Foot Locker 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

• $3 million charge, with no tax benefit, related to an other-than-temporary impairment of our investment

in a money-market fund,

• Impairment of store long-lived assets related to the U.S. retail divisions totaling $67 million or $41

million, after-tax, and

• Exit costs related to the store closing program, primarily representing lease termination costs, totaling

$5 million, or $3 million after-tax.

• Included in the results for 2007 are impairment charges and store closing expenses totaling $128 million, or

$81 million after-tax. In addition, the 2007 results include a $62 million benefit related to a Canadian income

tax valuation adjustment.

• Excluding the impairment charges, store closing costs, and the income tax valuation adjustments for both

2008 and 2007, net income from continuing operations would have been $106 million in 2008 as compared with

$62 million in 2007. This primarily reflects a $40 million improvement in gross margin as the Company was

significantly less promotional during 2008.

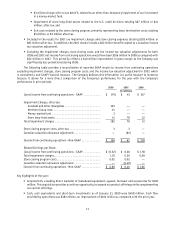

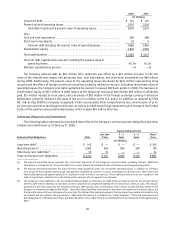

The following table provides a reconciliation of reported GAAP results to income from continuing operations

excluding impairment charges, store closing program costs, and the income tax valuation adjustment in 2007, which

is considered a non-GAAP financial measure. The Company believes this information is a useful measure to investors

because it allows for a more direct comparison of the Company’s performance for the year with the Company’s

performance in prior periods.

2008 2007 2006

(in millions)

(Loss) income from continuing operations - GAAP ........... $ (79) $ 43 $ 247

Impairment Charges, after-tax:

Goodwill and other intangibles . . . . . . . . . . . . . . . . . . . . . . . 123 — —

Northern Group note............................... 15 — —

Money-market fund ............................... 3 — —

Store long-lived assets ............................. 41 78 12

Total impairment charges.............................. 182 78 12

Store closing program costs, after-tax .................... 3 3 —

Canadian valuation allowance adjustment . . . . . . . . . . . . . . . . . — (62) —

Income from continuing operations - Non-GAAP ............ $ 106 $ 62 $ 259

Diluted Earnings per Share:

(Loss) income from continuing operations - GAAP ........... $ (0.52) $ 0.28 $ 1.58

Total impairment charges.............................. 1.18 0.50 0.08

Store closing program costs............................ 0.02 0.02 —

Canadian valuation allowance adjustment . . . . . . . . . . . . . . . . . — (0.40) —

Income from continuing operations - Non-GAAP ............ $ 0.68 $ 0.40 $1.66

Key highlights of the year:

• Acquired CCS, a leading direct marketer of skateboard equipment, apparel, footwear and accessories for $106

million. This acquisition provides us with an opportunity to expand our product offerings while complementing

our current offerings.

• Cash, cash equivalents and short-term investments as of January 31, 2009 were $408 million. Cash flow

provided by operations was $383 million, an improvement of $100 million as compared with the prior year.