Foot Locker 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

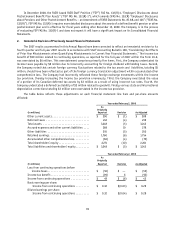

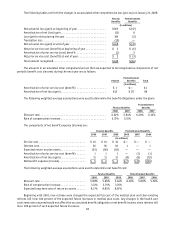

18. Other Liabilities

2008 2007

(in millions)

Pension benefits ............................................................ $183 $ 35

Postretirement benefits ...................................................... 11 9

Straight-line rent liability ..................................................... 98 99

Income taxes .............................................................. 30 29

Deferred taxes ............................................................. 12 10

Workers’ compensation and general liability reserves ................................ 13 13

Reserve for discontinued operations ............................................. 10 9

Repositioning and restructuring reserves ......................................... 1 2

Fair value of derivatives ...................................................... 24 32

Other .................................................................... 11 12

$393 $250

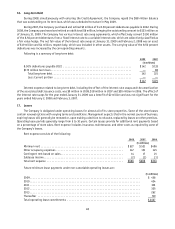

19. Discontinued Operations

In 1997, the Company exited its Domestic General Merchandise segment. In 1998, the Company exited both its

International General Merchandise and Specialty Footwear segments. In 2001, the Company discontinued its Northern

Group segment.

During 2008, the Company adjusted its Northern Group reserve by $1 million and recorded a charge of $2 million

related to the Domestic General Merchandise reserve representing revisions to the lease liability. During 2007, the

Company adjusted the International General Merchandise reserve by $3 million, reflecting favorable lease terminations

and to revise estimates on its lease liability. During 2006, the Company adjusted its Northern Group and International

General Merchandise reserve by $4 million, primarily reflecting favorable lease terminations.

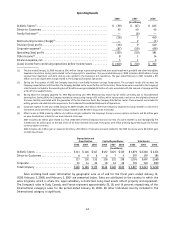

The major components of the pre-tax losses (gains) on disposal and disposition activity related to the reserves

are presented below. The remaining reserve balances as of January 31, 2009 primarily represent lease obligations;

$2 million is expected to be utilized within twelve months and the remaining $10 million thereafter.

2005 2006 2007 2008

Balance

Charge/

(Income)

Net

Usage(1) Balance

Charge/

(Income)

Net

Usage(1) Balance

Charge/

(Income)

Net

Usage(1) Balance

(in millions)

Northern Group ............................. $ 5 $(2) $(1) $ 2 $— $10 $12 $(1) $(11) $—

International General Merchandise .............. 8 (2) — 6 (3) 1 4 — (1) 3

Specialty Footwear ........................... 1 — — 1 — (1) — — — —

Domestic General Merchandise .................. 8 — (2) 6 — 1 7 2 — 9

Total ...................................... $22 $(4) $(3) $15 $(3) $11 $23 $ 1 $(12) $12

(1) Net usage includes the effect of foreign exchange translation adjustments.

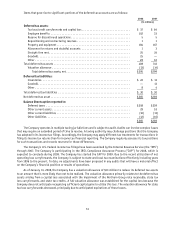

20. Repositioning and Restructuring Reserves

The Company recorded charges in 1993 and in 1991 to reflect the anticipated costs to sell or close under-

performing specialty and general merchandise stores in the United States and Canada. During 2007, the Company

adjusted the reserve by $2 million primarily due to favorable lease terminations. The Company recorded restructuring

charges in 1999 for programs to sell or liquidate eight non-core businesses. The restructuring plan also included an

accelerated store-closing program in North America and Asia, corporate headcount reduction, and a distribution center

shutdown. For both reserves the balance was $1 million as of January 31, 2009 and $2 million as of February 2, 2008,

classified as a non current liability.