Foot Locker 2008 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2008 Foot Locker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

Capital Structure

May 2008 Amended Credit Agreement

On May 16, 2008, the Company entered into an amended credit agreement with its banks, providing for a $175

million revolving credit facility and extending the maturity date to May 16, 2011 (the “Credit Agreement”). The Credit

Agreement also provides an incremental facility of up to $100 million under certain circumstances. Simultaneously

with entering into the Credit Agreement, the Company repaid the $88 million that was outstanding on its term loan

with the banks, which was scheduled to mature in May 2009.

The Credit Agreement provides that the Company comply with certain financial covenants, including (i) a fixed

charge coverage ratio of 1.25:1 for the 2008 fiscal year, 1.50:1 for the 2009 fiscal year, and 1.75:1 for each year

thereafter and (ii) a minimum liquidity/excess cash flow covenant, which provides that if at the end of any fiscal

quarter minimum liquidity, as defined in the Credit Agreement, is less than $350 million, the excess cash flow for the

four consecutive fiscal quarters ended on such date must be at least $25 million. The amount permitted to be paid

by the Company as dividends in any fiscal year is $105 million under the terms of the Credit Agreement. With regard

to stock purchases, the Credit Agreement provides that not more than $50 million in the aggregate may be expended

unless the fixed charge coverage ratio is at least 2.0:1 for the period of four consecutive fiscal quarters most recently

ended prior to any stock repurchase. Additionally, the Credit Agreement provides for a security interest in certain of

the Company’s intellectual property and certain other non-inventory assets. The Company was in compliance with all

covenants on January 31, 2009.

During 2008, the Company purchased and retired $6 million of the $200 million 8.50 percent debentures payable

in 2022, bringing the outstanding balance to $123 million, excluding the fair value of the interest rate swap, for the

year ended January 31, 2009. The fair value of the interest rate swaps, included in other assets, was approximately $19

million and the carrying value of the 8.50 debentures was increased by the corresponding amount.

March 2009 New Credit Agreement

On March 20, 2009, the Company entered into a new credit agreement with its banks, providing for a $200 million

revolving credit facility maturing on March 20, 2013 (the “New Credit Agreement”), which replaces the existing Credit

Agreement. The New Credit Agreement also provides an incremental facility of up to $100 million under certain

circumstances. The New Credit Agreement provides for a security interest in certain of the Company’s domestic

assets, including certain inventory assets. However, no material covenants or payment restrictions exist until the

Company is borrowing under the agreement and, in that event, the restrictions may vary depending upon the level

of borrowings.

Credit Rating

As of March 30, 2009, the Company’s corporate credit ratings from Standard & Poor’s and Moody’s Investors Service

are BB- and Ba3, respectively. Additionally, as of March 30, 2009, Moody’s Investor Services has rated the Company’s

senior unsecured notes B1.

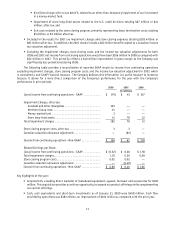

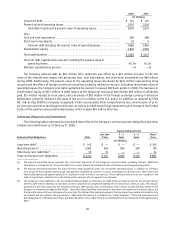

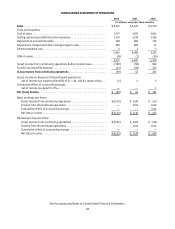

Debt Capitalization and Equity

For purposes of calculating debt to total capitalization, the Company includes the present value of operating

lease commitments in total net debt. Total net debt including the present value of operating leases is considered a

non-GAAP financial measure. The present value of operating leases is discounted using various interest rates ranging

from 4 percent to 13 percent, which represent the Company’s incremental borrowing rate at inception of the lease.

Operating leases are the primary financing vehicle used to fund store expansion and, therefore, we believe that the

inclusion of the present value of operating leases in total debt is useful to our investors, credit constituencies, and

rating agencies. The following table sets forth the components of the Company’s capitalization, both with and without

the present value of operating leases: