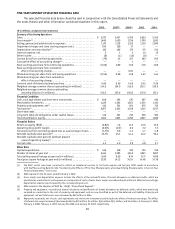

23. Fair Value Measurements

On February 3, 2008, the Company adopted SFAS No. 157, “Fair Value Measurements” (“SFAS No.157”). SFAS No. 157

provides a single definition of fair value and a common framework for measuring fair value as well as new disclosure

requirements for fair value measurements used in financial statements. Under SFAS No. 157, fair value is determined

based upon the exit price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants exclusive of any transaction costs. SFAS No. 157 also specifies a fair value hierarchy

based upon the observability of inputs used in valuation techniques. Observable inputs (highest level) reflect market

data obtained from independent sources, while unobservable inputs (lowest level) reflect internally developed market

assumptions.

In February 2008, the FASB issued FSP FAS 157-1, “Application of FASB Statement No. 157 to FASB Statement No.

13 and Other Accounting Pronouncements That Address Fair Value Measurements for Purposes of Lease Classification

or Measurement under Statement 13” (“FSP FAS 157-1”). FSP FAS 157-1 amended SFAS No. 157 to exclude from its scope

SFAS No. 13, “Accounting for Leases,” and its related interpretive accounting pronouncements that address leasing

transactions. Also in February 2008, the FASB issued FSP FAS 157-2, “Effective Date of FASB Statement No. 157” (“FSP

FAS 157-2”). FSP FAS 157-2 amended SFAS No. 157 to defer the effective date of SFAS No. 157 for non-financial assets

and non-financial liabilities, except for items that are recognized or disclosed at fair value in the financial statements

on a recurring basis, at least annually until fiscal years beginning after November 15, 2008. The Company is currently

assessing the impact of SFAS No. 157 on its non-financial assets and non-financial liabilities measured at fair value on

a nonrecurring basis.

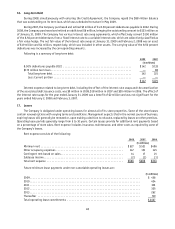

In accordance with SFAS No. 157, fair value measurements are classified under the following hierarchy:

Level 1 – Quoted prices for identical instruments in active markets.

Level 2 – Quoted prices for similar instruments in active markets; quoted prices for identical or similar instruments

in markets that are not active; and model-derived valuations in which all significant inputs or significant value-

drivers are observable in active markets.

Level 3 – Model-derived valuations in which one or more significant inputs or significant value-drivers are

unobservable.